Question: Pls do step by step a) Brendan is working as a consultant to the Rainbow Clothing Company, and he has been asked to compute the

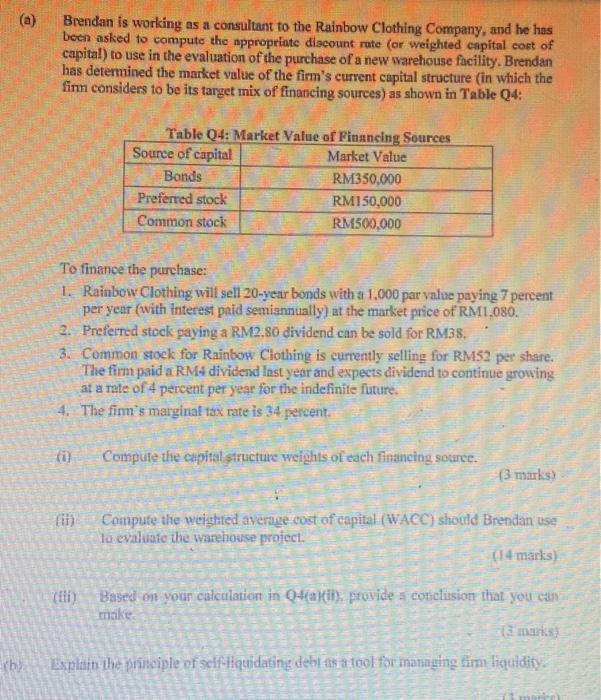

a) Brendan is working as a consultant to the Rainbow Clothing Company, and he has been asked to compute the appropriate discount rute (or weighted capital cost of capital) to use in the evaluation of the purchase of a new warehouse facility. Brendan has determined the market value of the firm's current capital strueture (in which the firn considers to be its target mix of financing sources) as shown in Table Q4: To finance the purchase: 1. Rainbow Clothing will sell 20 -year bonds with a 1,000 par value paying 7 percent per year (with interest paid semiannually) at the market price of RM1, 080. 2. Preferred stock paying a RM2,80 dividend can be sold for RM38, 3. Common stock for Rainbow Clothing is currently selling for RM52 per share. The firm paid a RM4 dividend last yeor and expects dividend to continue growing at a rate of 4 percent per year for the indefinite future. 4. The fimn's marginal tox rate is 34 percent. (i) Compute the eapital structure weights of each financing source. (3 marks) (ii) Compute the weighted average cost of capital (WACC) should Brendan use to evaliaic the wanehouse project. (14 marks) (fii) Based on your calculation in Q+ (a)(ii), provide a conclission that you cun mike Expltit the pritiple of sciftliquidating dehi is a tool for managng firm liqudity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts