Question: pls help and ANSWER ALL Lesson 1 - Future Value and Length of Loans a) You are borrowing money from a bank that calculates simple

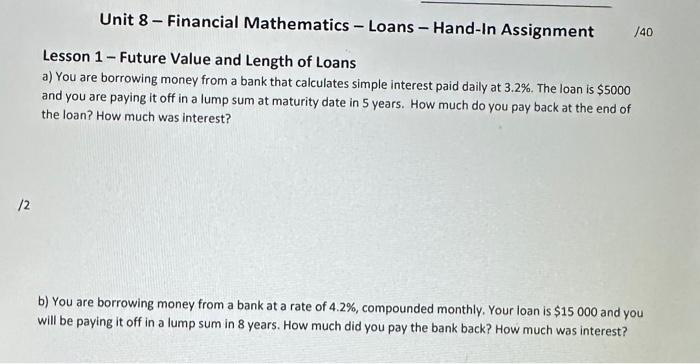

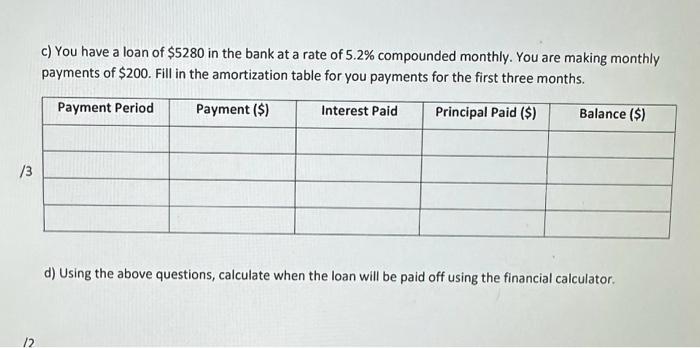

Lesson 1 - Future Value and Length of Loans a) You are borrowing money from a bank that calculates simple interest paid daily at 3.2%. The loan is $5000 and you are paying it off in a lump sum at maturity date in 5 years. How much do you pay back at the end of the loan? How much was interest? b) You are borrowing money from a bank at a rate of 4.2%, compounded monthly. Your loan is $15000 and you will be paying it off in a lump sum in 8 years. How much did you pay the bank back? How much was interest? c) You have a loan of $5280 in the bank at a rate of 5.2% compounded monthly. You are making monthly payments of $200. Fill in the amortization table for you payments for the first three months. d) Using the above questions, calculate when the loan will be paid off using the financial calculator

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts