Question: pls help 1-2 Reference Reference Reference Reference Avderson industries is deciding whether to autornate one phase of its producton process. The manufacturing equpment has a

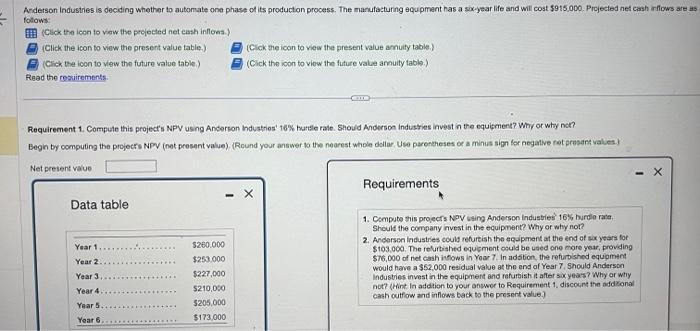

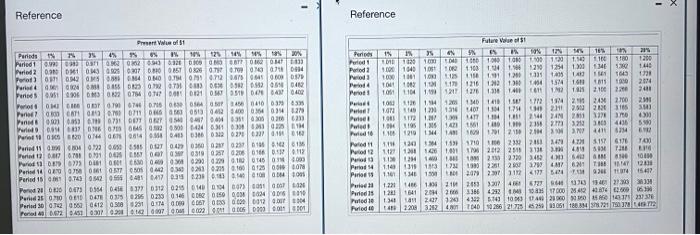

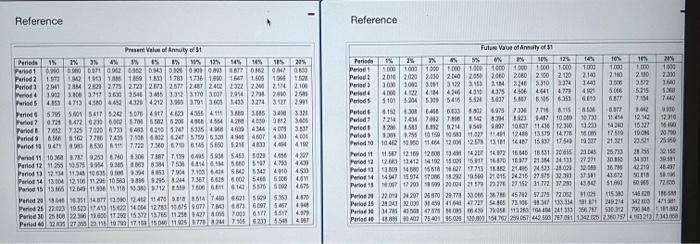

Reference Reference Reference Reference Avderson industries is deciding whether to autornate one phase of its producton process. The manufacturing equpment has a six-year life and will cost $915,000. Projected net cash iflows are as folows: (Click the icon to vow the projocted net eash infloes.) iClick the icon to wiew the present value table, ) (Cick the icon to view the present value amuity table.) (Click tha icon to vew the future value table.) (Cick the icon to viow the future valee amuity table.) Read the resuirements. Requirement 1. Compule this project's NPV using Anderson hdustries' 16% hurtle rate. Should Anderson Industies invest in the equitment? Why or whty net? Begin by computing the projecrs NPV (not prosent value). (Round your answer to the nearest whole deliar, Use paroneheses or a minus sign for neganive ret presans values) Net present value Data table Requirements 1. Compute this proecrs NPV wimg Anderson industres 16% burdo rate. Should the company hivest in the equipment? Why or why not? 2. Andersen industries could refurtish the equipment at the end of wax years for $103.000. The relurbishtd equement opuld be used one more year, providing $76,000 of net cash infows in Yoor 7 . In adstion, the refurbished equamint would have a $52,000 residual value at the end of Year 7 , Should Anderson industries invest in the equipment and refurbish it after sxyeas? Why or why not? (Hint in addaion to your onswor to Requirement 1, discount the addiconal cash outfow and inflows back to the present value.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts