Question: pls explain like its a written exam Question 6.8 (15pts) A manufacturer is considering six mutually exclusive cost-reduction projects for its manufacturing plant. All have

pls explain like its a written exam

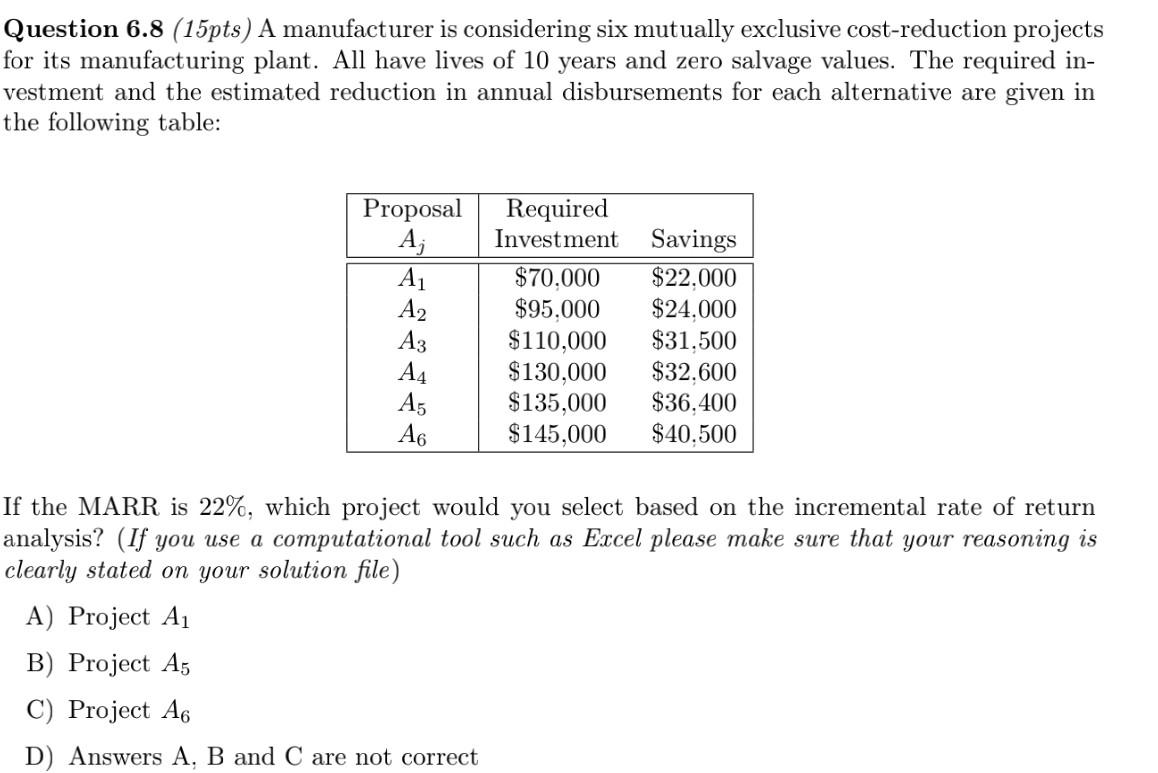

Question 6.8 (15pts) A manufacturer is considering six mutually exclusive cost-reduction projects for its manufacturing plant. All have lives of 10 years and zero salvage values. The required in- vestment and the estimated reduction in annual disbursements for each alternative are given in the following table: Proposal Required Aj Investment Savings A $70,000 $22.000 A2 $95.000 $24,000 A3 $110,000 $31,500 A4 $130,000 $32.600 A5 $135,000 $36,400 A6 $145,000 $40.500 If the MARR is 22%, which project would you select based on the incremental rate of return analysis? (If you use a computational tool such as Excel please make sure that your reasoning is clearly stated on your solution file) A) Project A B) Project A5 C) Project A6 D) Answers A, B and C are not correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts