Question: Pls ANSWER only if 100% SURE Thumbs Up for right answer (DO provide FORMULAS in EXCEL) In March 2020 , Henley Organization purchased production equipment

Pls ANSWER only if 100% SURE

Thumbs Up for right answer

(DO provide FORMULAS in EXCEL)

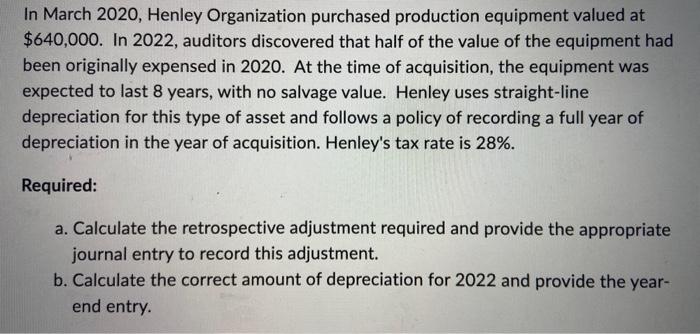

In March 2020 , Henley Organization purchased production equipment valued at $640,000. In 2022 , auditors discovered that half of the value of the equipment had been originally expensed in 2020. At the time of acquisition, the equipment was expected to last 8 years, with no salvage value. Henley uses straight-line depreciation for this type of asset and follows a policy of recording a full year of depreciation in the year of acquisition. Henley's tax rate is 28%. Required: a. Calculate the retrospective adjustment required and provide the appropriate journal entry to record this adjustment. b. Calculate the correct amount of depreciation for 2022 and provide the yearend entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts