Question: Pls help me solve this question . Question 2 Thang Long Company is a manufucturer of eigarettes, pays VAT under credit thethed Record on the

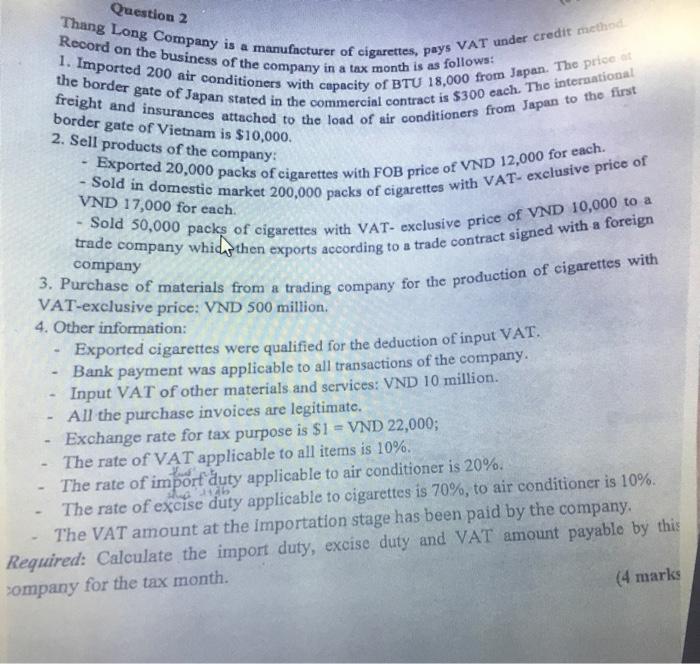

Question 2 Thang Long Company is a manufucturer of eigarettes, pays VAT under credit thethed Record on the business of the company in a tax month is as follows: 1. Imported 200 air conditioners with capacity of BTU 18,000 from Japan. The price at the border gate of Japan stated in the commercial contract is $300 each. The interaational freight and insurances attached to the load of air conditioners from Japan to the first border gate of Vietnam is $10,000. 2. Sell products of the company: - Exported 20,000 packs of cigarettes with FOB price of VND 12,000 for each. - Sold in domestic market 200,000 packs of cigarettes with VAT- exclusive price of VND 17,000 for each. - Sold 50,000 packs of cigarettes with VAT- exclusive price of VND 10,000 to a trade company whichthen exports according to a trade contract signed with a foreign 3. Purchase of VAT-exclusive price: VND 500 million. 4. Other information: - Exported cigarettes were qualified for the deduction of input VAT. - Bank payment was applicable to all transactions of the company. - Input VAT of other materials and services: VND 10 million. - All the purchase invoices are legitimate. - Exchange rate for tax purpose is $1= VND 22,000 ; - The rate of VAT applicable to all items is 10%. - The rate of import duty applicable to air conditioner is 20%. - The rate of excise duty applicable to cigarettes is 70%, to air conditioner is 10%. - The VAT amount at the importation stage has been paid by the company. Required: Calculate the import duty, excise duty and VAT amount payable by this company for the tax month. (4 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts