Question: pls help!! Bill Sanders started a part-time consulting practice, Sanders Consulting Associates (SCA), on January 1, Year 1. SCA experienced the following transactions during Year

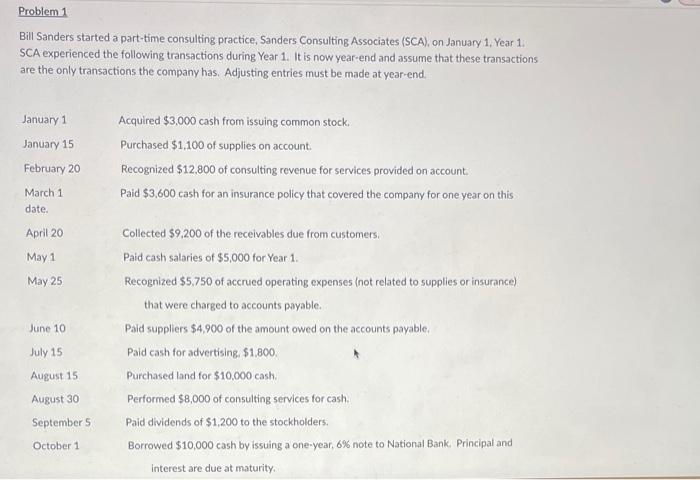

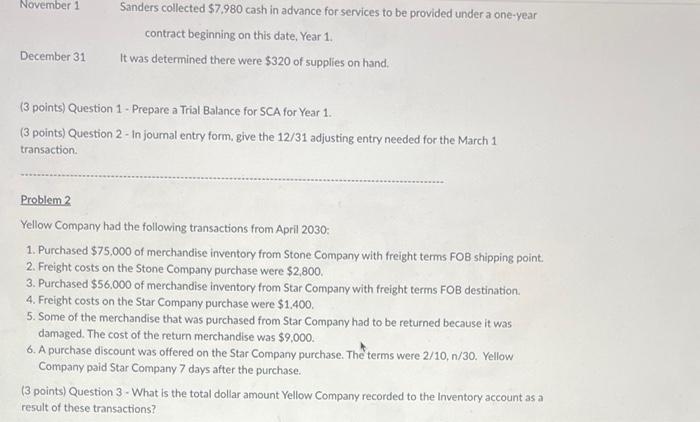

Bill Sanders started a part-time consulting practice, Sanders Consulting Associates (SCA), on January 1, Year 1. SCA experienced the following transactions during Year 1. It is now year-end and assume that these transactions are the only transactions the company has. Adjusting entries must be made at year-end. November 1 Sanders collected $7,980 cash in advance for services to be provided under a one-year contract beginning on this date, Year 1 . December 31 It was determined there were $320 of supplies on hand. (3 points) Question 1- Prepare a Trial Balance for SCA for Year 1. (3 points) Question 2 - In joumal entry form, give the 12/31 adjusting entry needed for the March 1 transaction. Problem 2 Yellow Company had the following transactions from April 2030: 1. Purchased $75.000 of merchandise inventory from Stone Company with freight terms FOB shipping point. 2. Freight costs on the Stone Company purchase were $2,800. 3. Purchased $6.000 of merchandise inventory from Star Company with freight terms FOB destination. 4. Freight costs on the Star Company purchase were $1.400. 5. Some of the merchandise that was purchased from Star Company had to be returned because it was damaged. The cost of the return merchandise was $9,000. 6. A purchase discount was offered on the Star Company purchase. The terms were 2/10,n/30. Yellow Company paid Star Company 7 days after the purchase. (3 points) Question 3 - What is the total dollar amount Yellow Company recorded to the inventory account as a result of these transactions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts