Question: pls give the correct answer for each ill rate. pls make sure no mistakes Your client has $95,000 invested in stock A. She would like

pls give the correct answer for each ill rate. pls make sure no mistakes

pls give the correct answer for each ill rate. pls make sure no mistakes

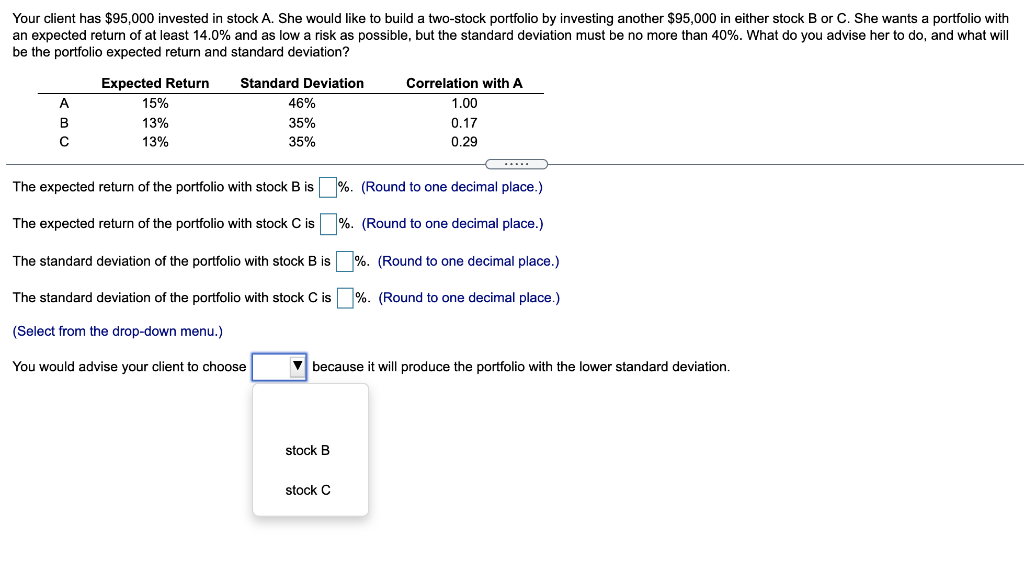

Your client has $95,000 invested in stock A. She would like to build a two-stock portfolio by investing another $95,000 in either stock B or C. She wants a portfolio with an expected return of at least 14.0% and as low a risk as possible, but the standard deviation must be no more than 40%. What do you advise her to do, and what will be the portfolio expected return and standard deviation? A Expected Return 15% 13% 13% Standard Deviation 46% 35% 35% Correlation with A 1.00 0.17 0.29 B C The expected return of the portfolio with stock B is %. (Round to one decimal place.) The expected return of the portfolio with stock C is %. (Round to one decimal place.) The standard deviation of the portfolio with stock B is %. (Round to one decimal place.) The standard deviation of the portfolio with stock C is %. (Round to one decimal place.) (Select from the drop-down menu.) You would advise your client to choose because it will produce the portfolio with the lower standard deviation. stock B stock C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts