Question: Pls answer the attach question with clearly. Case study: NIK-05 Ltd: Development of Managerial Infrastructure in the business model of a pellet producer Abstract: Nikola

Pls answer the attach question with clearly.

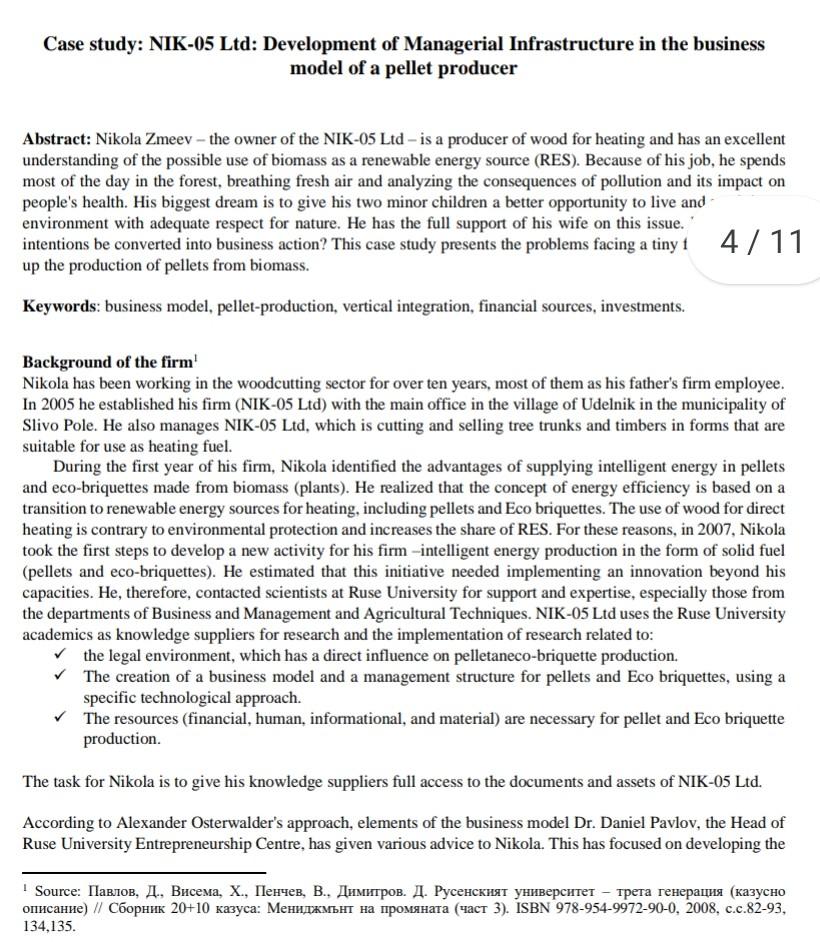

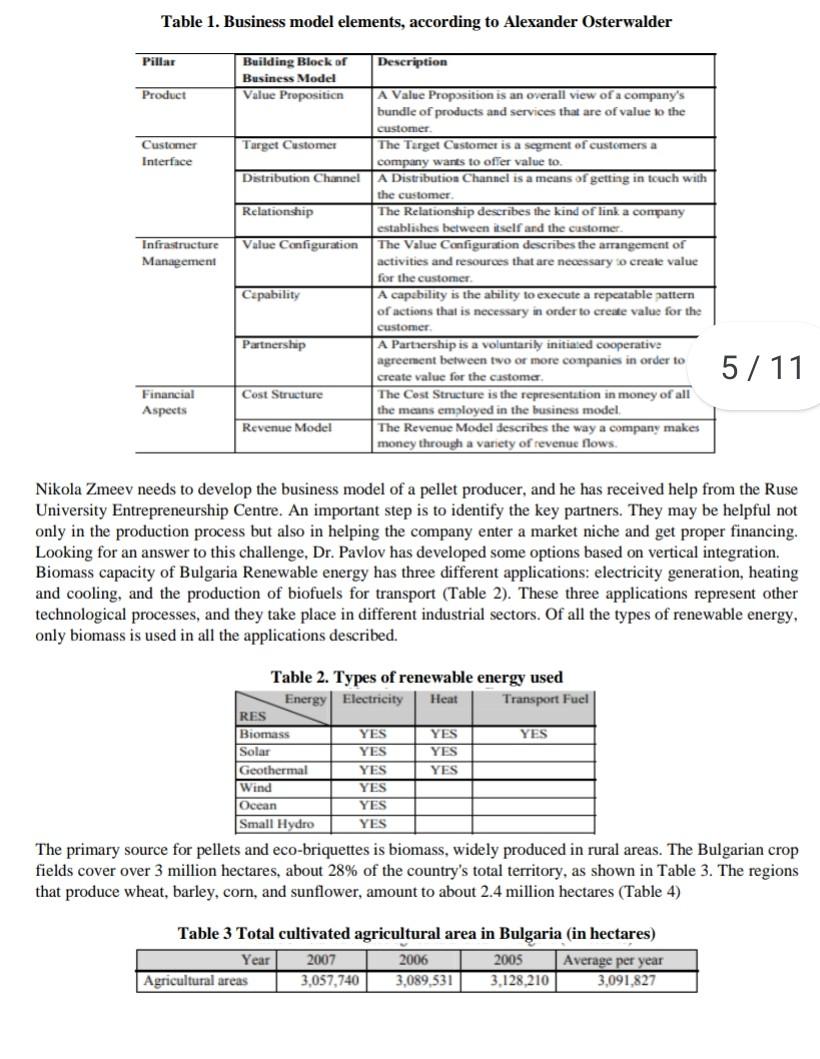

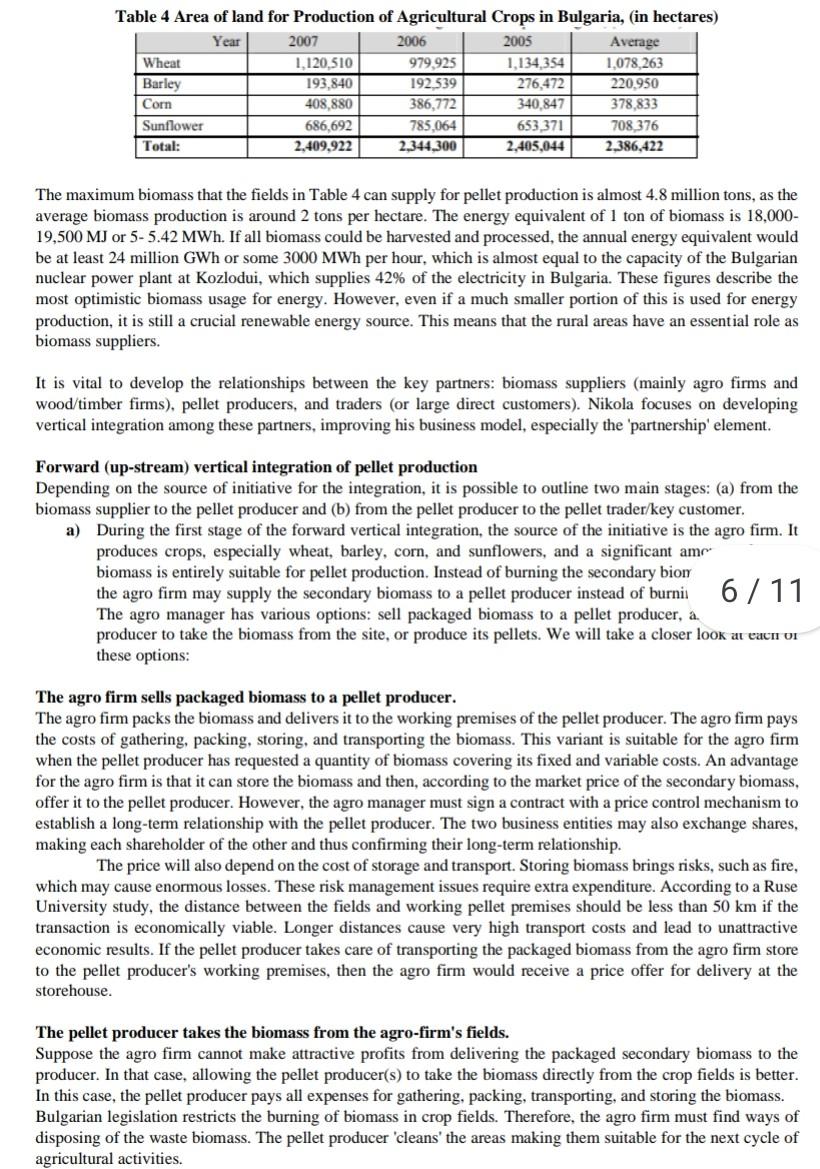

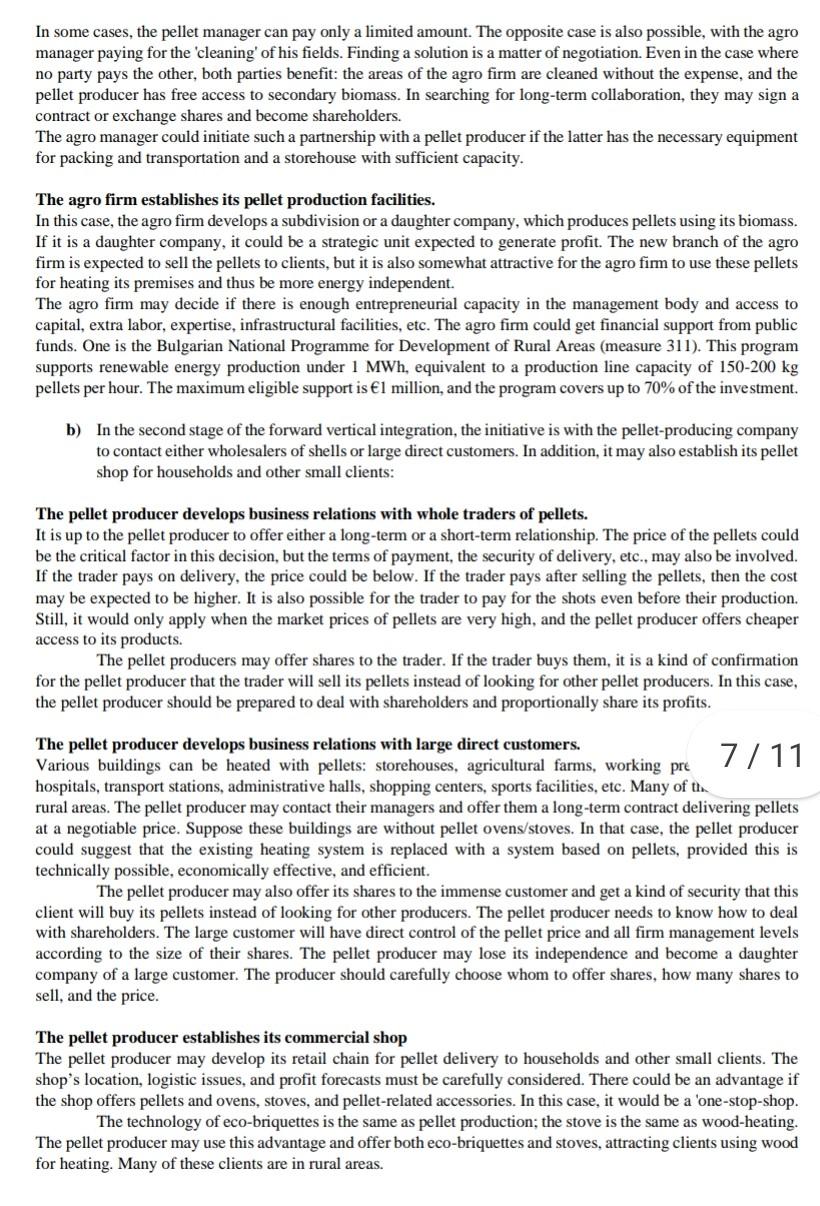

Case study: NIK-05 Ltd: Development of Managerial Infrastructure in the business model of a pellet producer Abstract: Nikola Zmeev - the owner of the NIK-05 Ltd - is a producer of wood for heating and has an excellent understanding of the possible use of biomass as a renewable energy source (RES). Because of his job, he spends most of the day in the forest, breathing fresh air and analyzing the consequences of pollution and its impact on people's health. His biggest dream is to give his two minor children a better opportunity to live and environment with adequate respect for nature. He has the full support of his wife on this issue. intentions be converted into business action? This case study presents the problems facing a tiny 1/1/1 up the production of pellets from biomass. Keywords: business model, pellet-production, vertical integration, financial sources, investments. Background of the firm 1 Nikola has been working in the woodcutting sector for over ten years, most of them as his father's firm employee. In 2005 he established his firm (NIK-05 Ltd) with the main office in the village of Udelnik in the municipality of Slivo Pole. He also manages NIK-05 Ltd, which is cutting and selling tree trunks and timbers in forms that are suitable for use as heating fuel. During the first year of his firm, Nikola identified the advantages of supplying intelligent energy in pellets and eco-briquettes made from biomass (plants). He realized that the concept of energy efficiency is based on a transition to renewable energy sources for heating, including pellets and Eco briquettes. The use of wood for direct heating is contrary to environmental protection and increases the share of RES. For these reasons, in 2007, Nikola took the first steps to develop a new activity for his firm -intelligent energy production in the form of solid fuel (pellets and eco-briquettes). He estimated that this initiative needed implementing an innovation beyond his capacities. He, therefore, contacted scientists at Ruse University for support and expertise, especially those from the departments of Business and Management and Agricultural Techniques. NIK-05 Ltd uses the Ruse University academics as knowledge suppliers for research and the implementation of research related to: the legal environment, which has a direct influence on pelletaneco-briquette production. The creation of a business model and a management structure for pellets and Eco briquettes, using a specific technological approach. The resources (financial, human, informational, and material) are necessary for pellet and Eco briquette production. The task for Nikola is to give his knowledge suppliers full access to the documents and assets of NIK-05 Ltd. According to Alexander Osterwalder's approach, elements of the business model Dr. Daniel Pavlov, the Head of Ruse University Entrepreneurship Centre, has given various advice to Nikola. This has focused on developing the 'Source: , ., , ., , ., . . - ( ) // 20+10 : ( 3). ISBN 978-954-9972-90-0, 2008, ..82-93, Table 1. Business model elements, according to Alexander Osterwalder Nikola Zmeev needs to develop the business model of a pellet producer, and he has received help from the Ruse University Entrepreneurship Centre. An important step is to identify the key partners. They may be helpful not only in the production process but also in helping the company enter a market niche and get proper financing. Looking for an answer to this challenge, Dr. Pavlov has developed some options based on vertical integration. Biomass capacity of Bulgaria Renewable energy has three different applications: electricity generation, heating and cooling, and the production of biofuels for transport (Table 2). These three applications represent other technological processes, and they take place in different industrial sectors. Of all the types of renewable energy, only biomass is used in all the applications described. Table 2. Tvnes of renewable energv used The primary source for pellets and eco-briquettes is biomass, widely produced in rural areas. The Bulgarian crop fields cover over 3 million hectares, about 28% of the country's total territory, as shown in Table 3 . The regions that produce wheat, barley, corn, and sunflower, amount to about 2.4 million hectares (Table 4) The maximum biomass that the fields in Table 4 can supply for pellet production is almost 4.8 million tons, as the average biomass production is around 2 tons per hectare. The energy equivalent of 1 ton of biomass is 18,000 19,500MJ or 5 - 5.42MWh. If all biomass could be harvested and processed, the annual energy equivalent would be at least 24 million GWh or some 3000MWh per hour, which is almost equal to the capacity of the Bulgarian nuclear power plant at Kozlodui, which supplies 42% of the electricity in Bulgaria. These figures describe the most optimistic biomass usage for energy. However, even if a much smaller portion of this is used for energy production, it is still a crucial renewable energy source. This means that the rural areas have an essential role as biomass suppliers. It is vital to develop the relationships between the key partners: biomass suppliers (mainly agro firms and wood/timber firms), pellet producers, and traders (or large direct customers). Nikola focuses on developing vertical integration among these partners, improving his business model, especially the 'partnership' element. Forward (up-stream) vertical integration of pellet production Depending on the source of initiative for the integration, it is possible to outline two main stages: (a) from the biomass supplier to the pellet producer and (b) from the pellet producer to the pellet trader/key customer. a) During the first stage of the forward vertical integration, the source of the initiative is the agro firm. It produces crops, especially wheat, barley, corn, and sunflowers, and a significant amr biomass is entirely suitable for pellet production. Instead of burning the secondary bior the agro firm may supply the secondary biomass to a pellet producer instead of burni 6/1 The agro manager has various options: sell packaged biomass to a pellet producer, a. producer to take the biomass from the site, or produce its pellets. We will take a closer look at eacn ou these options: The agro firm sells packaged biomass to a pellet producer. The agro firm packs the biomass and delivers it to the working premises of the pellet producer. The agro firm pays the costs of gathering, packing, storing, and transporting the biomass. This variant is suitable for the agro firm when the pellet producer has requested a quantity of biomass covering its fixed and variable costs. An advantage for the agro firm is that it can store the biomass and then, according to the market price of the secondary biomass, offer it to the pellet producer. However, the agro manager must sign a contract with a price control mechanism to establish a long-term relationship with the pellet producer. The two business entities may also exchange shares, making each shareholder of the other and thus confirming their long-term relationship. The price will also depend on the cost of storage and transport. Storing biomass brings risks, such as fire, which may cause enormous losses. These risk management issues require extra expenditure. According to a Ruse University study, the distance between the fields and working pellet premises should be less than 50km if the transaction is economically viable. Longer distances cause very high transport costs and lead to unattractive economic results. If the pellet producer takes care of transporting the packaged biomass from the agro firm store to the pellet producer's working premises, then the agro firm would receive a price offer for delivery at the storehouse. The pellet producer takes the biomass from the agro-firm's fields. Suppose the agro firm cannot make attractive profits from delivering the packaged secondary biomass to the producer. In that case, allowing the pellet producer(s) to take the biomass directly from the crop fields is better. In this case, the pellet producer pays all expenses for gathering, packing, transporting, and storing the biomass. Bulgarian legislation restricts the burning of biomass in crop fields. Therefore, the agro firm must find ways of disposing of the waste biomass. The pellet producer 'cleans' the areas making them suitable for the next cycle of agricultural activities. In some cases, the pellet manager can pay only a limited amount. The opposite case is also possible, with the agro manager paying for the 'cleaning' of his fields. Finding a solution is a matter of negotiation. Even in the case where no party pays the other, both parties benefit: the areas of the agro firm are cleaned without the expense, and the pellet producer has free access to secondary biomass. In searching for long-term collaboration, they may sign a contract or exchange shares and become shareholders. The agro manager could initiate such a partnership with a pellet producer if the latter has the necessary equipment for packing and transportation and a storehouse with sufficient capacity. The agro firm establishes its pellet production facilities. In this case, the agro firm develops a subdivision or a daughter company, which produces pellets using its biomass. If it is a daughter company, it could be a strategic unit expected to generate profit. The new branch of the agro firm is expected to sell the pellets to clients, but it is also somewhat attractive for the agro firm to use these pellets for heating its premises and thus be more energy independent. The agro firm may decide if there is enough entrepreneurial capacity in the management body and access to capital, extra labor, expertise, infrastructural facilities, etc. The agro firm could get financial support from public funds. One is the Bulgarian National Programme for Development of Rural Areas (measure 311). This program supports renewable energy production under 1MWh, equivalent to a production line capacity of 150200kg pellets per hour. The maximum eligible support is 1 million, and the program covers up to 70% of the investment. b) In the second stage of the forward vertical integration, the initiative is with the pellet-producing company to contact either wholesalers of shells or large direct customers. In addition, it may also establish its pellet shop for households and other small clients: The pellet producer develops business relations with whole traders of pellets. It is up to the pellet producer to offer either a long-term or a short-term relationship. The price of the pellets could be the critical factor in this decision, but the terms of payment, the security of delivery, etc., may also be involved. If the trader pays on delivery, the price could be below. If the trader pays after selling the pellets, then the cost may be expected to be higher. It is also possible for the trader to pay for the shots even before their production. Still, it would only apply when the market prices of pellets are very high, and the pellet producer offers cheaper access to its products. The pellet producers may offer shares to the trader. If the trader buys them, it is a kind of confirmation for the pellet producer that the trader will sell its pellets instead of looking for other pellet producers. In this case, the pellet producer should be prepared to deal with shareholders and proportionally share its profits. The pellet producer develops business relations with large direct customers. 7/11 Various buildings can be heated with pellets: storehouses, agricultural farms, working pre hospitals, transport stations, administrative halls, shopping centers, sports facilities, etc. Many of the at a negotiable price. Suppose these buildings are without pellet ovens/stoves. In that case, the pellet producer could suggest that the existing heating system is replaced with a system based on pellets, provided this is technically possible, economically effective, and efficient. The pellet producer may also offer its shares to the immense customer and get a kind of security that this client will buy its pellets instead of looking for other producers. The pellet producer needs to know how to deal with shareholders. The large customer will have direct control of the pellet price and all firm management levels according to the size of their shares. The pellet producer may lose its independence and become a daughter company of a large customer. The producer should carefully choose whom to offer shares, how many shares to sell, and the price. The pellet producer establishes its commercial shop The pellet producer may develop its retail chain for pellet delivery to households and other small clients. The shop's location, logistic issues, and profit forecasts must be carefully considered. There could be an advantage if the shop offers pellets and ovens, stoves, and pellet-related accessories. In this case, it would be a 'one-stop-shop. The technology of eco-briquettes is the same as pellet production; the stove is the same as wood-heating. The pellet producer may use this advantage and offer both eco-briquettes and stoves, attracting clients using wood for heating. Many of these clients are in rural areas. The pellet producer is expected to know that pellet ovens are relatively expensive in Bulgaria. In the autumn of 2008 , they are available in the Ruse city market for 3000, which is about the annual average salary in Bulgaria. Another challenge is the market price of the pellets, which is about 150 per tonne. The cost of buying the necessary shots during the cold months (about 4 tonnes) is 20% of the average annual salary. Therefore, it will be some time before pellets become a viable heating product for most households. Backward (down-stream) vertical integration of pellet production Depending on the source of the initiative, it is possible to outline two main stages again: (a) from the pellet trader/large customer to the pellet producer and (b) from the pellet producer to the biomass supplier. a) During the first stage of the backward vertical integration, the initiative is with the pellet trader/large customer because of market reasons (for the trader) or willingness to replace the existing conventional heating system with a pellet system. They contract a pellet producer for the long term, giving the necessary agreements to buy its products as stated in the contract. If there is no pellet producer available, then the trader or the large customer may establish a company for pellet production. This could be shown as a daughter company or a subdivision of their existing company. It is also essential to contract biomass suppliers and offer a joint venture with an agro firm sharing the following responsibilities: the agro firm supplies secondary biomass; the joint venture produces pellets; the trader (or large customer) buys and sells pellets This case is attractive for traders and direct customers who operate in areas with low biomass but high prices for conventional energy. Importing the pellets from other regions or states or establishing a daughter company is possible. This is the case for a tiny pellet producer in the Ruse region, a daughter company of an Italian firm. The entire pellet production of this company is exported to Italy. Large customers must develop pellet heating systems in their buildings, search for a pellet producer in parallel, and develop long-term collaboration. The Ruse Municipality administration intends to replace some conventional heating ovens with pellet ovens in selected kindergartens and schools. b) The initiative is with the pellet producer to the biomass supplier during the second stage of backward vertical integration (from the pellet producer to the biomass supplier). The manager contracts an agro firm for long-term usage of the secondary biomass. There are three alternatives here: the pellet producer can buy the packaged biomass, pack and transport the biomass, or produce the biomass itself. Pellet producer buys the packed secondary biomass. In this case, the pellet produced initiates commercial relations with the agro firm. It is a matter of negotiation to fix the price and financial mechanism for its updating. The cost of transporting the biomass from the agro firm to the pellet producer could be borne by one. Depending on the place of delivery, the secondary biomass nrice will vary. The price will be lower if the pellet producer takes the packaged biomass from the agro f higher if it delivers it to the pellet producer's factory. There could be some exchange of shares. The pellet producer may offer to buy some sl. 8/1 firm. This could be applied when the agro firm faces financial problems. The agro firm receives. market for its secondary biomass by allowing the pellet producer to buy some of its shares. The pellet producer may offer the opposite arrangement and invite the agro firm to buy its shares. In this case, the pellet producer allows the agro firm to control its activity (according to the shareholding size) to ensure that the pellet producer will buy mainly its biomass, not that of competitors. In both cases described, the agro firm and pellet producer must be prepared to deal with shareholders; otherwise, a long-term contract could be an acceptable alternative. The pellet producer packs and transports the biomass. The pellet producer must own or have adequate access to agricultural vehicles to pack the secondary biomass and facilities to store the packaged biomass. The pellet producer can optimize the costs related to packing and transporting. It is a matter of negotiation whether that will be free of charge or whether the pellet producer will pay a specific price for having access to the agro firm's fields. The pellet producer may offer to sell some shares the cost of pellet production. Pellet producer produces the biomass. If all the other variants fail for economic, technical, or other reasons, the pellet producer must develop its biomass production unit. This agro unit could be a subdivision of the pellet producer or a daughter company. The new team has to have access to land by owning or renting it. In this case, the pellet producer is independent in its choice of biomass suppliers and can control the price of the biomass. From an organizational point of view, there are some new expenses that the parent company has to bear in comparison with the other cases: Costs related to the agro machines and agro stores - purchasing, maintenance, renting, etc.; Higher transport costs if the fields are far from the working premises of the pellet producer; The threat of paying higher rent to the landowners if other appropriate fields are not available and dealing with landowners; A variety of other issues conceming the management of a unit is new for the pellet producer; the manager needs time to learn the appropriate, economically practical solutions, and these 'lessons' come at a price. Financial issues In 2009. Nikola Zmeev considered purchasing one of two possible pelletizing machines: the MGL-200, produced in the Czech Republic, and the BM-130, produced by Andromeda Ltd, in Ruse, Bulgaria. The price of the MGL200 pelletizer was half that of the BM-130, while there was no significant difference in output capacity; 100 kg /hour for wood pellets and 150kg /hour for pellets produced from straw or crops. According to the investment analysis, the total initial costs (for the MGL-200) are 63,000 (VAT included). This breaks down as follows: 30,500 for a production line which consists of a thin breaker, a dryer, and a pelletizing press machine; 15,000 for construction (or purchase) of working premises with proper rooms and workshops in the village of Udelnik, 15,500 for devices that gather and break down the biomass in the forest (a rough breaker, a tractor, and one axis trailer); 2,000 for administrative and management activities, fees, and taxes. The minimum labor requirement is one worker for the pellet production line and one or two f,9/11 breaking the biomass in the forest. The sum of 63,000 exceeds the current annual tumover of NIK-05 Ltd, and banks have refused to provide the firm with credit. There are two opportunities for Nikola to attract additional financial sources: - partners (but some of them have refused to participate in this initiative due to the difficult circumstances of the financial crisis); - public funds for small firms support. (a good example is the Bulgarian Rural Areas Development Program 2007-2013, measure 312 "Support in creation and development of small firms.") NIK-05 Ltd is eligible for Measure 312 of the Bulgarian Rural Areas Development Program and can apply. According to the financial requirements, the firm must make all payments in advance and receive a grant for up to 70% of the eligible costs. Nikola can do it only if he can access a bank loan to cover the initial costs. He has a He plans to use a second-hand tractor and trailer, both given for free by partners (mainly relatives); the working premises will be rented; the biomass will be dried naturally (instead of with a dryer machine) in the fields during the summer harvest. Measure 312 requires the beneficiary to use the mobile assets within the territory of the rural municipality. Therefore NIK-05 is eligible to use the rough breaker only in forests within the region of Slivo Pole Municipality. This obstacle predetermines the maximum transport expenses (up to 15 kilometers). There is no restriction in Measure 312 regarding the territorial origin of the biomass (straw and wood). Annual expenses forecast in pellets production for 'Variant 2. ' The variable costs are 75 per ton of pellets, and they include: - labor and transport expenses for gathering, breaking, and transporting the wood biomass from the forests to the plant in the village of Udelnik or buying and delivering 1 ton of straw bales. - Electricity and labor in the pelletizing workshop. The annual fixed costs are expected to be 5,660, and they include: - rent of work premises. - Machine service and maintenance. - administrative and management costs; - expenses related to bank interest and other annual bank fees (not including the credit capital itself) (1) X=TFC/(PV), where: X is the break-even point, TFC is total fixed costs, P is the unit sale price, V is a unit variable cost. (2) TFC=IC/PBP+FC, where: IC is initial costs, PBP is the payback period of the investments (in our case, it is equal to the period of return of the loan), and FC is fixed costs. A combination of formula (2) and formula (1) gives formula (3), which allows us to calculate the breakeven point (X) for one year within the period of return of the bank loan ( 60 months): (3) X=(IC/PBP+FC)/(PV) We replace formula (3) with data about NIK-05 Ltd and calculate: X=193,2 tonnes =(20000/5+5660)/(12575) If the annual sales of pellets are over 198.4 tons, then NIK-05 Ltd can cover all expenses and return the bank loan within 60 months. If NIK-05 Ltd successfully benefits from measure 312 to the amount of 10,500, then minimal annual sales of pellets are: X312=139,76 tonnes =(9500/5+5088)/(12575). The output capacities of the 1 production line are determined by the pelletizing press (MGL-200), which are 0.1 tonne/hour when using wood and 0.15 tonne/hour in the case of straw. If it works 24 hours per day and 356 days per year (8760 hours), then the maximum output is 876 tonnes of wood pellets or 1314 tonnes of straw pellets. NIK-05 Ltd plans for the production line to work 80 hours per week for 52 weeks. In this case, the annual production would be 416 tonnes of wood pellets or 624 tonnes of straw pellets. The technology can produce pellets far beyond the break-even point ( X=193.2 tonnes). The priority for NIK-05 Ltd should be searching for significant clients for shells and making contracts with them. The company should also explore the development of direct sales to households. Conclusion The significant issues and problems of NIK-05 are related to searching for appropriate partners to develop proper markets and attract adequate financing. It has been easier for Nikola in the past because the firm dealt directly with small clients, and he managed to develop a positive reputation while working in his father's firm. But now, he faces a different market with another type of client. The major milestone for his pellet project is to sign a contract with solid partners (clients), enabling him to buy the technology he needs to start producing this renewable energy fuel. Therefore his key areas of interest are; firstly, to show them his level of loyalty by integrating them into his activity and being transparent; secondly, to ensure that the pellets he is going to produce are high quality, and to constantly monitor the production costs and improve the whole management of his firm with the help of Ruse University Entrepreneurship Center; third, once he has some clients, to enlarge his target group, searching for markets outside the Ruse region, or even outside Bulgaria. (Bucharest, the capital of Romania, is only 70km from Ruse.) The problems Nikola faced are related to changing how his firm was organized. Until now, he has been the firm's sole owner, and he has dealt with small clients, which is the pure market economics of Adam Smith. But he has become aware that the future belongs to business networks and clusters. He has to decide how to develop such a network. His optimism is based on the various collaborations with scientists at Ruse University. Answer the following questions: a) Examine the extent to which Nikola Zmeev has been able to create cooperation with Ruse University. b) Explain the components of Alexander Osterwalder's business model. c) Describe the advantages of vertical integration in your own words. d) Create a business model for NIK-05's pellet manufacturing activity, including a brief description of each of the nine partsStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock