Question: pls help answer these M&A questions The following data will be used to answer Questions 12-13. On April 28, 2016, St. Jude Medical issued a

pls help answer these M&A questions

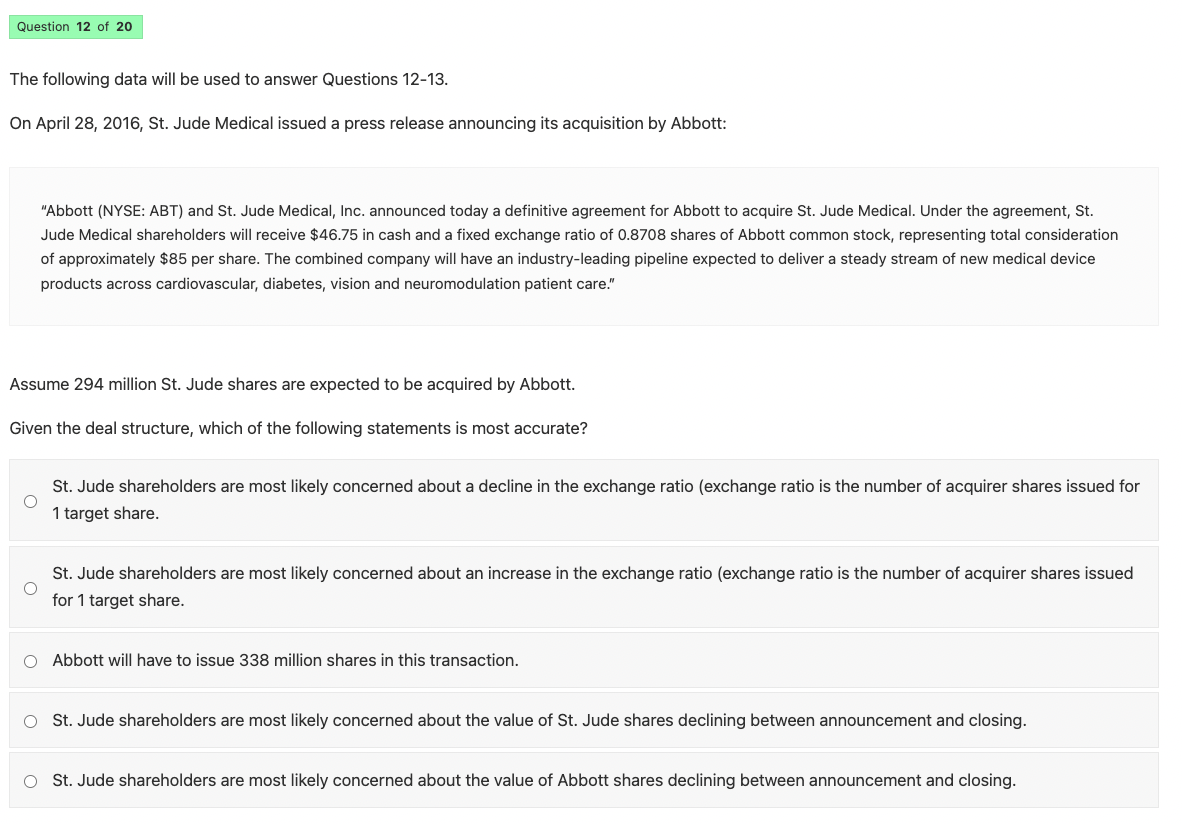

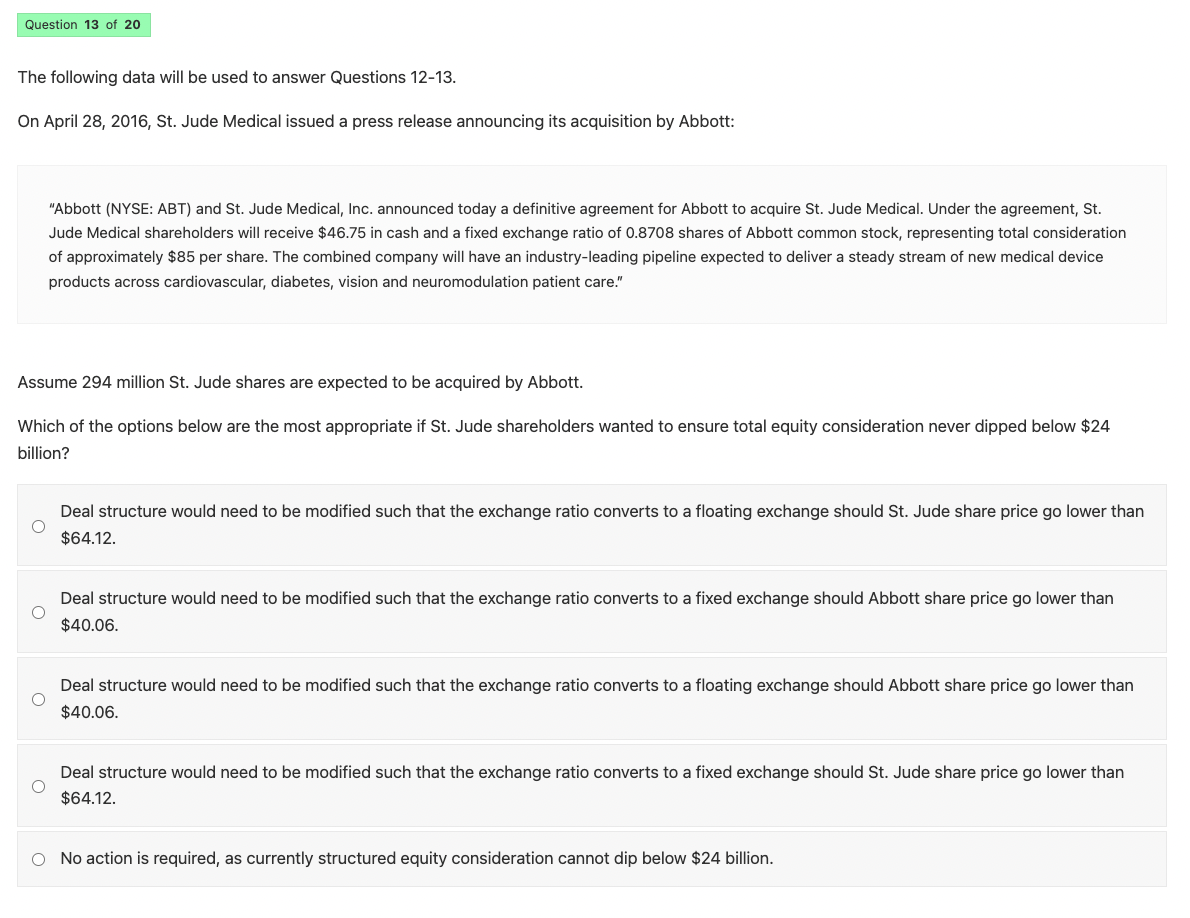

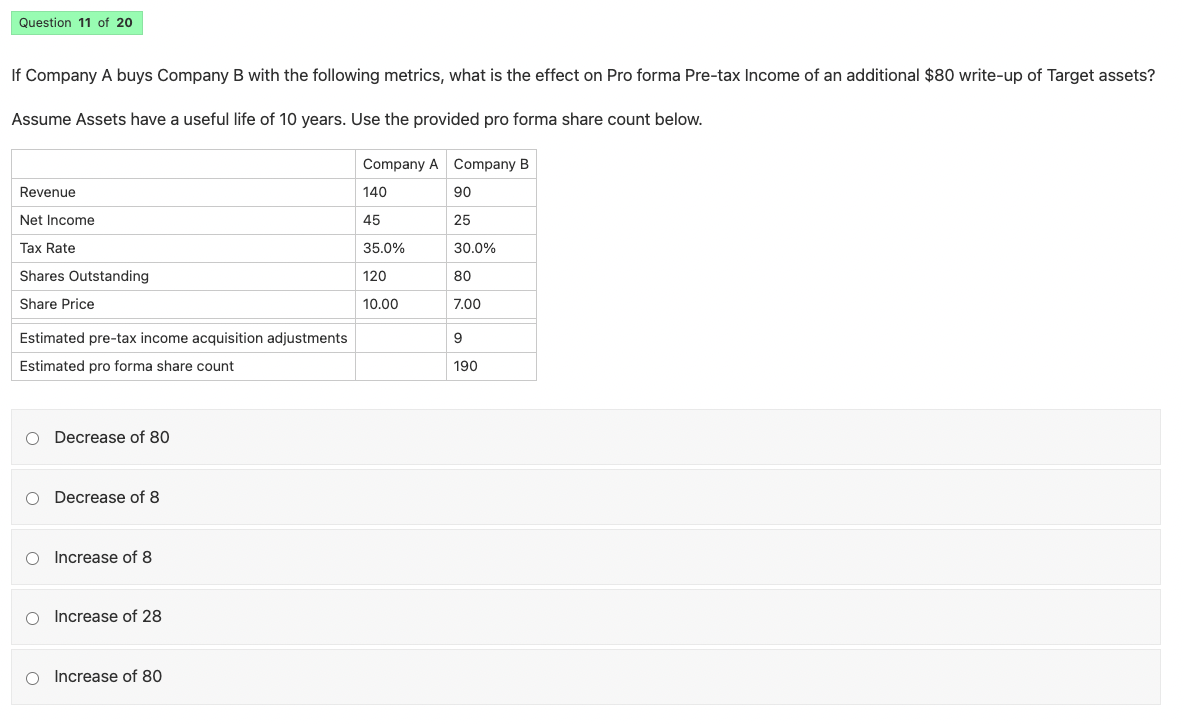

The following data will be used to answer Questions 12-13. On April 28, 2016, St. Jude Medical issued a press release announcing its acquisition by Abbott: "Abbott (NYSE: ABT) and St. Jude Medical, Inc. announced today a definitive agreement for Abbott to acquire St. Jude Medical. Under the agreement, St. Jude Medical shareholders will receive $46.75 in cash and a fixed exchange ratio of 0.8708 shares of Abbott common stock, representing total consideration of approximately $85 per share. The combined company will have an industry-leading pipeline expected to deliver a steady stream of new medical device products across cardiovascular, diabetes, vision and neuromodulation patient care." Assume 294 million St. Jude shares are expected to be acquired by Abbott. Given the deal structure, which of the following statements is most accurate? St. Jude shareholders are most likely concerned about a decline in the exchange ratio (exchange ratio is the number of acquirer shares issued for 1 target share. St. Jude shareholders are most likely concerned about an increase in the exchange ratio (exchange ratio is the number of acquirer shares issued for 1 target share. Abbott will have to issue 338 million shares in this transaction. St. Jude shareholders are most likely concerned about the value of St. Jude shares declining between announcement and closing. St. Jude shareholders are most likely concerned about the value of Abbott shares declining between announcement and closing. The following data will be used to answer Questions 12-13. On April 28, 2016, St. Jude Medical issued a press release announcing its acquisition by Abbott: "Abbott (NYSE: ABT) and St. Jude Medical, Inc. announced today a definitive agreement for Abbott to acquire St. Jude Medical. Under the agreement, St. Jude Medical shareholders will receive $46.75 in cash and a fixed exchange ratio of 0.8708 shares of Abbott common stock, representing total consideration of approximately $85 per share. The combined company will have an industry-leading pipeline expected to deliver a steady stream of new medical device products across cardiovascular, diabetes, vision and neuromodulation patient care." Assume 294 million St. Jude shares are expected to be acquired by Abbott. Which of the options below are the most appropriate if St. Jude shareholders wanted to ensure total equity consideration never dipped below $24 billion? Deal structure would need to be modified such that the exchange ratio converts to a floating exchange should St. Jude share price go lower than $64.12. Deal structure would need to be modified such that the exchange ratio converts to a fixed exchange should Abbott share price go lower than $40.06. Deal structure would need to be modified such that the exchange ratio converts to a floating exchange should Abbott share price go lower than $40.06. Deal structure would need to be modified such that the exchange ratio converts to a fixed exchange should St. Jude share price go lower than $64.12. No action is required, as currently structured equity consideration cannot dip below $24 billion. If Company A buys Company B with the following metrics, what is the effect on Pro forma Pre-tax Income of an additional $80 write-up of Target assets? Assume Assets have a useful life of 10 years. Use the provided pro forma share count below. Decrease of 80 Decrease of 8 Increase of 8 Increase of 28 Increase of 80

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts