Question: Pls help for correct answer and explain, tks! Ronnie who is single moved into California this year with her two dependent children she has sole

Pls help for correct answer and explain, tks!

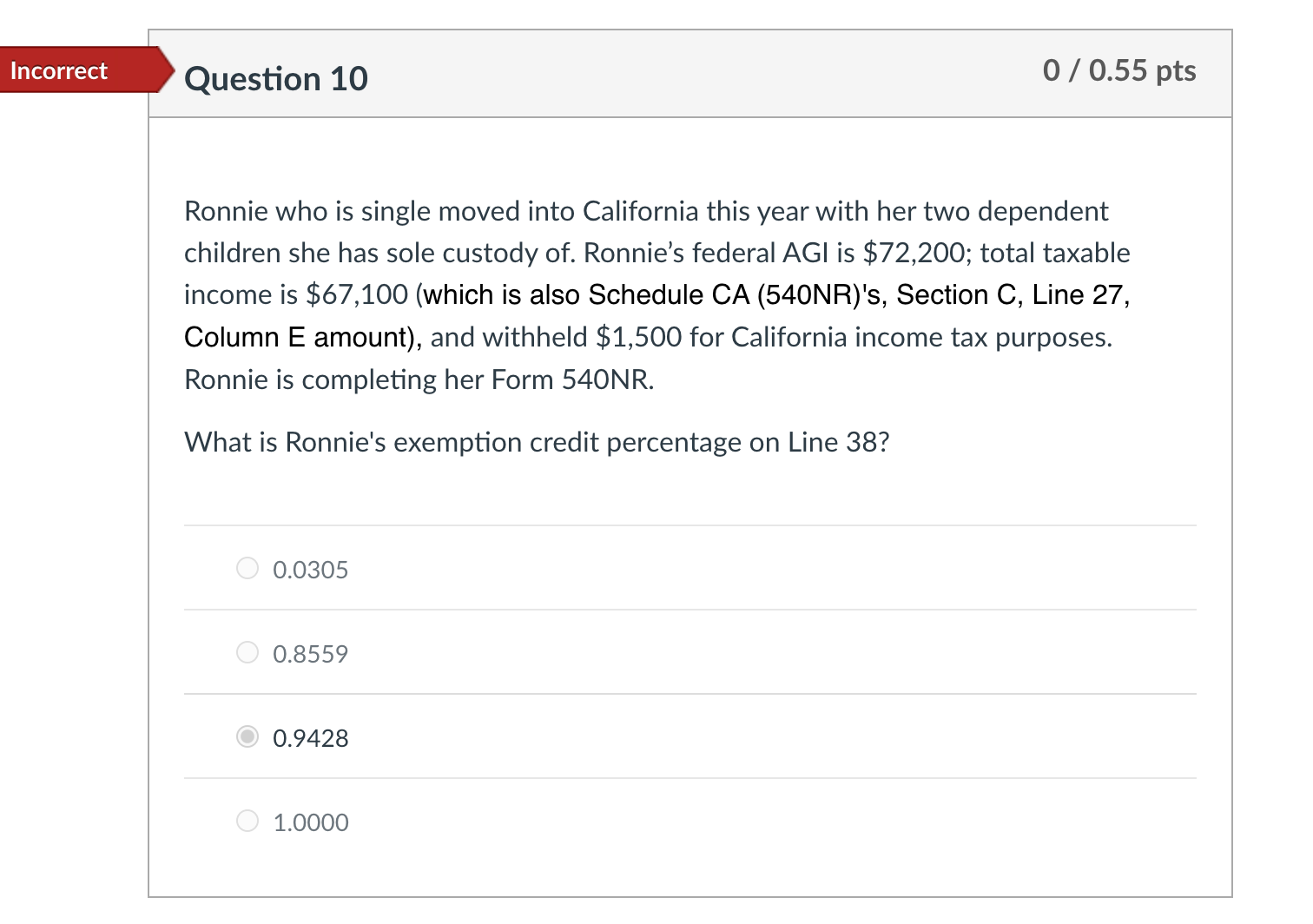

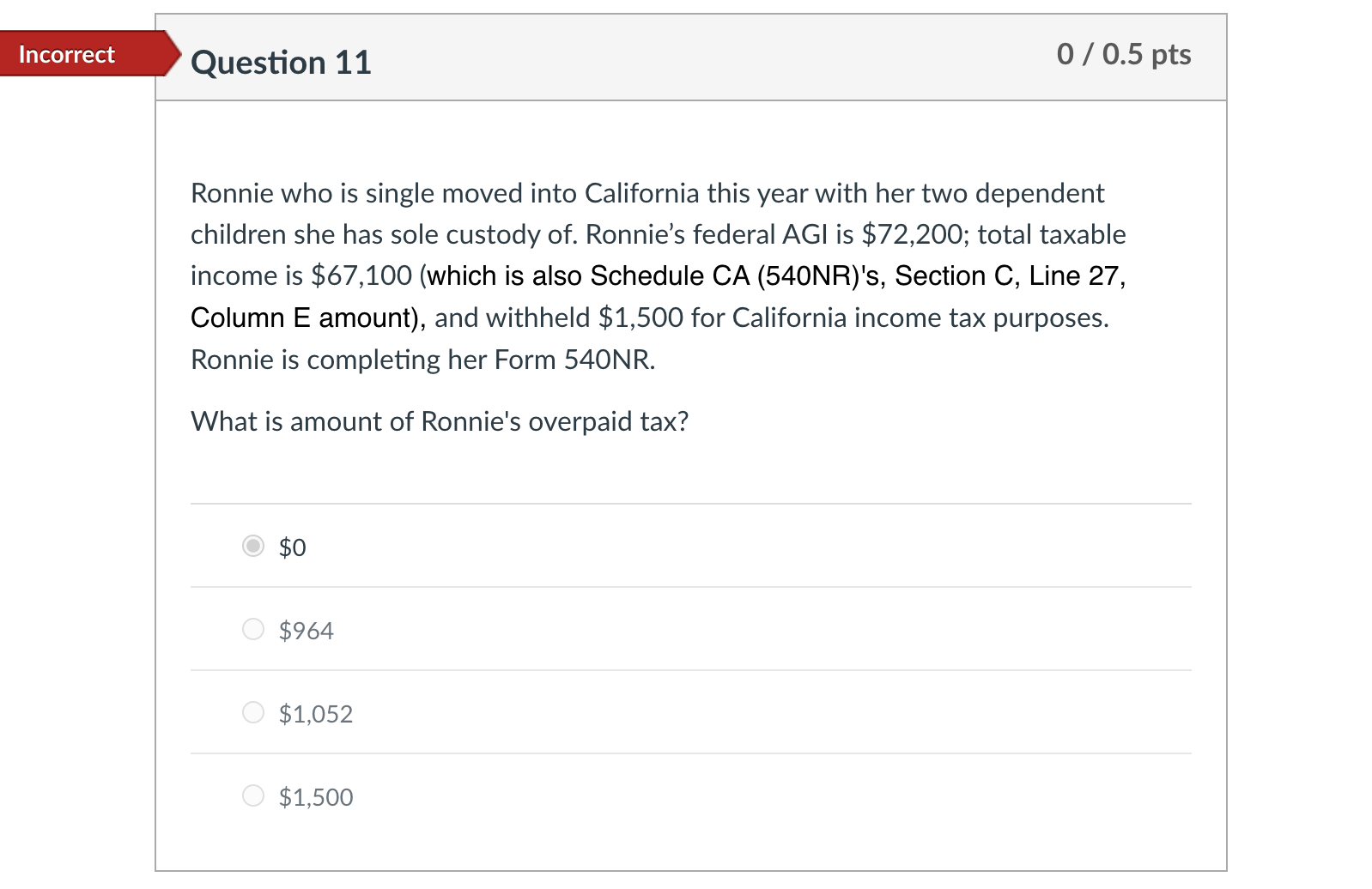

Ronnie who is single moved into California this year with her two dependent children she has sole custody of. Ronnie's federal AGI is $72,200; total taxable income is $67,100 (which is also Schedule CA (540NR)'s, Section C, Line 27, Column E amount), and withheld $1,500 for California income tax purposes. Ronnie is completing her Form 540NR. What is Ronnie's exemption credit percentage on Line 38? 0.0305 0.8559 0.9428 1.0000 Ronnie who is single moved into California this year with her two dependent children she has sole custody of. Ronnie's federal AGI is $72,200; total taxable income is $67,100 (which is also Schedule CA (540NR)'s, Section C, Line 27, Column E amount), and withheld $1,500 for California income tax purposes. Ronnie is completing her Form 540NR. What is amount of Ronnie's overpaid tax? $0 $964 $1,052 $1,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts