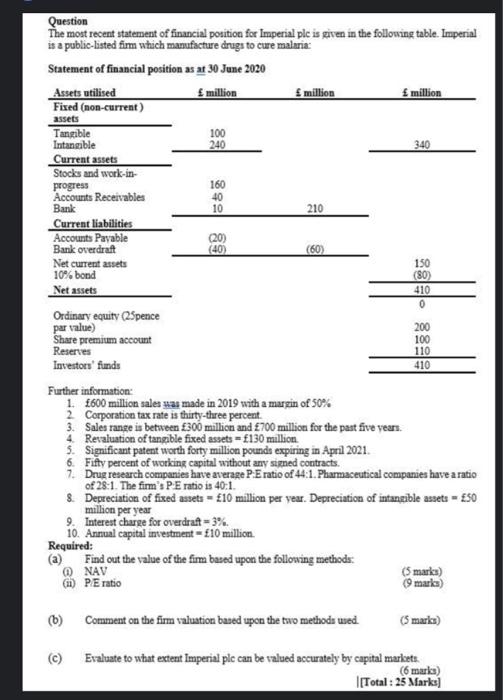

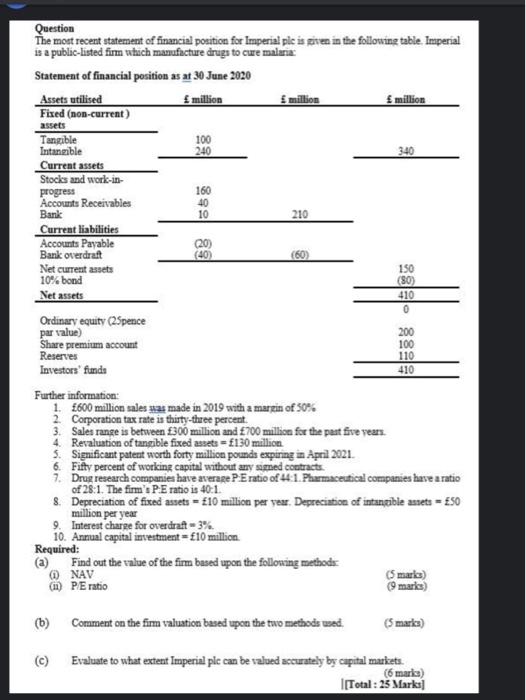

Question: pls do it ASAP. Question The most recent statement of financial position for Imperial ple is given in the following table. Imperial is a public-listed

Question The most recent statement of financial position for Imperial ple is given in the following table. Imperial is a public-listed firm which manufacture drugs to cure malaria Statement of financial position as at 30 June 2020 Assets utilised million million 1 million Fixed (non-current) assets Tangible 100 Intangible 240 340 Current assets Stocks and work-in- progress 160 Accounts Receivables 40 Bank 10 210 Current liabilities Accounts Payable (20) Bank overdraft (40) (60) Net current assets 150 10% bond (80) Net assets 410 0 Ordinary equity C2Spence par value) 200 Share premium account 100 Reserves 110 Investors' funds 410 Further information: 1 600 million sales was made in 2019 with a margin of 50% 2 Corporation tax rate is thirty-three percent 3. Sales range is between 300 million and E700 million for the past five years. 4 Revaluation of tangible fixed assets 130 million 5. Significant patent worth forty million pounds expiring in April 2021 6. Fifty percent of working capital without any signed contracts. 7. Drug research companies have average P: E ratio of 44:1. Pharmaceutical companies have a ratio of 28:1. The firm's PE ratio is 40:1 & Depreciation of fixed assets = 10 million per year. Depreciation of intangible assets - 50 million per year 9. Interest charge for overdraft - 3% 10. Annual capital investment - 10 million Required: (2) Find out the value of the firm based upon the following methods: @ NAV (marks) PE ratio (9 marks) Comment on the firm valuation based upon the two methods used (5 marks) Evaluate to what extent Imperial ple can be valued accurately by capital markets . (6 marks) [Total: 25 Marks] Question The most recent statement of financial position for Imperial pie is given in the following table. Imperial is a public-listed firm which manufacture drugs to cwe malaria Statement of financial position as at 30 June 2020 Assets utilised { million 1 million 1 million Fixed (non-current) assets Tangible 100 Intangible 240 340 Current assets Stocks and work-in- progress 160 Accounts Receivables 40 Bank 10 210 Current liabilities Accounts Payable (20) Bank overdraft (40) (60) Net current assets 150 10% bond (80) Net assets 410 0 Ordinary equity (2Spence par value) 200 Share premium account 100 Reserves 110 Investors' funds 410 Further information: 1. 600 million sales was made in 2019 with a margin of 50% 2. Corporation tax rate is thirty-three percent 3. Sales range is between 300 million and 700 million for the past five years. 4 Revaluation of tangible fixed assets = 130 million $. Significant patent worth forty million pounds expiring in April 2021. 6. Fifty percent of working capital without any signed contracts 7. Drug research companies have average PE ratio of 44:1. Pharmaceutical companies have a ratio of 28.1. The firm's PE ratio is 40:1 8. Depreciation of fixed assets = 10 million per year. Depreciation of intangible assets = 50 million per year 9. Interest charge for overdraft - 3% 10. Annual capital investment - 10 million Required: (2) Find out the value of the firm based upon the following methods *) NAV (5 marks) m PE ratio (9 marks) (b) Comment on the firm valuation based upon the two methods used. (5 marka) (C) Evaluate to what extent Imperial ple can be valued accurately by capital markets. [Total: 25 Marks] (6 marks) Question The most recent statement of financial position for Imperial ple is given in the following table. Imperial is a public-listed firm which manufacture drugs to cure malaria Statement of financial position as at 30 June 2020 Assets utilised million million 1 million Fixed (non-current) assets Tangible 100 Intangible 240 340 Current assets Stocks and work-in- progress 160 Accounts Receivables 40 Bank 10 210 Current liabilities Accounts Payable (20) Bank overdraft (40) (60) Net current assets 150 10% bond (80) Net assets 410 0 Ordinary equity C2Spence par value) 200 Share premium account 100 Reserves 110 Investors' funds 410 Further information: 1 600 million sales was made in 2019 with a margin of 50% 2 Corporation tax rate is thirty-three percent 3. Sales range is between 300 million and E700 million for the past five years. 4 Revaluation of tangible fixed assets 130 million 5. Significant patent worth forty million pounds expiring in April 2021 6. Fifty percent of working capital without any signed contracts. 7. Drug research companies have average P: E ratio of 44:1. Pharmaceutical companies have a ratio of 28:1. The firm's PE ratio is 40:1 & Depreciation of fixed assets = 10 million per year. Depreciation of intangible assets - 50 million per year 9. Interest charge for overdraft - 3% 10. Annual capital investment - 10 million Required: (2) Find out the value of the firm based upon the following methods: @ NAV (marks) PE ratio (9 marks) Comment on the firm valuation based upon the two methods used (5 marks) Evaluate to what extent Imperial ple can be valued accurately by capital markets . (6 marks) [Total: 25 Marks] Question The most recent statement of financial position for Imperial pie is given in the following table. Imperial is a public-listed firm which manufacture drugs to cwe malaria Statement of financial position as at 30 June 2020 Assets utilised { million 1 million 1 million Fixed (non-current) assets Tangible 100 Intangible 240 340 Current assets Stocks and work-in- progress 160 Accounts Receivables 40 Bank 10 210 Current liabilities Accounts Payable (20) Bank overdraft (40) (60) Net current assets 150 10% bond (80) Net assets 410 0 Ordinary equity (2Spence par value) 200 Share premium account 100 Reserves 110 Investors' funds 410 Further information: 1. 600 million sales was made in 2019 with a margin of 50% 2. Corporation tax rate is thirty-three percent 3. Sales range is between 300 million and 700 million for the past five years. 4 Revaluation of tangible fixed assets = 130 million $. Significant patent worth forty million pounds expiring in April 2021. 6. Fifty percent of working capital without any signed contracts 7. Drug research companies have average PE ratio of 44:1. Pharmaceutical companies have a ratio of 28.1. The firm's PE ratio is 40:1 8. Depreciation of fixed assets = 10 million per year. Depreciation of intangible assets = 50 million per year 9. Interest charge for overdraft - 3% 10. Annual capital investment - 10 million Required: (2) Find out the value of the firm based upon the following methods *) NAV (5 marks) m PE ratio (9 marks) (b) Comment on the firm valuation based upon the two methods used. (5 marka) (C) Evaluate to what extent Imperial ple can be valued accurately by capital markets. [Total: 25 Marks] (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts