Question: Pls help me with Problems 1 to 7 :(( The agreed to admit AQUAMAN into the business. Compute the capital balances of the partners after

Pls help me with Problems 1 to 7 :((

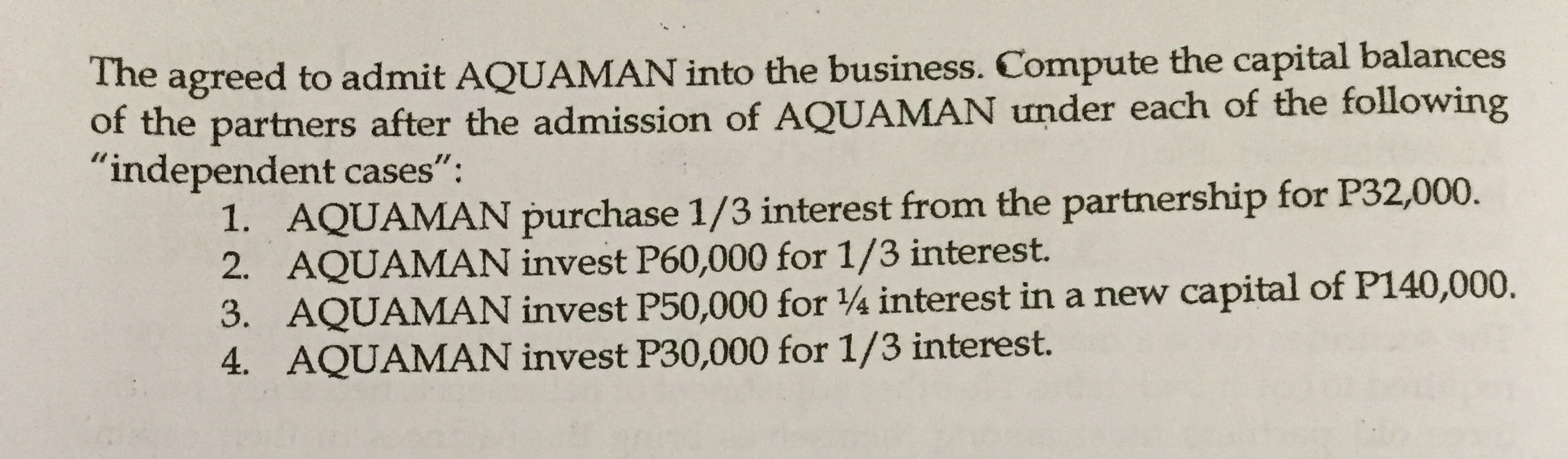

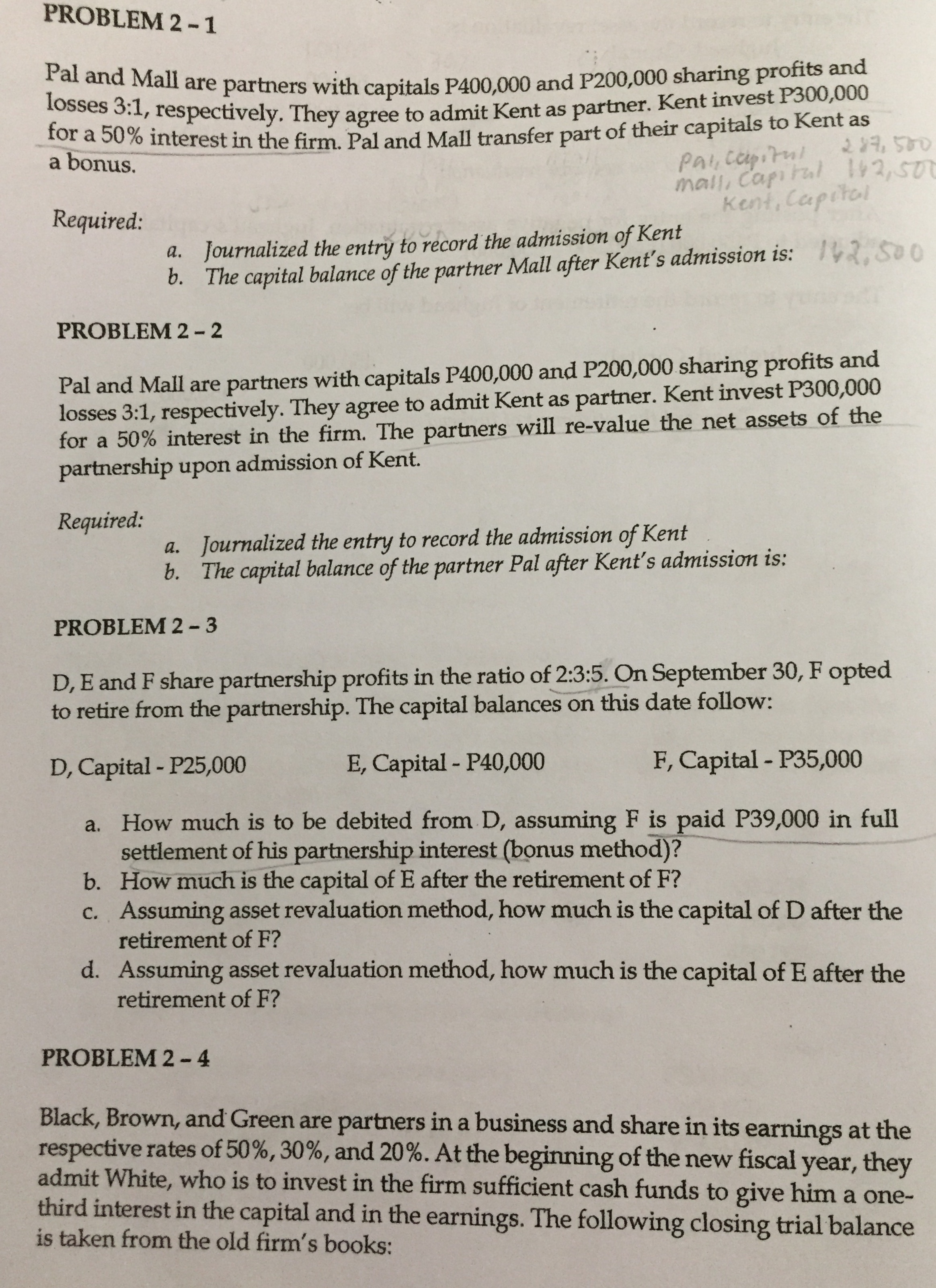

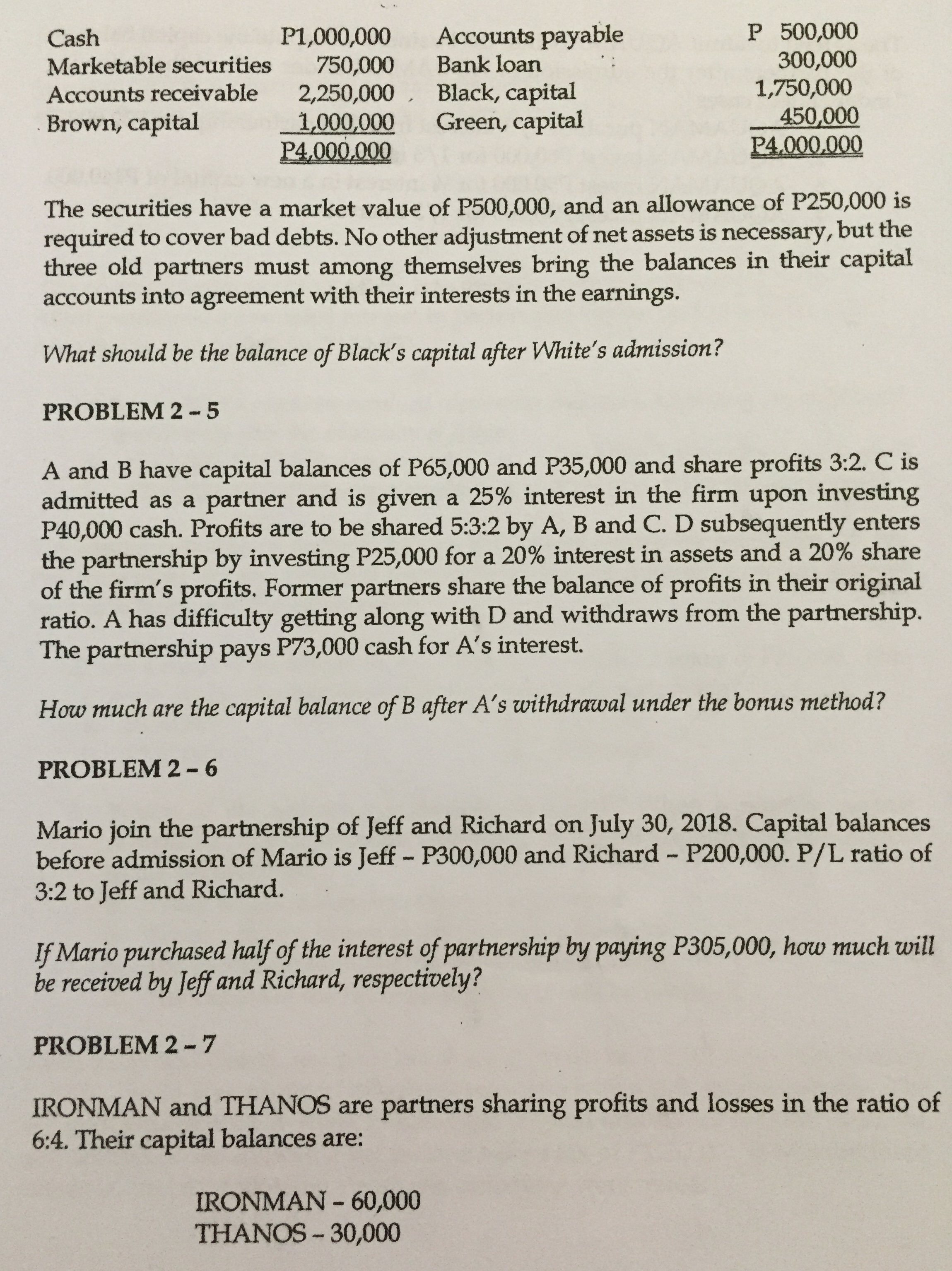

The agreed to admit AQUAMAN into the business. Compute the capital balances of the partners after the admission of AQUAMAN under each of the following "independent cases": 1. AQUAMAN purchase 1/3 interest from the partnership for P32,000. 2. AQUAMAN invest P60,000 for 1/3 interest. 3. AQUAMAN invest P50,000 for 1/4 interest in a new capital of P140,000. 4. AQUAMAN invest P30,000 for 1/3 interest.PROBLEM 2 - 1 Pal and Mall are partners with capitals P400,000 and P200,000 sharing profits and losses 3:1, respectively. They agree to admit Kent as partner. Kent invest P300,000 for a 50% interest in the firm. Pal and Mall transfer part of their capitals to Kent as a bonus. Pal, Capital 287, 500 mall, Capital 142, 50 Required: Kent, Capital a. Journalized the entry to record the admission of Kent b. The capital balance of the partner Mall after Kent's admission is: 142, 50 0 PROBLEM 2 - 2 Pal and Mall are partners with capitals P400,000 and P200,000 sharing profits and losses 3:1, respectively. They agree to admit Kent as partner. Kent invest P300,000 for a 50% interest in the firm. The partners will re-value the net assets of the partnership upon admission of Kent. Required: a. Journalized the entry to record the admission of Kent b. The capital balance of the partner Pal after Kent's admission is: PROBLEM 2 - 3 D, E and F share partnership profits in the ratio of 2:3:5. On September 30, F opted to retire from the partnership. The capital balances on this date follow: D, Capital - P25,000 E, Capital - P40,000 F, Capital - P35,000 a. How much is to be debited from D, assuming F is paid P39,000 in full settlement of his partnership interest (bonus method)? b. How much is the capital of E after the retirement of F? c. Assuming asset revaluation method, how much is the capital of D after the retirement of F? d. Assuming asset revaluation method, how much is the capital of E after the retirement of F? PROBLEM 2 - 4 Black, Brown, and Green are partners in a business and share in its earnings at the respective rates of 50%, 30%, and 20%. At the beginning of the new fiscal year, they admit White, who is to invest in the firm sufficient cash funds to give him a one- third interest in the capital and in the earnings. The following closing trial balance is taken from the old firm's books:Cash P1,000,000 Accounts payable P 500,000 Marketable securities 750,000 Bank loan 300,000 Accounts receivable 2,250,000 Black, capital 1,750,000 Brown, capital 1,000,000 Green, capital 450,000 P4,000,000 P4,000,000 The securities have a market value of P500,000, and an allowance of P250,000 is required to cover bad debts. No other adjustment of net assets is necessary, but the three old partners must among themselves bring the balances in their capital accounts into agreement with their interests in the earnings. What should be the balance of Black's capital after White's admission? PROBLEM 2 - 5 A and B have capital balances of P65,000 and P35,000 and share profits 3:2. C is admitted as a partner and is given a 25% interest in the firm upon investing P40,000 cash. Profits are to be shared 5:3:2 by A, B and C. D subsequently enters the partnership by investing P25,000 for a 20% interest in assets and a 20% share of the firm's profits. Former partners share the balance of profits in their original ratio. A has difficulty getting along with D and withdraws from the partnership. The partnership pays P73,000 cash for A's interest. How much are the capital balance of B after A's withdrawal under the bonus method? PROBLEM 2 - 6 Mario join the partnership of Jeff and Richard on July 30, 2018. Capital balances before admission of Mario is Jeff - P300,000 and Richard - P200,000. P/L ratio of 3:2 to Jeff and Richard. If Mario purchased half of the interest of partnership by paying P305,000, how much will be received by Jeff and Richard, respectively? PROBLEM 2 - 7 IRONMAN and THANOS are partners sharing profits and losses in the ratio of 6:4. Their capital balances are: IRONMAN - 60,000 THANOS - 30,000