Question: pls help me to answer this i have limited only For numbers 42 and 4; On January 1. 2021. Salamat Inc. purchased nontrading equity securities

pls help me to answer this i have limited only

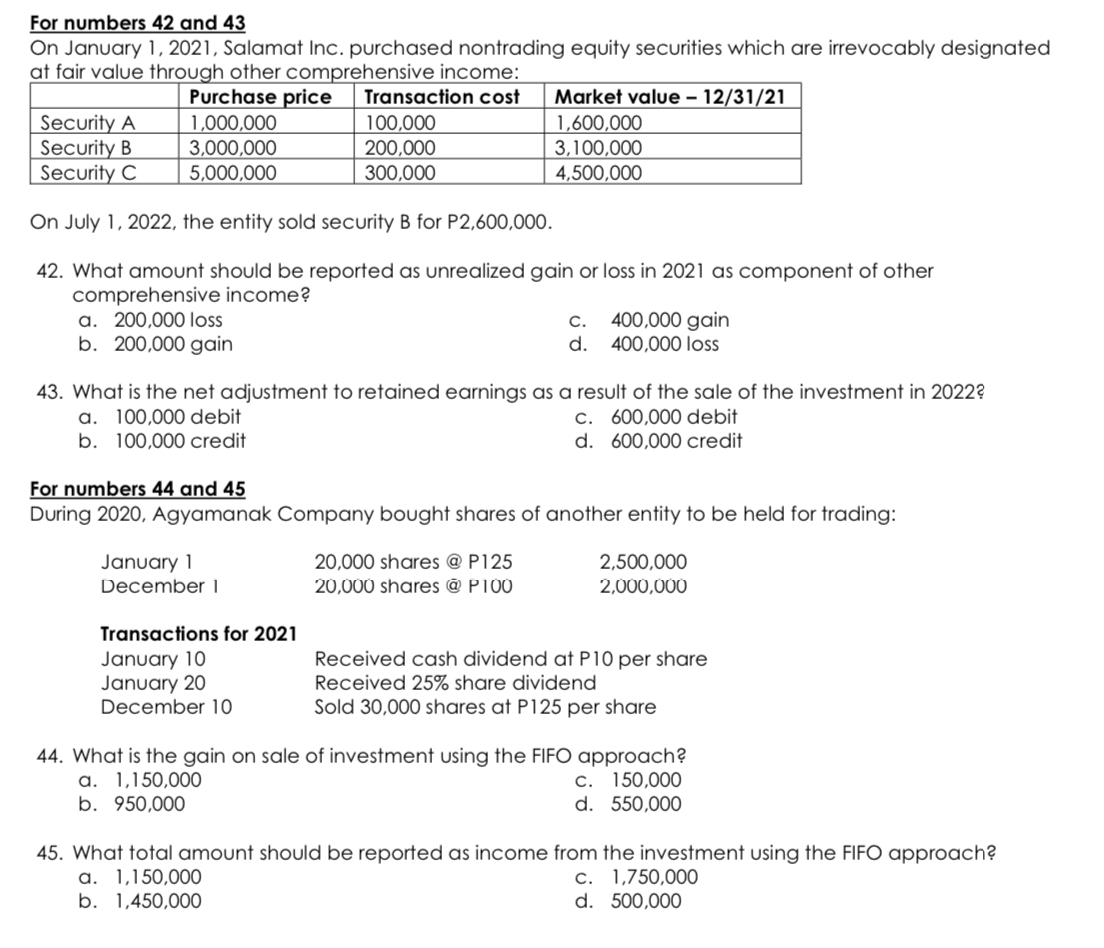

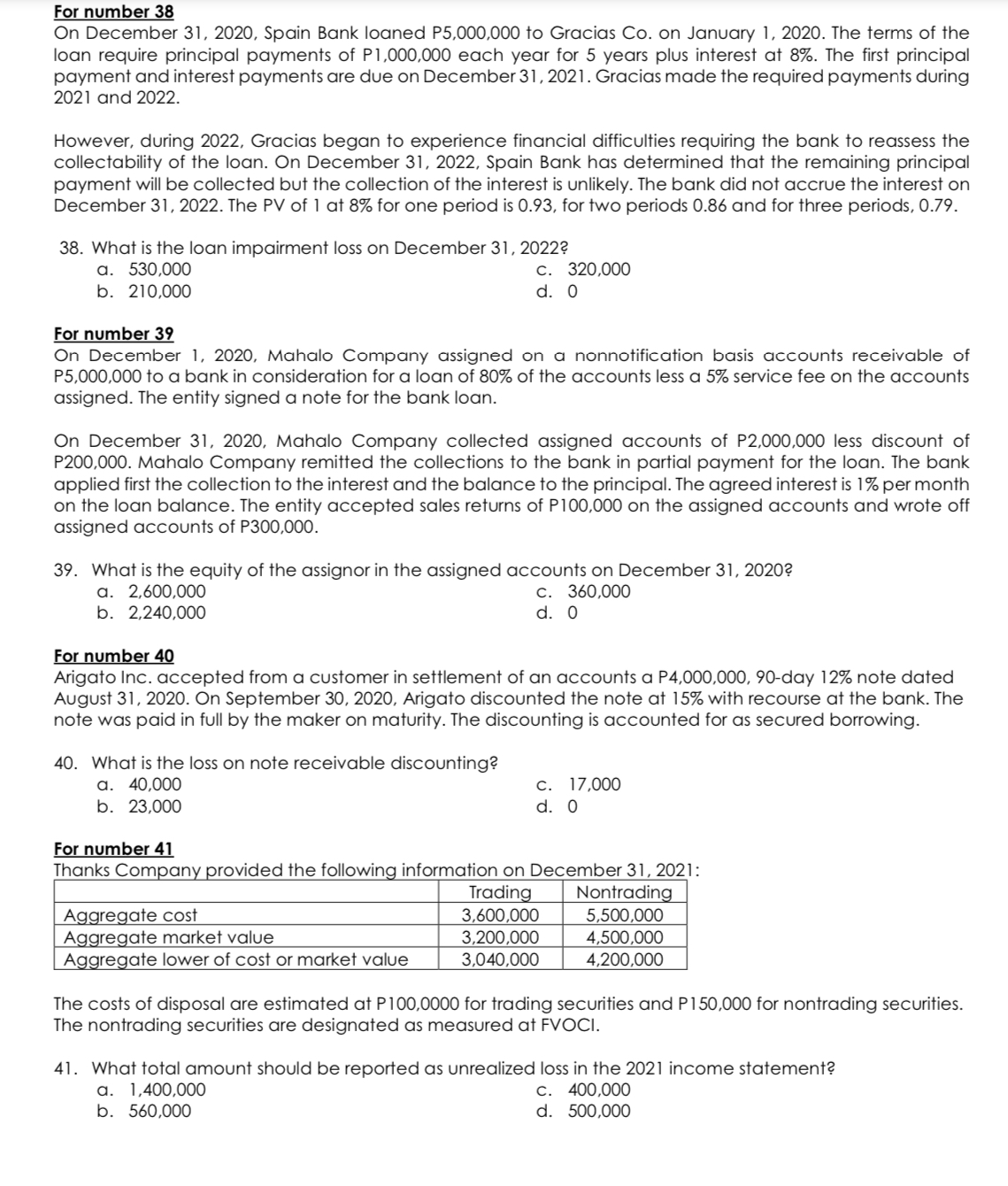

For numbers 42 and 4; On January 1. 2021. Salamat Inc. purchased nontrading equity securities which are irrevocably designated at fair value throUoh other com - rehensive income: _'.- Market value - 12 31 21 1.000.000 100.000 3,000,000 3.100.000 5000.000 300.000 On July 1. 2022. the entity sold seCUrily B for P2.600.000. 42. What amount should be reported as unrealized gain or loss in 2021 as component of other comprehensive income? a. 200.000 loss c. 400.000 gain b. 200.000 gain d. 400.000 loss 43. What is the net adjustment to retained earnings as a result of the sale of the investment in 20222 0. 100.000 debit c. 600.000 debit b. 100.000 credit d. 600.000 credit For numbers 44 and 4 During 2020. Agyamanak Company bought shares of another entity to be held for trading: January 1 20.000 shares @ P125 2.500.000 December 1 20.000 shares @ P100 2.000.000 Transactions for 2021 January 10 Received cash dividend at P10 per share January 20 Received 25% share dividend December 10 Sold 30.000 shares at P125 per share 44. What is the gain on sale of investment using the FIFO approach? a. 1.150.000 c. 150.000 b. 950.000 d. 550.000 45. What total amount should be reported as income from the investment using the FIFO approach? a. 1.150.000 c. 1.750.000 b. 1.450.000 d. 500.000 For number 3 On December 3]. 2020, Spain Bank loaned P5000000 to Gracias Co. on January 1, 2020. The terms of the loan require principal payments of P1000000 each year for 5 years plus interest at 8%. The rst principal payment and interest payments are due on December 3] , 2021 . Gracias made the required payments during 202] and 2022. However, during 2022. Gracias began to experience financial difficulties requiring the bank to reassess the collectabity of the loan. On December 3], 2022, Spain Bank has determined that the remaining principal payment will be collected but the collection of the interest is unlikely. The bank did not accrue the interest on December 3]. 2022. The PV of l at 8% for one period is 0.93. for two periods 0.86 and for three periods. 0.79. 38. What is the loan impairment loss on December 3]. 20228 a. 530000 c. 320000 b. 210.000 d. 0 For number 9 On December 1, 2020, Mahala Company assigned on a nonnatitication basis accounts receivable of P5000000 to a bank in consideration for a loan of 80% of the accounts less a 5% service fee on the accounts assigned. The entity signed a note for the bank loan. On December 3], 2020. Mahala Company collected assigned accounts of P2000000 less discount of P200000. Mahalo Company remitted the collections to the bank in partial payment for the loan. The bank applied rst the collection to the interest and the balance to the principal. The agreed interest is 1% per month on the loan balance. The entity accepted sales returns of P100000 on the assigned accounts and wrote off assigned accounts of P300000. 39. What is the equity of the assignor in the assigned accounts on December 3]. 20208 a. 2.600.000 c. 360,000 b. 2.240.000 d. 0 MM Arigato Inc. accepted from a customer in settlement of an accounts a P4000000, 90day 12% note dated August 31, 2020. On September 30. 2020. Arigato discounted the note at 15% with recourse at the bank. The note was paid in full by the maker on maturity. The discounting is accounted for as secured borrowing. 40. What is the loss on note receivable discounting? a. 40000 c. 17000 b. 23,000 d. 0 For num 41 Thanks Coman rovided the followin- information on December 3]. 202]: Trading Nontrading Aggregate cost 3.600000 5.500000 Ac \"reate market value 3.200000 4.500000 Aggregate lower of cost or market value 3.040000 4.200000 The costs of disposal are estimated at P1000000 for trading securities and P150000 tor nontrading securities. The nontrading securities are designated as measured at FVOCI. 4]. What total amount should be reported as unrealized loss in the 2021 income statement? a. 1.400.000 c. 400.000 b. 560.000 d. 500.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts