Question: Pls, give an answer to question 3 & 4 ONLY. Do not use an excel sheet unless you are going to show full workings. You

Pls, give an answer to question 3 & 4 ONLY. Do not use an excel sheet unless you are going to show full workings. You may write the answers but make sure they are legible. Thanks

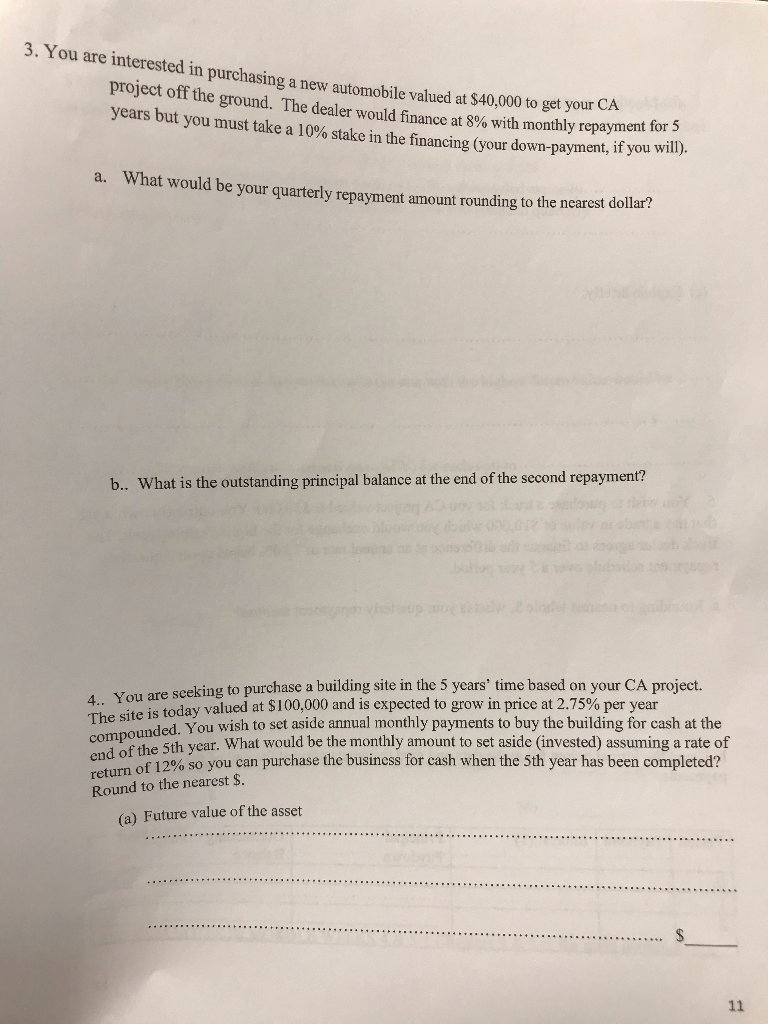

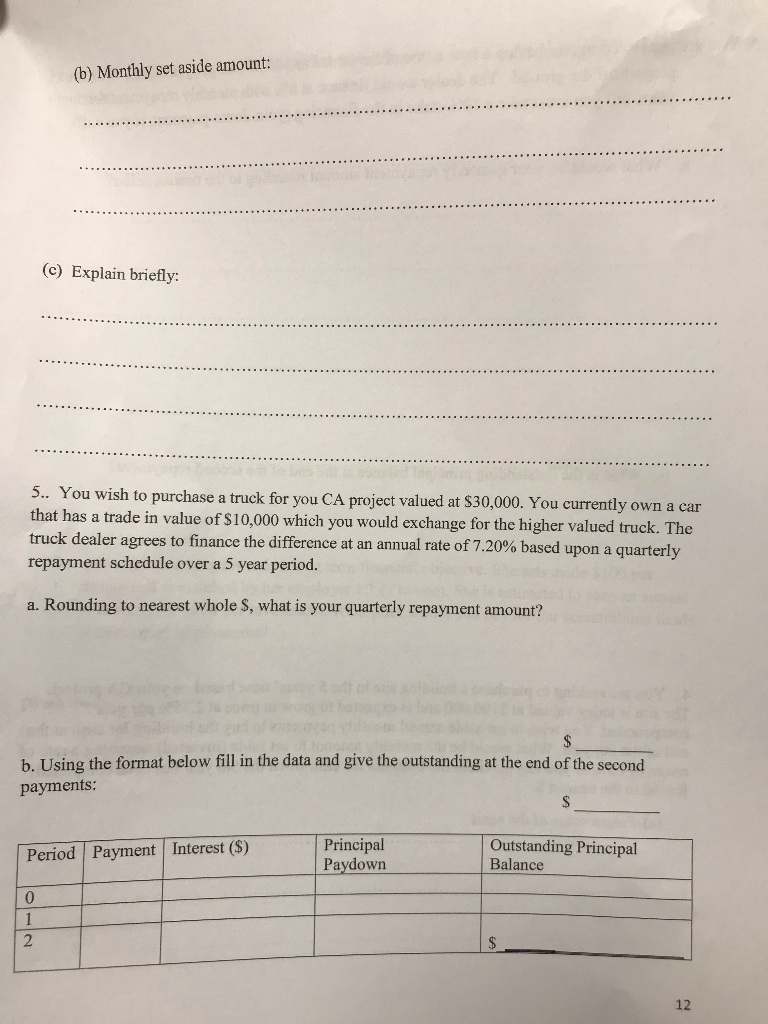

3. You are interested in purchasing a new automobile valued at $40,000 to go project off the ground. The dealer would finance at 8% with monthly repaym years but you must take a 10% stake in the financing (your down-payment, it ed at $40,000 to get your CA Tinance at 8% with monthly repayment for 5 mg (Your down-payment, if you will). a. what would be your quarterly repayment amount rounding to the nearest donk b.. What is the outstanding principal balance at the end of the second repayment? are seeking to purchase a building site in the 5 years' time based on your CA project. s today valued at $100,000 and is expected to grow in price at 2.75% per year ded. You wish to set aside annual monthly payments to buy the building for cash at the 5th year. What would be the monthly amount to set aside (invested) assuming a rate of 12% so you can purchase the business for cash when the 5th year has been completed? compounded. You wish to se end of the 5th year. What would 1 return of 12% so you Round to the nearest $. (a) Future value of the asset (b) Monthly set aside amount: c) Explain briefly: 5.. You wish to purchase a truck for you CA project valued at $30,000. You currently own a car that has a trade in value of $10,000 which you would exchange for the higher valued truck. The truck dealer agrees to finance the difference at an annual rate of 7.20% based upon a quarterly repayment schedule over a 5 year period. a. Rounding to nearest whole $, what is your quarterly repayment amount? h Using the format below fill in the data and give the outstanding at the end of the second payments: Period Payment Interest ($) Principal Paydown Outstanding Principal Balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts