Question: PLS HELP ASAP 26- A portfolio has an expected return of 12.38%. The portfolio consists of stock A with an expected return of 7.52% and

PLS HELP ASAP

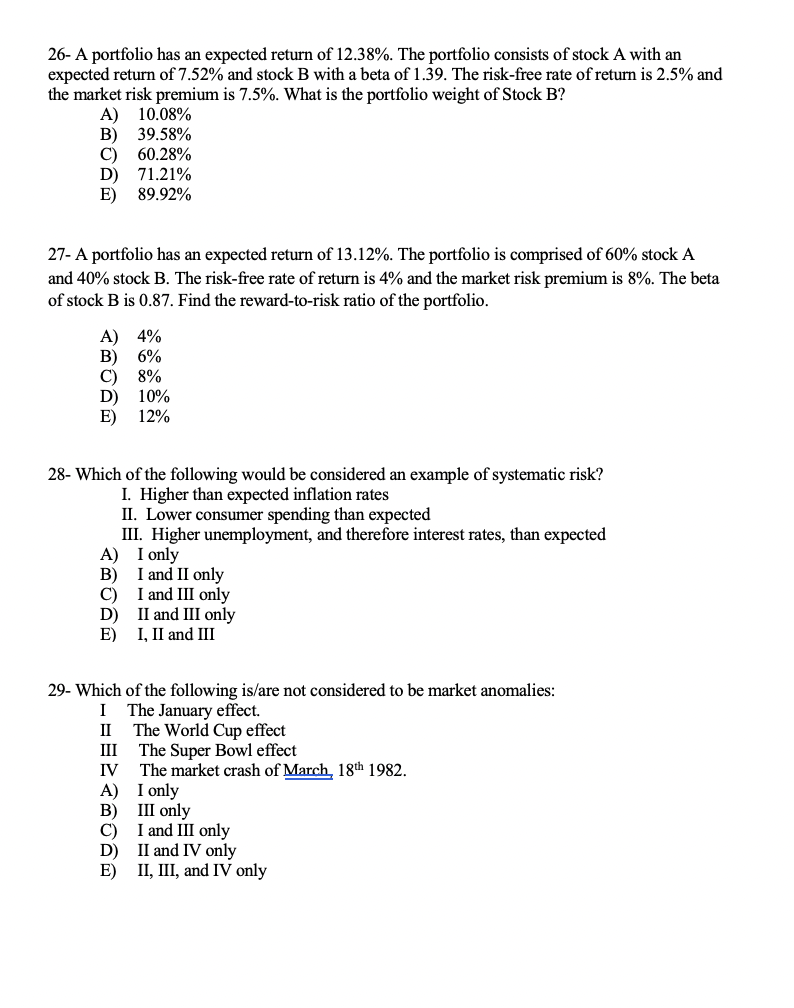

26- A portfolio has an expected return of 12.38%. The portfolio consists of stock A with an expected return of 7.52% and stock B with a beta of 1.39. The risk-free rate of return is 2.5% and the market risk premium is 7.5%. What is the portfolio weight of Stock B? A) 10.08% B) 39.58% C) 60.28% D) 71.21% E) 89.92% 27-A portfolio has an expected return of 13.12%. The portfolio is comprised of 60% stock A and 40% stock B. The risk-free rate of return is 4% and the market risk premium is 8%. The beta of stock B is 0.87. Find the reward-to-risk ratio of the portfolio. A) 4% B) 6% C) D) 10% E) 12% 8% 28- Which of the following would be considered an example of systematic risk? I. Higher than expected inflation rates II. Lower consumer spending than expected III. Higher unemployment, and therefore interest rates, than expected A) I only B) I and II only C) I and III only D) II and III only E) I, II and III 29- Which of the following is/are not considered to be market anomalies: I The January effect. II The World Cup effect III The Super Bowl effect IV The market crash of March 18th 1982. A) I only B) III only C) I and III only D) II and IV only E) II, III, and IV only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts