Question: pls help me solve this USING EXCEL Case 3: Analysis of Treasury Bonds On October 15, 2018, an investor purchased a 3-year Treasury bond with

pls help me solve this USING EXCEL

pls help me solve this USING EXCEL

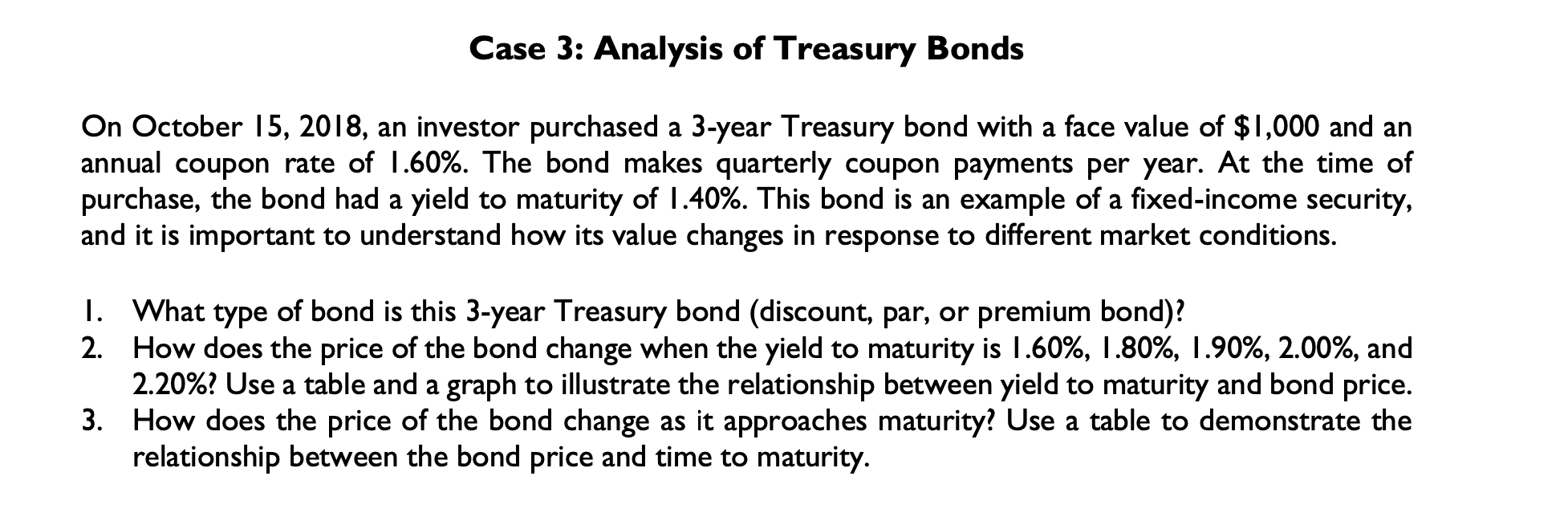

Case 3: Analysis of Treasury Bonds On October 15, 2018, an investor purchased a 3-year Treasury bond with a face value of $1,000 and an annual coupon rate of 1.60%. The bond makes quarterly coupon payments per year. At the time of purchase, the bond had a yield to maturity of I.40%. This bond is an example of a fixed-income security, and it is important to understand how its value changes in response to different market conditions. I. What type of bond is this 3-year Treasury bond (discount, par, or premium bond)? 2. How does the price of the bond change when the yield to maturity is 1.60%,1.80%,1.90%,2.00%, and 2.20% ? Use a table and a graph to illustrate the relationship between yield to maturity and bond price. 3. How does the price of the bond change as it approaches maturity? Use a table to demonstrate the relationship between the bond price and time to maturity. Case 3: Analysis of Treasury Bonds On October 15, 2018, an investor purchased a 3-year Treasury bond with a face value of $1,000 and an annual coupon rate of 1.60%. The bond makes quarterly coupon payments per year. At the time of purchase, the bond had a yield to maturity of I.40%. This bond is an example of a fixed-income security, and it is important to understand how its value changes in response to different market conditions. I. What type of bond is this 3-year Treasury bond (discount, par, or premium bond)? 2. How does the price of the bond change when the yield to maturity is 1.60%,1.80%,1.90%,2.00%, and 2.20% ? Use a table and a graph to illustrate the relationship between yield to maturity and bond price. 3. How does the price of the bond change as it approaches maturity? Use a table to demonstrate the relationship between the bond price and time to maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts