Question: pls do by hand calculation not excel 1) Allied Materials needs $3 million in debt capital for expanded composites manufacturing. It offers small-denomination bonds at

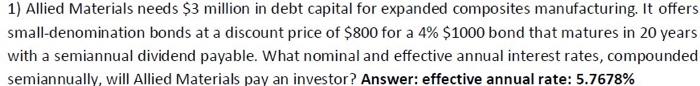

1) Allied Materials needs $3 million in debt capital for expanded composites manufacturing. It offers small-denomination bonds at a discount price of $800 for a 4%$1000 bond that matures in 20 years with a semiannual dividend payable. What nominal and effective annual interest rates, compounded semiannually, will Allied Materials pay an investor? Answer: effective annual rate: 5.7678%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts