Question: Pls answer quickly I will upvote The bank has recently been sanction by the Financial Supervisor Authority (FSA) for insufficient processes and routines associated with

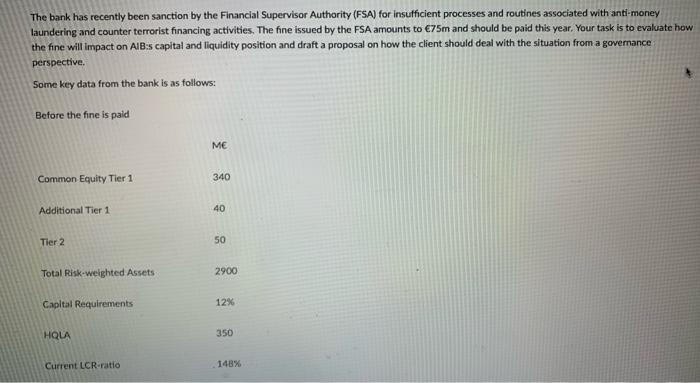

The bank has recently been sanction by the Financial Supervisor Authority (FSA) for insufficient processes and routines associated with anti-money laundering and counter terrorist financing activities. The fine issued by the FSA amounts to 75m and should be paid this year. Your task is to evaluate how the fine will impact on AlB:s capital and liquidity position and draft a proposal on how the client should deal with the situation from a governance perspective. Some key data from the bank is as follows: Before the fine is paid ME Common Equity Tier 1 340 Additional Tier 1 40 Tier 2 50 Total Risk-weighted Assets 2900 Capital Requirements 12% HQLA 350 Current LCR-ratio 148% 1. Analyse the capital and liquidity position of the bank after the fine has been paid. In order to answer this question you will need to make calculations and some assumptions. Make sure to show your calculations and motivate your assumptions (max 500 words, max op) 2. A key problem in the sanction from the FSA was the governance structure of the including the risk appetite and risk culture. Discuss these concepts and how they align with the three lines of defence. Organize your discussion with recommendations in bullets on how the could update its governance structure to become compliant max 500 words, max 3p). 3. Finally, prior to the fee the bank had substantial liquidity reserves almost 50% above the regulatory threshold), Discuss why you think they kutt so much liquidity reserves and the problems of liquidity hording in banks (max 300 words, max 2pl. The bank has recently been sanction by the Financial Supervisor Authority (FSA) for insufficient processes and routines associated with anti-money laundering and counter terrorist financing activities. The fine issued by the FSA amounts to 75m and should be paid this year. Your task is to evaluate how the fine will impact on AlB:s capital and liquidity position and draft a proposal on how the client should deal with the situation from a governance perspective. Some key data from the bank is as follows: Before the fine is paid ME Common Equity Tier 1 340 Additional Tier 1 40 Tier 2 50 Total Risk-weighted Assets 2900 Capital Requirements 12% HQLA 350 Current LCR-ratio 148% 1. Analyse the capital and liquidity position of the bank after the fine has been paid. In order to answer this question you will need to make calculations and some assumptions. Make sure to show your calculations and motivate your assumptions (max 500 words, max op) 2. A key problem in the sanction from the FSA was the governance structure of the including the risk appetite and risk culture. Discuss these concepts and how they align with the three lines of defence. Organize your discussion with recommendations in bullets on how the could update its governance structure to become compliant max 500 words, max 3p). 3. Finally, prior to the fee the bank had substantial liquidity reserves almost 50% above the regulatory threshold), Discuss why you think they kutt so much liquidity reserves and the problems of liquidity hording in banks (max 300 words, max 2pl

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts