Question: pls answer quickly Exercise 13 - Revision Exercise Angelos and Maria are a married couple. They are both tax residents and domiciled in Cyprus. Angelos

pls answer quickly

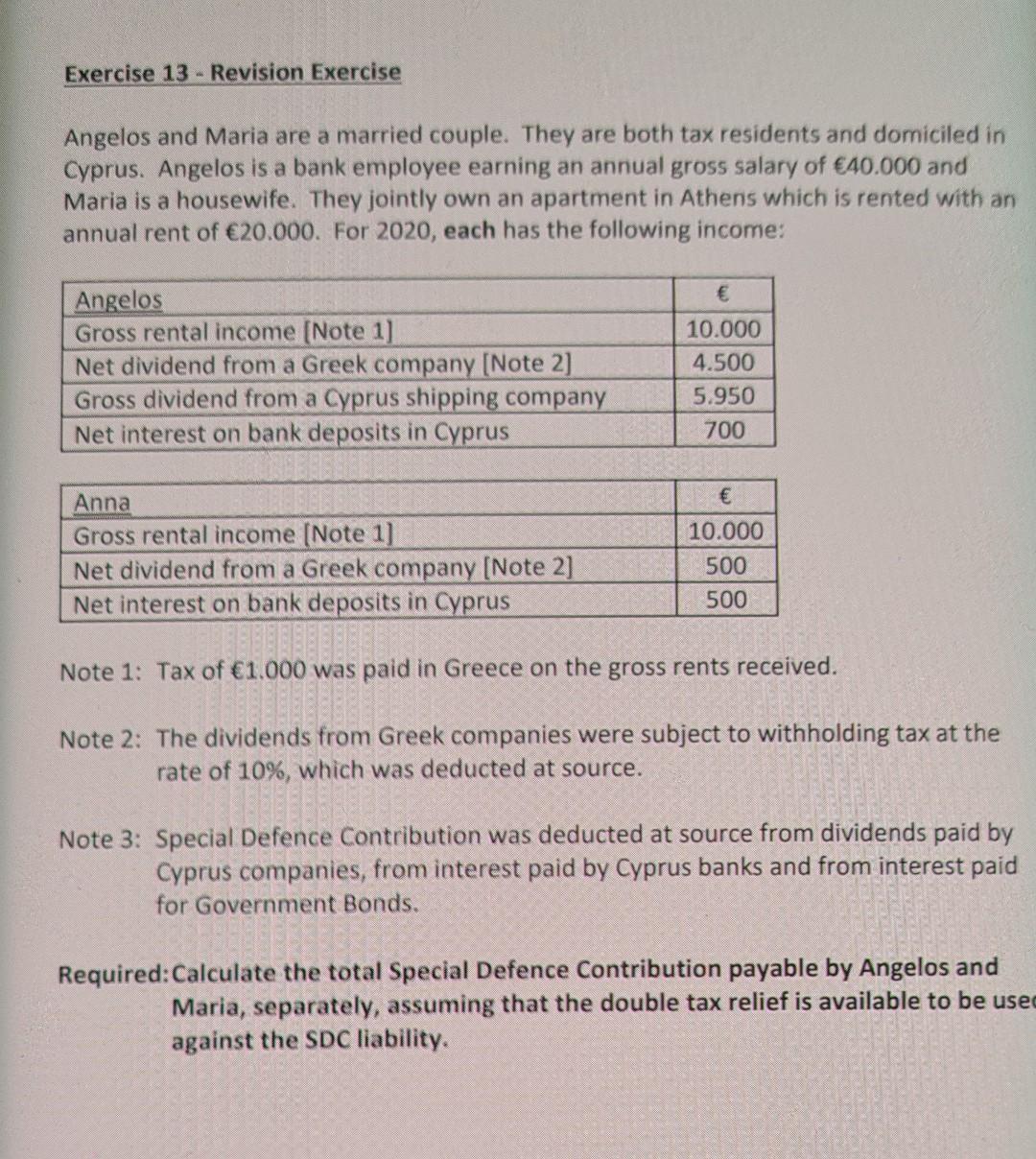

Exercise 13 - Revision Exercise Angelos and Maria are a married couple. They are both tax residents and domiciled in Cyprus. Angelos is a bank employee earning an annual gross salary of 40.000 and Maria is a housewife. They jointly own an apartment in Athens which is rented with an annual rent of 20.000. For 2020, each has the following income: Angelos Gross rental income (Note 1] Net dividend from a Greek company (Note 2] Gross dividend from a Cyprus shipping company Net interest on bank deposits in Cyprus 10.000 4.500 5.950 700 Anna Gross rental income (Note 1] Net dividend from a Greek company (Note 2] Net interest on bank deposits in Cyprus 10.000 500 500 Note 1: Tax of 1.000 was paid in Greece on the gross rents received. Note 2: The dividends from Greek companies were subject to withholding tax at the rate of 10%, which was deducted at source. Note 3: Special Defence Contribution was deducted at source from dividends paid by Cyprus companies, from interest paid by Cyprus banks and from interest paid for Government Bonds. Required: Calculate the total Special Defence Contribution payable by Angelos and Maria, separately, assuming that the double tax relief is available to be used against the SDC liability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts