Question: Pls help me to answer this i have limited only W Annyeong Co. reported current receivables on December 31, 2020 which consisted of the following:

Pls help me to answer this i have limited only

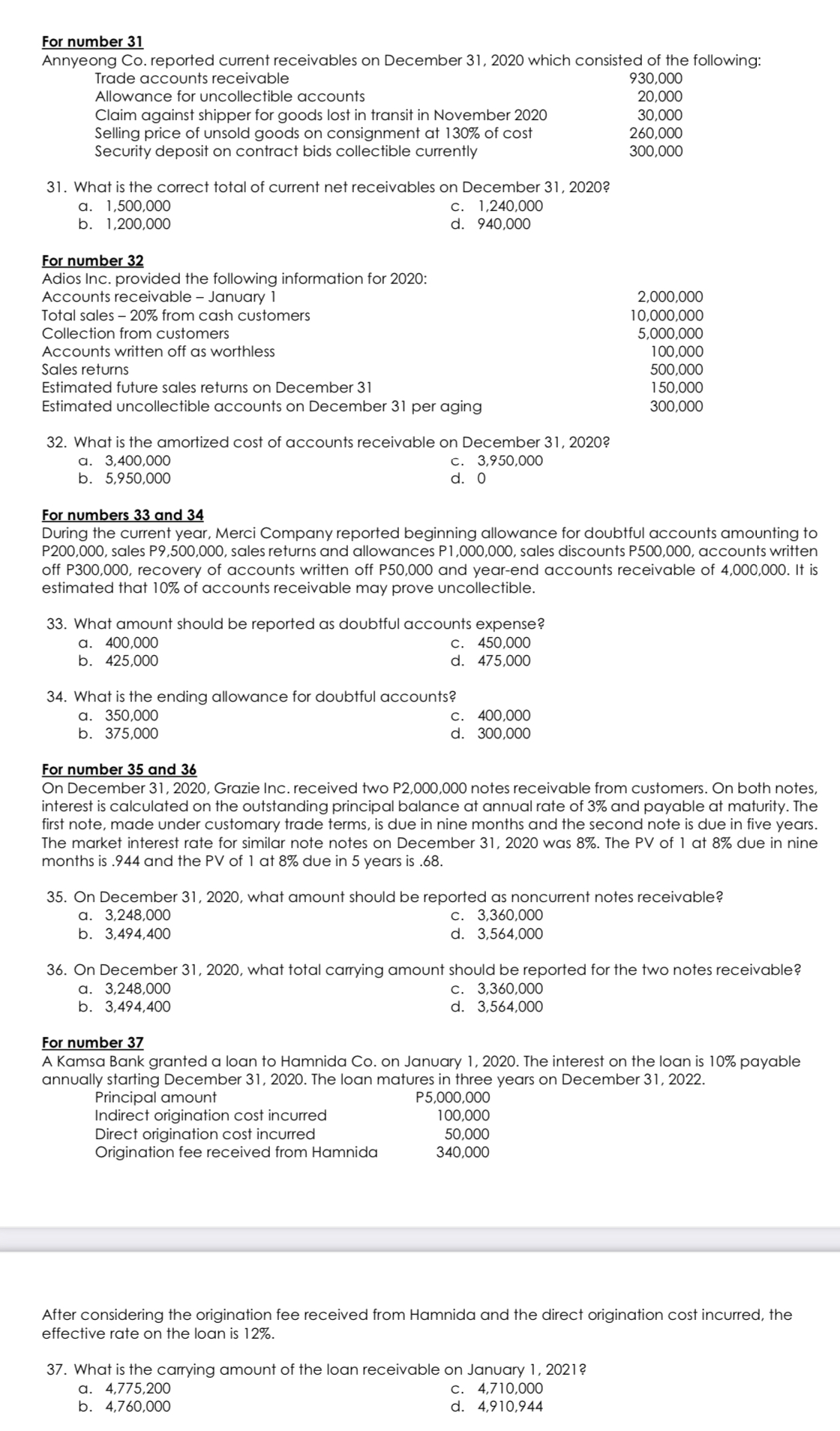

W Annyeong Co. reported current receivables on December 31, 2020 which consisted of the following: Trade accounts receivable 930.000 Allowance for uncollectible accounts 20.000 Claim against shipper for goods lost in transit in November 2020 30.000 Selling price of unsold goods on consignment at 130% of cost 260.000 Security deposit on contract bids collectible currently 300.000 31. What is the correct total of current net receivables on December 31 , 2020? a. 1,500,000 c. 1.240.000 b. 1.200.000 d. 940.000 MM Adios Inc. provided the following information for 2020'. Accounts receivable January 1 2000.000 Total sales 20% from cash customers 10,000,000 Collection from customers 5,000,000 Accounts written off as worthless 100.000 Sales returns 500.000 Estimated future sales returns on December 31 150.000 Estimated uncollectible accounts on December 31 per aging 300.000 32. What is the amortized cost of accounts receivable on December 31, 2020? a. 3.400.000 c. 3.950.000 b. 5,950,000 d. 0 WM During the current year. Merci Company reported beginning allowance for doubtful accounts amounting to P200000. sales P9,500,000, sales returns and allowances P1,000,000, sales discounts P501000, accounts written off P300000. recovery of accounts written off P50.000 and year-end accounts receivable of 4,000,000. It is estimated that 10% of accounts receivable may prove uncollectible. 33. What amount should be reported as doubtful accounts expense? or. 400,000 c. 450,000 b. 425.000 d. 475.000 34. What is the ending allowance for doubtful accounts? 0. 350.000 c. 400.000 b. 375.000 (J. 300.000 For num g and a On December 31.2020. Grazie Inc. received two P2.000.000 notes receivable from customers. On both notes. interest is calculated on the outstanding principal balance at annual rate of 3% and payable at maturity. The rst note. made under customary trade terms, is due in nine months and the second note is due in ve years. The market interest rate for similar note notes on December 31, 2020 was 8%. The PV of 1 at 8% due in nine months is .944 and the Pv of 1 at 8% due in 5 years is .68. 35. On December 31 . 2020. what amount should be reported as noncurrent notes receivable? a. 3,248,000 c. 3.360.000 b. 3,494,400 d. 3.564.000 36. On December 31 . 2020. what total carrying amount should be reported for the two notes receivable? a. 3.248.000 c. 3.360.000 b. 3,494,400 d. 3.564.000 For number 37 A Kamsa Bank granted a loan to Hamnida Co. on January 1. 2020. The interest on the loan is 10% payable annually starting December 31, 2020. The loan matures in three years on December 31, 2022. Principal amount P5.000.000 Indirect origination cost incurred 100.000 Direct origination cost incurred 50.000 Origination fee received from Hamnida 340.000 After considering the origination fee received from Hamnida and the direct origination cost incurred. the effective rate on the loan is 12%. 37. What is the carrying amount of the loan receivable on January 1, 2021 ? 0. 4,775,200 c. 4,710,000 b. 4.760.000 d. 4.910.944

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts