Question: Pls answer the questions with your detailed explanations, it's much appreciated! A business commenced with capital in cash of $1,000. Inventory costing $800 plus sales

Pls answer the questions with your detailed explanations, it's much appreciated!

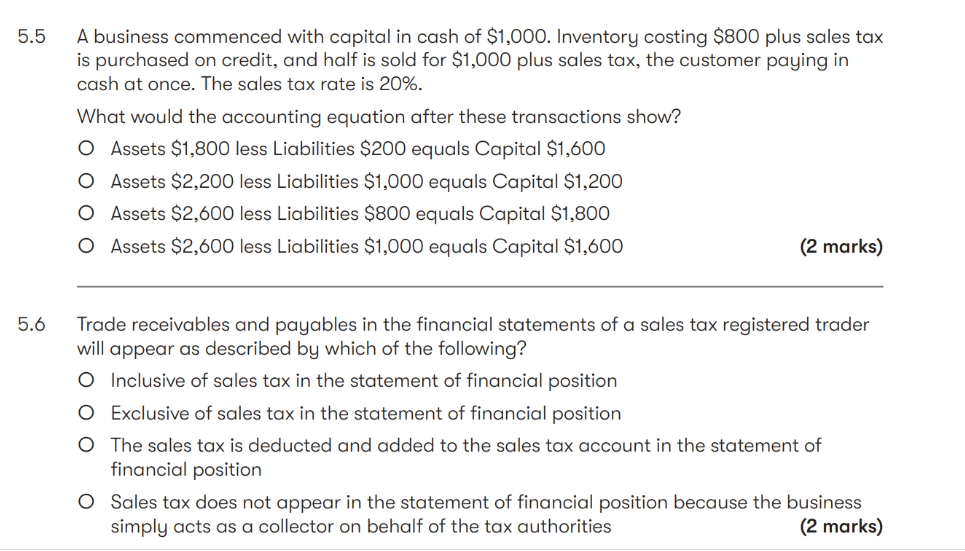

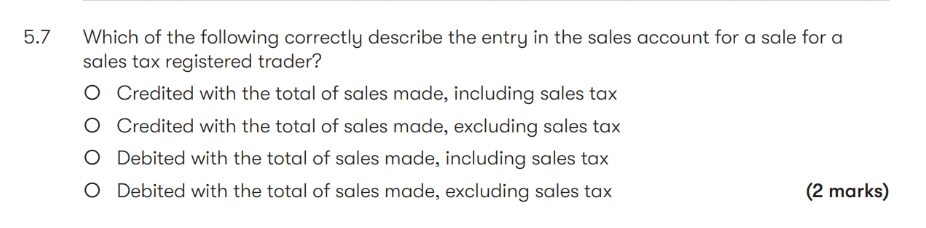

A business commenced with capital in cash of $1,000. Inventory costing $800 plus sales tax is purchased on credit, and half is sold for $1,000 plus sales tax, the customer paying in cash at once. The sales tax rate is 20%. What would the accounting equation after these transactions show? Assets $1,800 less Liabilities $200 equals Capital $1,600 Assets $2,200 less Liabilities $1,000 equals Capital $1,200 Assets $2,600 less Liabilities $800 equals Capital $1,800 Assets $2,600 less Liabilities $1,000 equals Capital $1,600 (2 marks) Trade receivables and payables in the financial statements of a sales tax registered trader will appear as described by which of the following? Inclusive of sales tax in the statement of financial position Exclusive of sales tax in the statement of financial position The sales tax is deducted and added to the sales tax account in the statement of financial position Sales tax does not appear in the statement of financial position because the business simply acts as a collector on behalf of the tax authorities (2 marks) .7 Which of the following correctly describe the entry in the sales account for a sale for a sales tax registered trader? Credited with the total of sales made, including sales tax Credited with the total of sales made, excluding sales tax Debited with the total of sales made, including sales tax Debited with the total of sales made, excluding sales tax (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts