Question: pls do both A Moving to the next question prevents changes to this answer. Question 7 of Question 7 3 points Jack has $10,000 of

pls do both

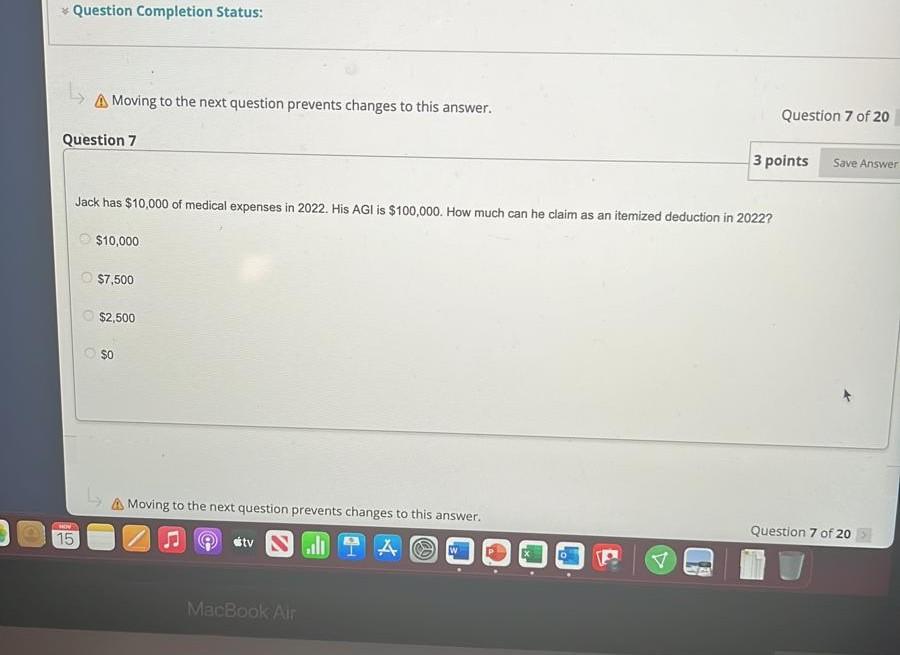

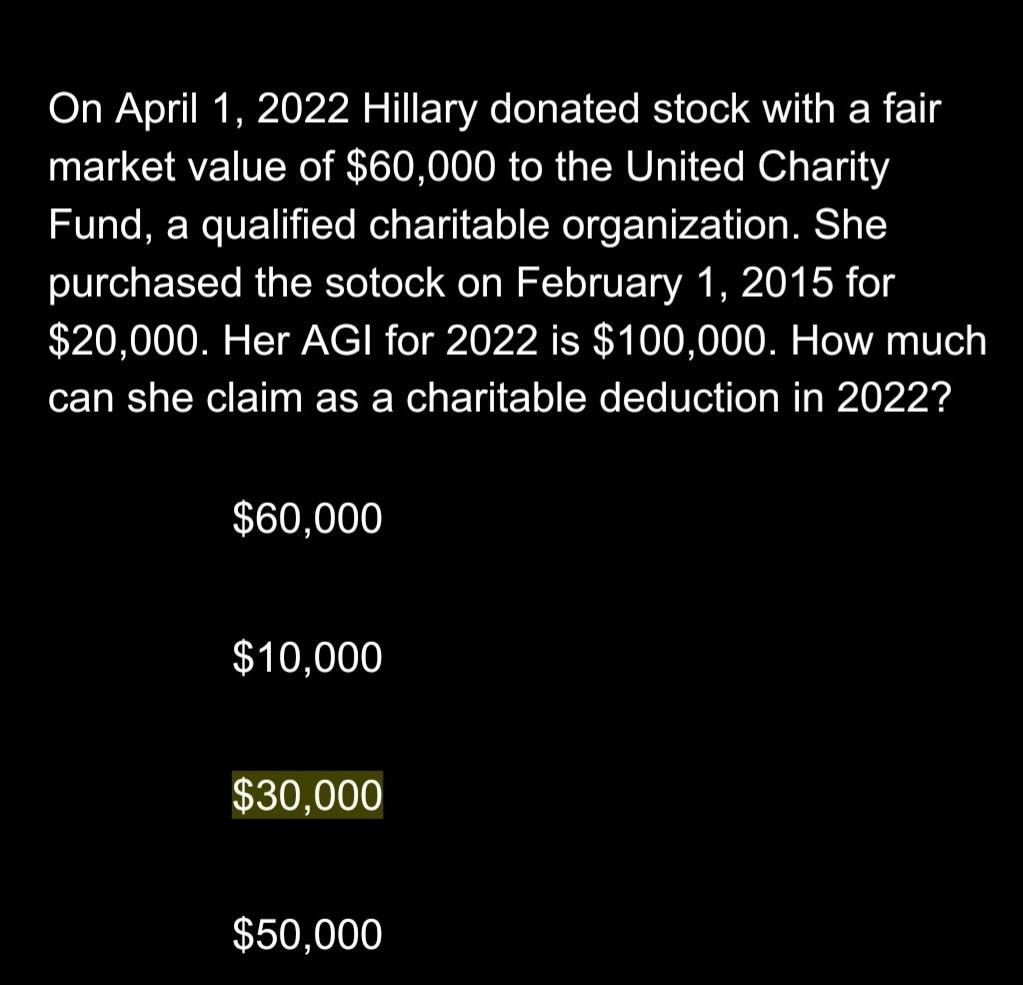

A Moving to the next question prevents changes to this answer. Question 7 of Question 7 3 points Jack has $10,000 of medical expenses in 2022 . His AGI is $100,000. How much can he claim as an itemized deduction in 2022? $10,000 $7,500 $2,500 $0 On April 1, 2022 Hillary donated stock with a fair market value of $60,000 to the United Charity Fund, a qualified charitable organization. She purchased the sotock on February 1, 2015 for $20,000. Her AGI for 2022 is $100,000. How much can she claim as a charitable deduction in 2022? $60,000$10,000$30,000$50,000

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock