Question: pls do the question right and if it needs to use a financial calculator show me how to use the calculator step by step the

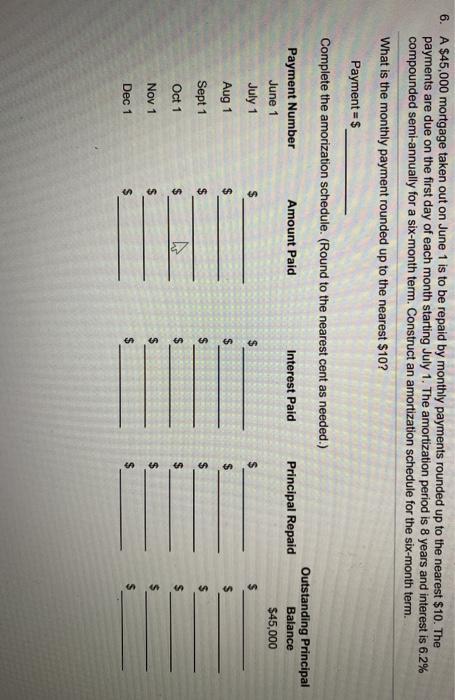

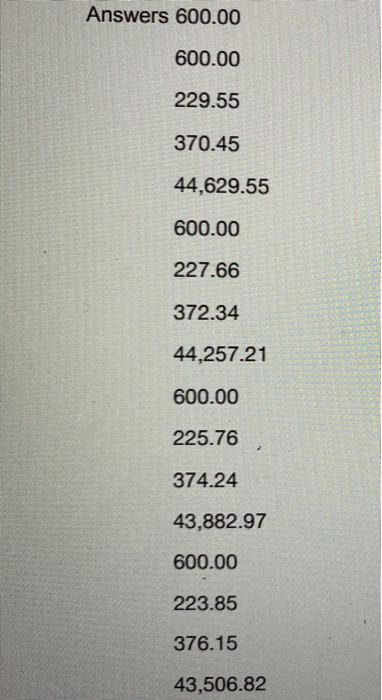

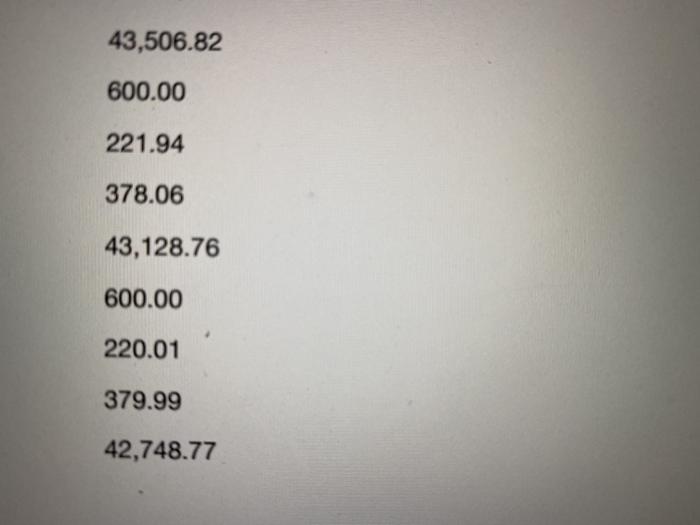

6. A $45,000 mortgage taken out on June 1 is to be repaid by monthly payments rounded up to the nearest $10. The payments are due on the first day of each month starting July 1. The amortization period is 8 years and interest is 6.2% compounded semi-annually for a six-month term. Construct an amortization schedule for the six-month term. What is the monthly payment rounded up to the nearest $10? Payment = $ Complete the amorization schedule. (Round to the nearest cent as needed.) Amount Paid Interest Paid Principal Repaid Outstanding Principal Balance $45,000 $ $ Payment Number June 1 July 1 Aug 1 Sept 1 $ GA $ GA GA $ Oct 1 $ $ $ Nov 1 $ GA $ $ Dec 1 $ $ Answers 600.00 600.00 229.55 370.45 44,629.55 600.00 227.66 372.34 44,257.21 600.00 225.76 374.24 43,882.97 600.00 223.85 376.15 43,506.82 43,506.82 600.00 221.94 378.06 43,128.76 600.00 220.01 379.99 42,748.77 6. A $45,000 mortgage taken out on June 1 is to be repaid by monthly payments rounded up to the nearest $10. The payments are due on the first day of each month starting July 1. The amortization period is 8 years and interest is 6.2% compounded semi-annually for a six-month term. Construct an amortization schedule for the six-month term. What is the monthly payment rounded up to the nearest $10? Payment = $ Complete the amorization schedule. (Round to the nearest cent as needed.) Amount Paid Interest Paid Principal Repaid Outstanding Principal Balance $45,000 $ $ Payment Number June 1 July 1 Aug 1 Sept 1 $ GA $ GA GA $ Oct 1 $ $ $ Nov 1 $ GA $ $ Dec 1 $ $ Answers 600.00 600.00 229.55 370.45 44,629.55 600.00 227.66 372.34 44,257.21 600.00 225.76 374.24 43,882.97 600.00 223.85 376.15 43,506.82 43,506.82 600.00 221.94 378.06 43,128.76 600.00 220.01 379.99 42,748.77

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts