Question: pls answer question #3 Use the following information to answer this, and the next two, questions. Upon graduation you recall the importance of saving for

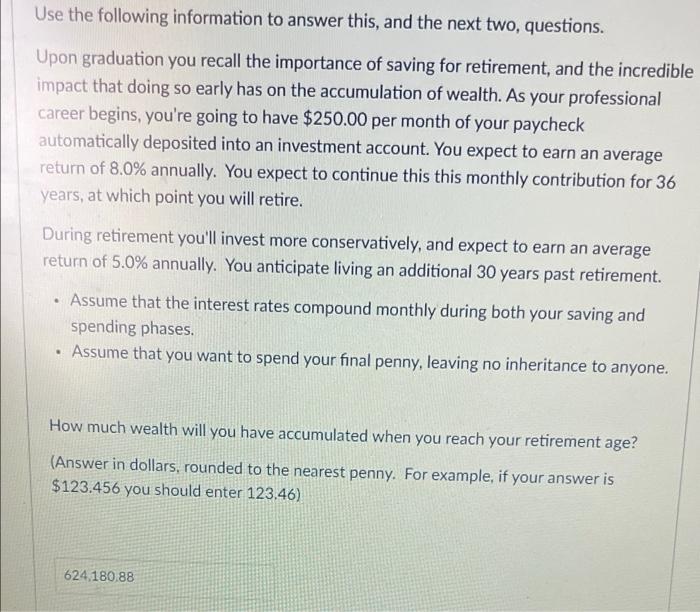

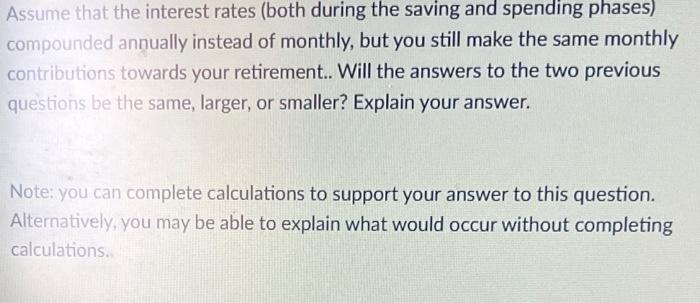

Use the following information to answer this, and the next two, questions. Upon graduation you recall the importance of saving for retirement, and the incredible impact that doing so early has on the accumulation of wealth. As your professional career begins, you're going to have $250.00 per month of your paycheck automatically deposited into an investment account. You expect to earn an average return of 8.0% annually. You expect to continue this this monthly contribution for 36 years, at which point you will retire. During retirement you'll invest more conservatively, and expect to earn an average return of 5.0% annually. You anticipate living an additional 30 years past retirement Assume that the interest rates compound monthly during both your saving and spending phases. Assume that you want to spend your final penny, leaving no inheritance to anyone. How much wealth will you have accumulated when you reach your retirement age? (Answer in dollars, rounded to the nearest penny. For example, if your answer is $123.456 you should enter 123.46) 624 180.88 How much will you be able to spend each month in retirement? (Answer in dollars, rounded to the nearest penny. For example, if your answer is $123.456 you should enter 123.46) 3350.74 Assume that the interest rates (both during the saving and spending phases) compounded annually instead of monthly, but you still make the same monthly contributions towards your retirement.. Will the answers to the two previous questions be the same, larger, or smaller? Explain your answer. Note: you can complete calculations to support your answer to this question. Alternatively, you may be able to explain what would occur without completing calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts