Question: Pls explain how to get answer without excel Your firm will purchase a new machine. The machine costs $650,000. The machine will be operated for

Pls explain how to get answer without excel

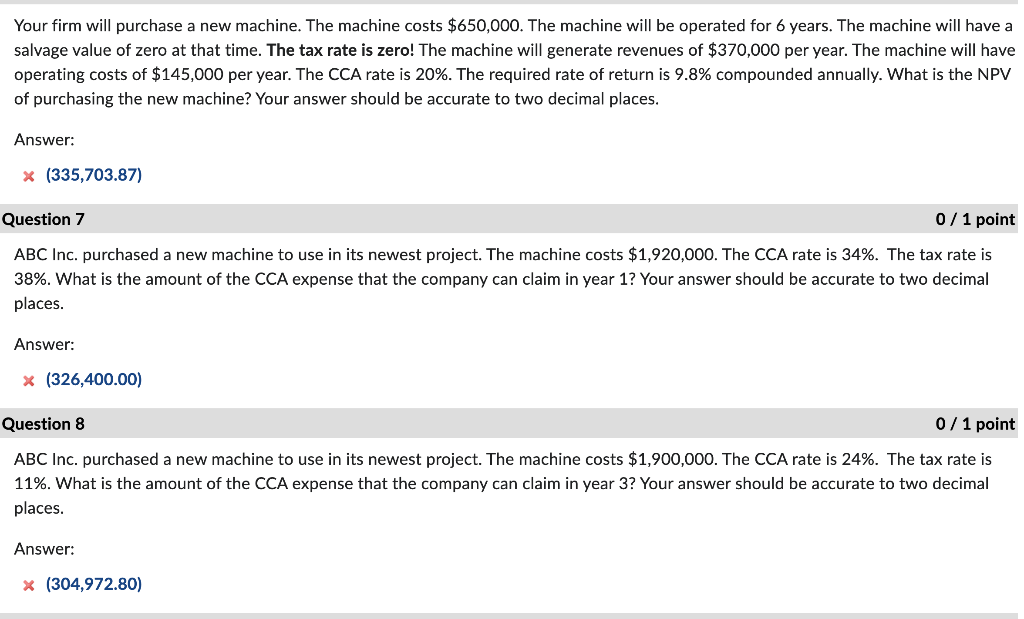

Your firm will purchase a new machine. The machine costs $650,000. The machine will be operated for 6 years. The machine will have a salvage value of zero at that time. The tax rate is zero! The machine will generate revenues of $370,000 per year. The machine will have operating costs of $145,000 per year. The CCA rate is 20%. The required rate of return is 9.8% compounded annually. What is the NPV of purchasing the new machine? Your answer should be accurate to two decimal places. Answer: x (335,703.87) Question 7 0/1 point ABC Inc. purchased a new machine to use in its newest project. The machine costs $1,920,000. The CCA rate is 34%. The tax rate is 38%. What is the amount of the CCA expense that the company can claim in year 1? Your answer should be accurate to two decimal places. Answer: x (326,400.00) Question 8 0/1 point ABC Inc. purchased a new machine to use in its newest project. The machine costs $1,900,000. The CCA rate is 24%. The tax rate is 11%. What is the amount of the CCA expense that the company can claim in year 3? Your answer should be accurate to two decimal places. Answer: x (304,972.80)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts