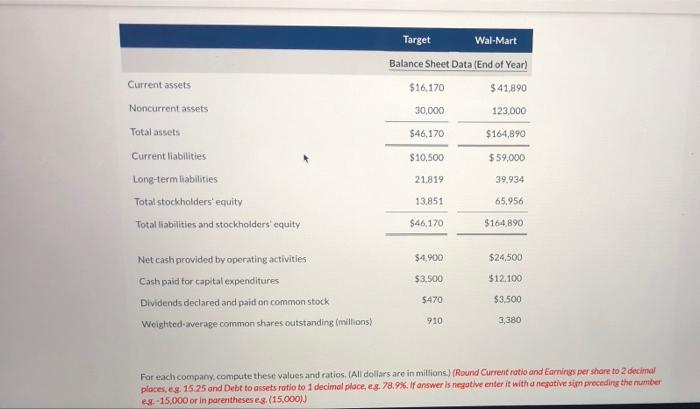

Question: PLS HELP Current assets Target Wal-Mart Balance Sheet Data (End of Year) $16,170 $41,890 30,000 123.000 $46,170 $164,890 $10,500 $ 59,000 Noncurrent assets Total assets

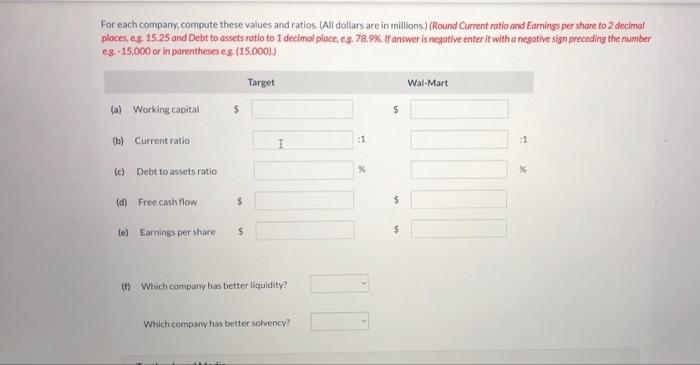

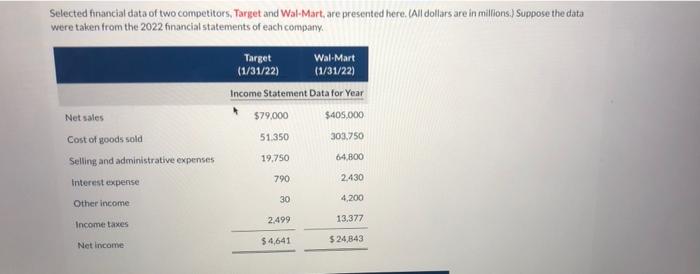

Current assets Target Wal-Mart Balance Sheet Data (End of Year) $16,170 $41,890 30,000 123.000 $46,170 $164,890 $10,500 $ 59,000 Noncurrent assets Total assets Current liabilities Long-term liabilities Total stockholders' equity Total liabilities and stockholders equity 21.819 39,934 13.851 65,956 $46,170 $164,890 $4.900 $24,500 $3.500 $12.100 Net cash provided by operating activities Cash paid for capital expenditures Dividends declared and paid on common stock Weighted average common shares outstanding (millions) $470 $3.500 910 3,380 For each company.compute these values and ratios. All dollars are in millions.) (Round Current ratio and Earnings per share to 2 decimal places, s. 15.25 and Debt to assets ratio to 1 decimal place, es. 78.9%. If answer is negative enter it with a negative sin preceding the number eg.-15,000 or in parentheses es. (15.000) For each company, compute these values and ratios. (All dollars are in millions) (Round Current ratio and Earnings per shore to 2 decimal places, eg. 15 25 and Debt to assets ratio to 1 decimal place, e5.78.9%. If answer is negative enter ht with a negative sign preceding the number eg. 15,000 or in parentheses es (15,0001). Target Wal-Mart (a) Working capital $ $ (b) Current ratio -1 :1 (c) Debt to assets ratio X (d) Free cash flow $ $ le) Earnings per share $ $ (1) Which company has better liquidity? Which company has better solvency? Selected financial data of two competitors, Target and Wal-Mart, are presented here. (All dollars are in millions.) Suppose the data were taken from the 2022 financial statements of each company. Target Wal-Mart (1/31/22) (1/31/22) Income Statement Data for Year $79.000 $405.000 Cost of goods sold 51.350 303.750 Selling and administrative expenses 64.800 Interest expense 4,200 Net sales 19.750 790 2.430 30 Other income 2.499 13.377 Income taxes $4,641 $ 24,843 Net Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts