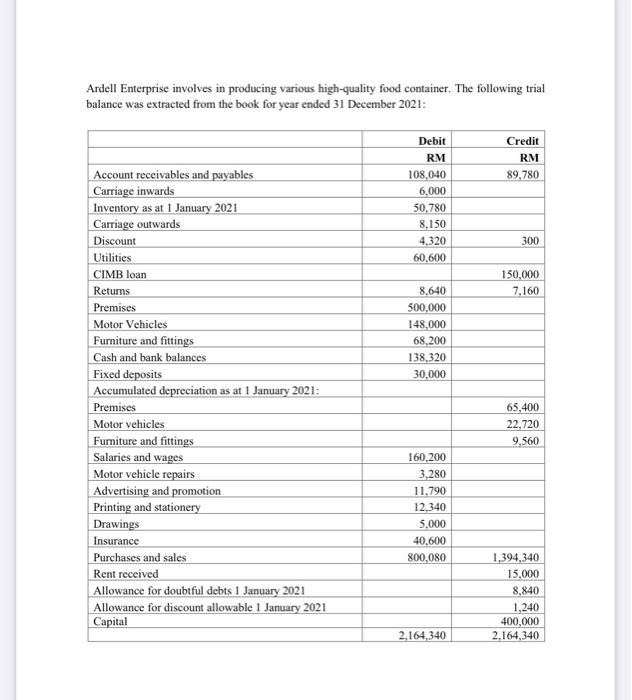

Question: pls anwser all Ardell Enterprise involves in producing various high-quality food container. The following trial balance was extracted from the book for year ended 31

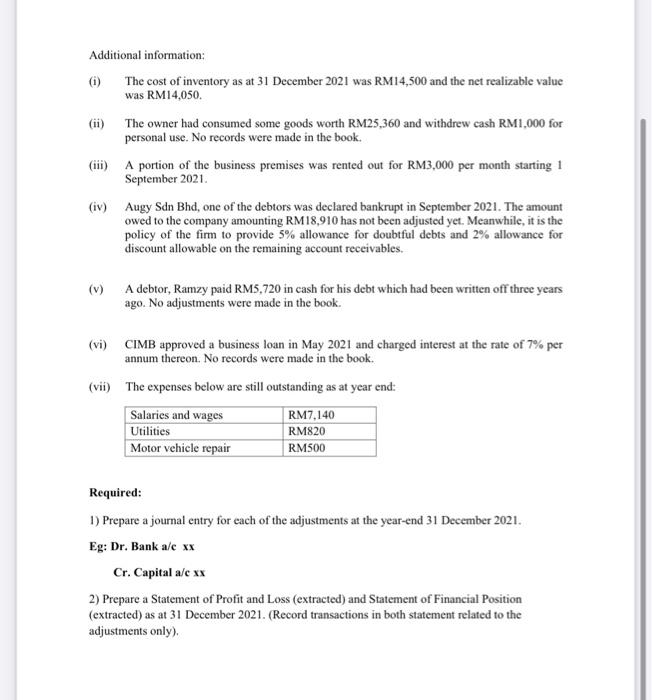

Ardell Enterprise involves in producing various high-quality food container. The following trial balance was extracted from the book for year ended 31 December 2021: Additional information: (i) The cost of inventory as at 31 December 2021 was RM14,500 and the net realizable value was RM14,050. (ii) The owner had consumed some goods worth RM25,360 and withdrew cash RM1,000 for personal use. No records were made in the book. (iii) A portion of the business premises was rented out for RM3,000 per month starting 1 September 2021. (iv) Augy Sdn Bhd, one of the debtors was declared bankrupt in September 2021. The amount owed to the company amounting RM18,910 has not been adjusted yet. Meanwhile, it is the policy of the firm to provide 5% allowance for doubtful debts and 2% allowance for discount allowable on the remaining account receivables. (v) A debtor, Ramzy paid RM5,720 in cash for his debt which had been written off three years ago. No adjustments were made in the book. (vi) CIMB approved a business loan in May 2021 and charged interest at the rate of 7% per annum thereon. No records were made in the book. (vii) The expenses below are still outstanding as at year end: Required: 1) Prepare a journal entry for each of the adjustments at the year-end 31 December 2021. Eg: Dr. Bank a/c xx Cr. Capital a/c xx 2) Prepare a Statement of Profit and Loss (extracted) and Statement of Financial Position (extracted) as at 31 December 2021. (Record transactions in both statement related to the adjustments only). Ardell Enterprise involves in producing various high-quality food container. The following trial balance was extracted from the book for year ended 31 December 2021: Additional information: (i) The cost of inventory as at 31 December 2021 was RM14,500 and the net realizable value was RM14,050. (ii) The owner had consumed some goods worth RM25,360 and withdrew cash RM1,000 for personal use. No records were made in the book. (iii) A portion of the business premises was rented out for RM3,000 per month starting 1 September 2021. (iv) Augy Sdn Bhd, one of the debtors was declared bankrupt in September 2021. The amount owed to the company amounting RM18,910 has not been adjusted yet. Meanwhile, it is the policy of the firm to provide 5% allowance for doubtful debts and 2% allowance for discount allowable on the remaining account receivables. (v) A debtor, Ramzy paid RM5,720 in cash for his debt which had been written off three years ago. No adjustments were made in the book. (vi) CIMB approved a business loan in May 2021 and charged interest at the rate of 7% per annum thereon. No records were made in the book. (vii) The expenses below are still outstanding as at year end: Required: 1) Prepare a journal entry for each of the adjustments at the year-end 31 December 2021. Eg: Dr. Bank a/c xx Cr. Capital a/c xx 2) Prepare a Statement of Profit and Loss (extracted) and Statement of Financial Position (extracted) as at 31 December 2021. (Record transactions in both statement related to the adjustments only)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts