Question: Pls help me solve it question has 3 parts Statement of Cash Flows The following financial statements and additional information for the Quick Company are

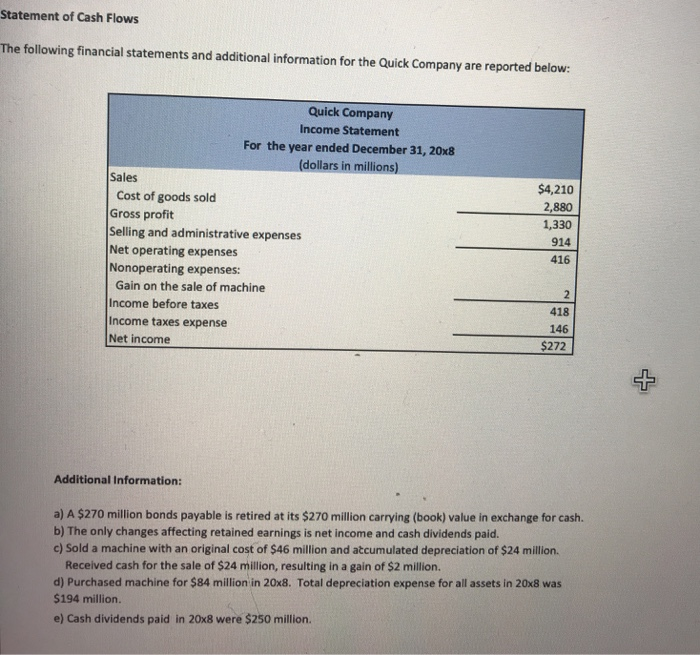

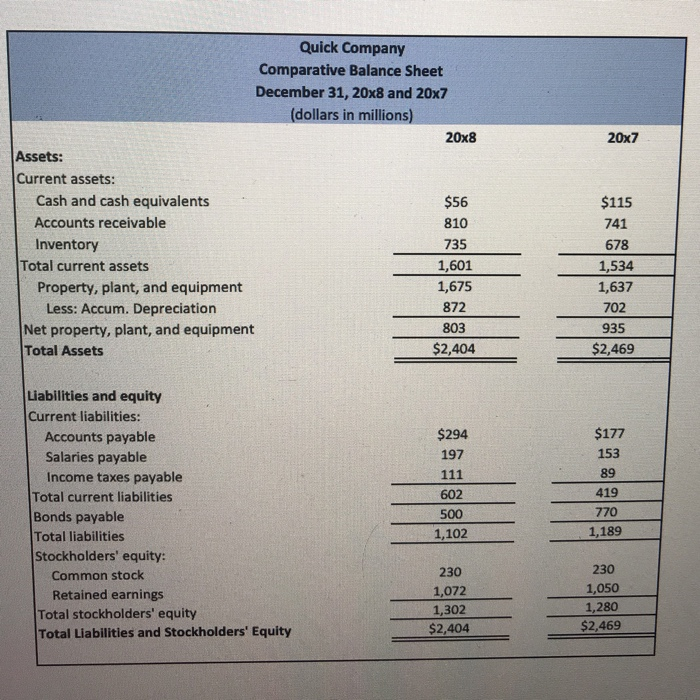

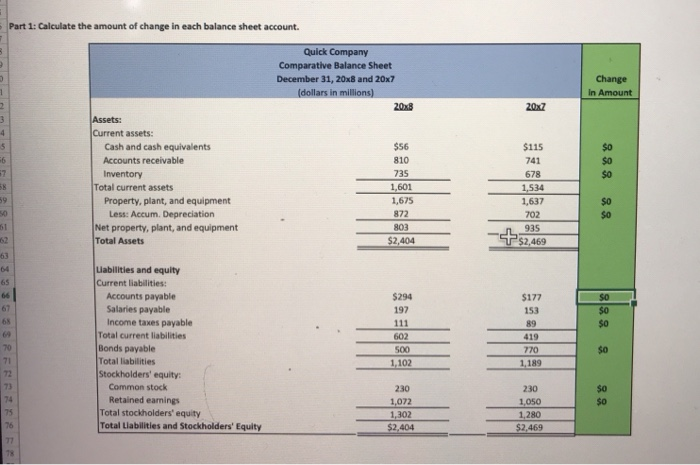

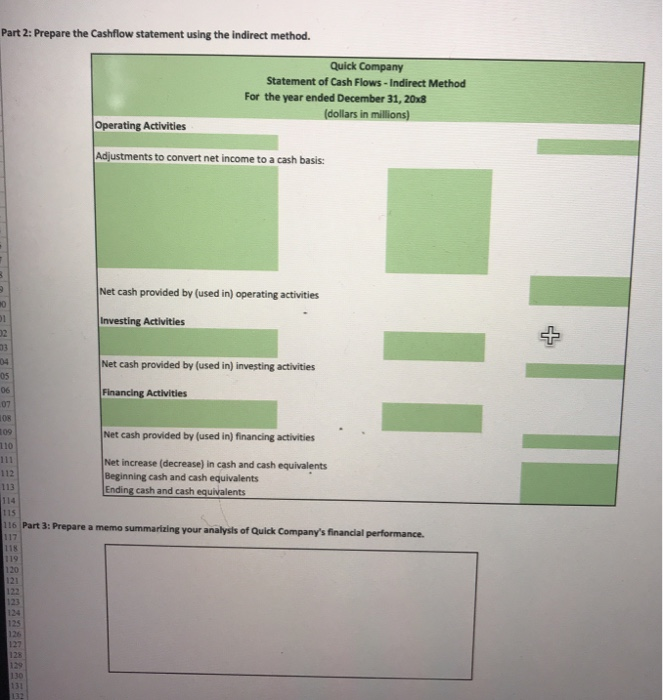

Statement of Cash Flows The following financial statements and additional information for the Quick Company are reported below: Quick Company Income Statement For the year ended December 31, 20x8 (dollars in millions) Sales $4,210 Cost of goods sold Gross profit Selling and administrative expenses Net operating expenses Nonoperating expenses: 2,880 1,330 914 416 Gain on the sale of machine 2 Income before taxes Income taxes expense Net income 418 146 $272 Additional Information: a) A $270 million bonds payable is retired at its $270 million carrying (book) value in exchange for cash. b) The only changes affecting retained earnings is net income and cash dividends paid. c) Sold a machine with an original cost of $46 million and atcumulated depreciation of $24 million. Received cash for the sale of $24 million, resulting in a gain of $2 million. d) Purchased machine for $84 million in 20x8. Total depreciation expense for all assets in 20x8 was $194 million. e) Cash dividends paid in 20x8 were $250 million. Quick Company Comparative Balance Sheet December 31, 20x8 and 20x7 (dollars in millions) 20x8 20x7 Assets: Current assets: Cash and cash equivalents $56 $115 Accounts receivable 810 741 Inventory 735 678 Total current assets 1,601 1,675 1,534 Property, plant, and equipment Less: Accum. Depreciation 1,637 872 702 Net property, plant, and equipment Total Assets 803 935 $2,404 $2,469 Liabilities and equity Current liabilities: Accounts payable Salaries payable $177 $294 197 153 89 111 Income taxes payable Total current liabilities Bonds payable Total liabilities Stockholders' equity: 419 602 770 500 1,189 1,102 230 230 Common stock 1,050 1,072 Retained earnings 1,280 $2,469 Total stockholders' equity Total Liabilities and Stockholders' Equity 1,302 $2,404 Part 1: Calculate the amount of change in each balance sheet account. Quick Company Comparative Balance Sheet December 31, 20x8 and 20x7 Change (dollars in millions) in Amount 20x8 20x2 Assets: 3 4 Current assets: $56 Cash and cash equivalents $115 $0 6 Accounts receivable 810 741 7 Inventory Total current assets Property, plant, and equipment 735 $0 678 1,601 1,534 59 1,675 S0 1,637 50 872 Less: Accum. Depreciation Net property, plant, and equipment Total Assets 702 61 803 935 62 $2,469 $2,404 63 64 Liabilities and equity Current liabilities: Accounts payable Salaries payable Income taxes payable Total current liabilities Bonds payable Total liabilities Stockholders' equity: 65 66 $294 S0 $177 67 197 153 $0 $0 68 111 89 69 602 419 70 500 770 71 1,102 1,189 72 73 Common stock 230 230 74 Retained eanings Total stockholders' equity Total Liabilities and Stockholders' Equity 1,050 1,072 $0 75 1,302 1,280 76 $2,404 $2,469 77 Part 2: Prepare the Cashflow statement using the indirect method. Quick Company Statement of Cash Flows-Indirect Method For the year ended December 31, 20x8 (dollars in millions) Operating Activities Adjustments to convert net income to a cash basis Net cash provided by (used in) operating activities 01 Investing Activities 02 03 Net cash provided by (used in) investing activities 04 05 Financing Activities 06 07 108 109 Net cash provided by (used in) financing activities 110 111 Net increase (decrease) in cash and cash equivalents Beginning cash and cash equivalents Ending cash and cash equivalents 112 113 114 115 116 Part 3: Prepare a memo summarizing your analysls of Quick Company's financial performance. 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 1I

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts