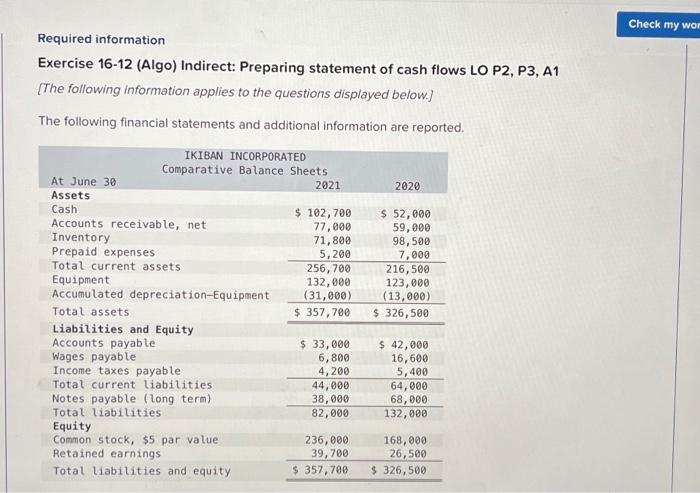

Question: pls answer Required information Exercise 16-12 (Algo) Indirect: Preparing statement of cash flows LO P2, P3, A1 [The following information applies to the questions displayed

![displayed below.] The following financial statements and additional information are reported. Additional](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f6d91e5e0d7_46966f6d91de85ac.jpg)

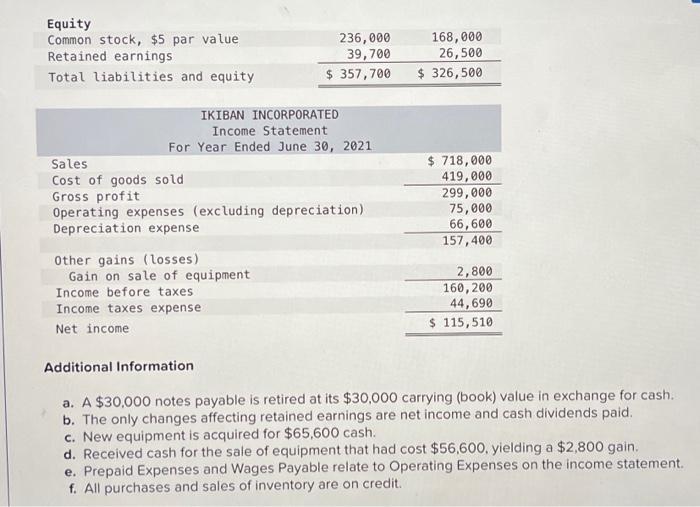

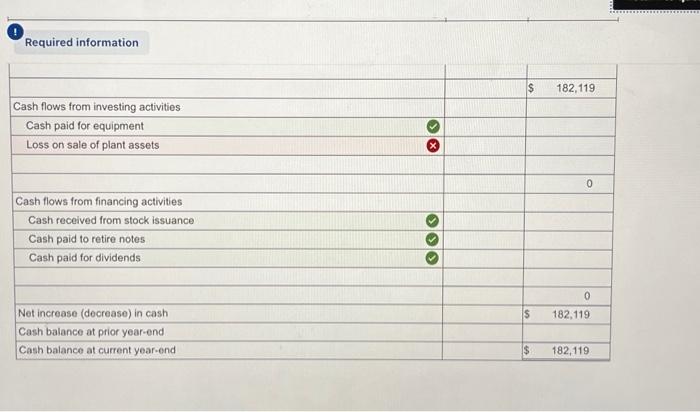

Required information Exercise 16-12 (Algo) Indirect: Preparing statement of cash flows LO P2, P3, A1 [The following information applies to the questions displayed below.] The following financial statements and additional information are reported. Additional Information a. A $30,000 notes payable is retired at its $30,000 carrying (book) value in exchange for cash. b. The only changes affecting retained earnings are net income and cash dividends paid. c. New equipment is acquired for $65,600 cash. d. Received cash for the sale of equipment that had cost $56,600, yielding a $2,800 gain. e. Prepaid Expenses and Wages Payable relate to Operating Expenses on the income statement. f. All purchases and sales of inventory are on credit. Required information \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Statement of Cash Flows (Indirect Method) } \\ \hline \multicolumn{4}{|c|}{ For Year Ended June 30, 2021} \\ \hline \multicolumn{4}{|l|}{ Cash flows from operating activities } \\ \hline Net income & & $115,510 & \\ \hline \multicolumn{4}{|c|}{ Adjustments to reconcile net income to net cash provided by operating activities } \\ \hline \multicolumn{4}{|c|}{ Income statement items not affecting cash } \\ \hline Depreciation expense & 0 & 66,600 & \\ \hline Gain on sale of plant assets & 0 & 9 & \\ \hline \multicolumn{4}{|c|}{ Changes in current operating assets and liabilities } \\ \hline Increase in accounts receivable & 0 & & \\ \hline Decrease in inventory & 0 & & \\ \hline Decrease in prepald expenses & 0 & & \\ \hline Decrease in accounts payable & 0 & & \\ \hline Decrease in wages payable & 0 & & \\ \hline \multirow[t]{2}{*}{ Decrease in income taxes payable } & 0 & & \\ \hline & & & 182,119 \\ \hline \multicolumn{4}{|l|}{ Cash flows from investing activites } \\ \hline Cash paid for equipment & 0 & & \\ \hline \end{tabular} Required information \begin{tabular}{|l|l|l|} \hline & & \\ \hline Cash flows from investing activities & 182,119 \\ \hline Cash paid for equipment & & \\ \hline Loss on sale of plant assets & & \\ \hline & & \\ \hline & & \\ \hline Cash flows from financing activities & & \\ \hline Cash recelved from stock issuance & & \\ \hline Cash paid to retire notes & & \\ \hline Cash paid for dividends & & \\ \hline & 182,119 \\ \hline Net increase (decrease) in cash & \\ \hline Cash balance at prior year-end & & \\ \hline Cash balance at current year-end & 182,119 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts