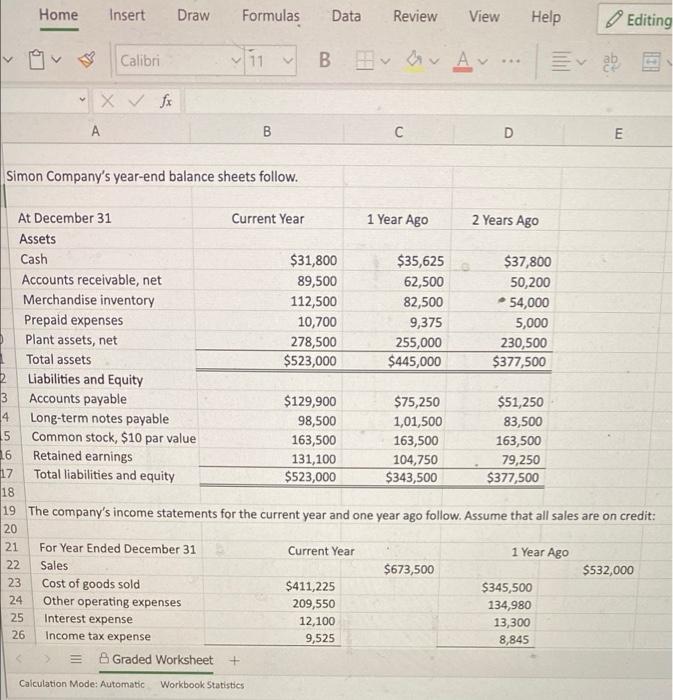

Question: Pls answer in excel form! Formulas Data Review View Calibri B & Av X fx A B C Simon Company's year-end balance sheets follow. At

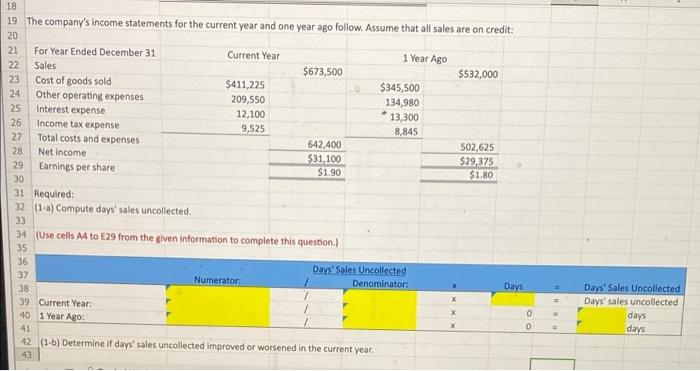

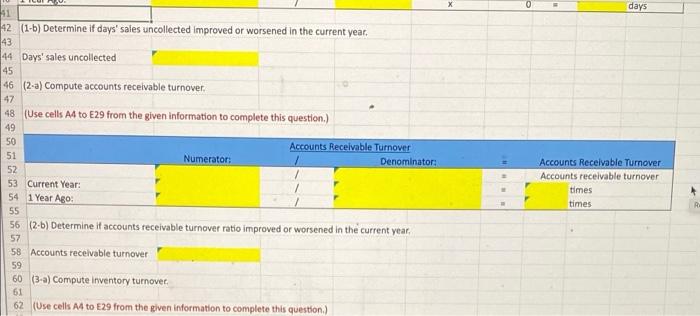

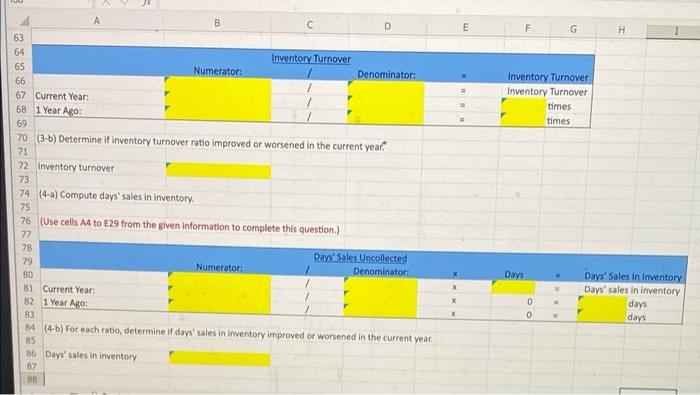

Formulas Data Review View Calibri B & Av X fx A B C Simon Company's year-end balance sheets follow. At December 31 Current Year 1 Year Ago Assets Cash $31,800 $35,625 $37,800 Accounts receivable, net 89,500 62,500 50,200 Merchandise inventory 112,500 82,500 54,000 Prepaid expenses 10,700 9,375 5,000 Plant assets, net 278,500 255,000 230,500 Total assets $523,000 $445,000 $377,500 Liabilities and Equity Accounts payable $129,900 $75,250 $51,250 Long-term notes payable 98,500 1,01,500 83,500 5 Common stock, $10 par value 163,500 163,500 163,500 6 Retained earnings 131,100 104,750 79,250 17 Total liabilities and equity $523,000 $343,500 $377,500 18 19 The company's income statements for the current year and one year ago follow. Assume that all sales are on credit: 20 21 For Year Ended December 31 Current Year 1 Year Ago 22 Sales $673,500 $532,000 Cost of goods sold $411,225 $345,500 Other operating expenses 209,550 134,980 25 Interest expense 12,100 13,300 26 Income tax expense 9,525 8,845 E Graded Worksheet + Calculation Mode: Automatic Workbook Statistics 3 4 23 24 Home Insert V Draw Help D Years Ago v E Editing S 18 19 The company's income statements for the current year and one year ago follow. Assume that all sales are on credit: 20 21 For Year Ended December 31 Current Year 1 Year Ago 22 Sales $673,500 $532,000 23 Cost of goods sold $411,225 $345,500 134,980 24 Other operating expenses 209,550 25 Interest expense . 12,100 13,300 26 Income tax expense 9,525 8,845 27 Total costs and expenses 502,625 28 Net income 642,400 $31,100 $1.90 $29,375 $1.80 29 Earnings per share 30 31 Required: 32 (1-a) Compute days' sales uncollected. 33 34 (Use cells A4 to E29 from the given information to complete this question.) 35 36 Days' Sales Uncollected 37 Numerator: Denominator: 38 39 Current Year: 40 1 Year Ago: 41 42 (1-b) Determine if days' sales uncollected improved or worsened in the current year. 43 Days 0 0 = Days' Sales Uncollected Days' sales uncollected days days 41 42 (1-b) Determine if days' sales uncollected improved or worsened in the current year. 43 44 Days' sales uncollected 45 46 (2-a) Compute accounts receivable turnover. 47 48 (Use cells A4 to E29 from the given information to complete this question.) 49 50 Accounts Receivable Turnover 51 Numerator: Denominator: 52 53 Current Year: 54 1 Year Ago: 55 56 (2-b) Determine if accounts receivable turnover ratio improved or worsened in the current year. 57 58 Accounts receivable turnover 59 60 (3-a) Compute inventory turnover. 61 62 (Use cells A4 to E29 from the given information to complete this question.) X days Accounts Receivable Turnover Accounts receivable turnover times times 100 B 63 64 Inventory Turnover 65 Numerator: Denominator: 66 67 Current Year: 68 1 Year Ago: 69 70 (3-b) Determine if inventory turnover ratio improved or worsened in the current year. 71 72 Inventory turnover 73 74 (4-a) Compute days' sales in inventory. 75 76 (Use cells A4 to E29 from the given information to complete this question.) 77 78 Days' Sales Uncollected Denominator: 79 Numerator: 80 81 Current Year: 82 1 Year Ago: 83 84 (4-b) For each ratio, determine if days' sales in inventory improved or worsened in the current year. 85 86 Days' sales in inventory 87 88 A E G Inventory Turnover Inventory Turnover times times N B Days 0 0 H Days' Sales In Inventory Days' sales in inventory days days

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts