Question: pls dont solve in excel I need know how Im going to solve this on the final Mertol Corporation has 10-year, 1000 par value bonds

pls dont solve in excel I need know how Im going to solve this on the final

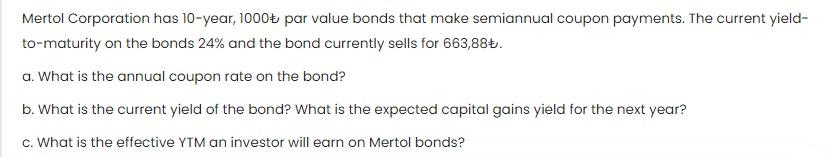

Mertol Corporation has 10-year, 1000 par value bonds that make semiannual coupon payments. The current yield- to-maturity on the bonds 24% and the bond currently sells for 663,88+. a. What is the annual coupon rate on the bond? b. What is the current yield of the bond? What is the expected capital gains yield for the next year? c. What is the effective YTM an investor will earn on Mertol bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts