Question: pls help me with this course: Acct202 Acct 202 Case study Sutra makes a unique women abayas and currently reviewing their production data for a

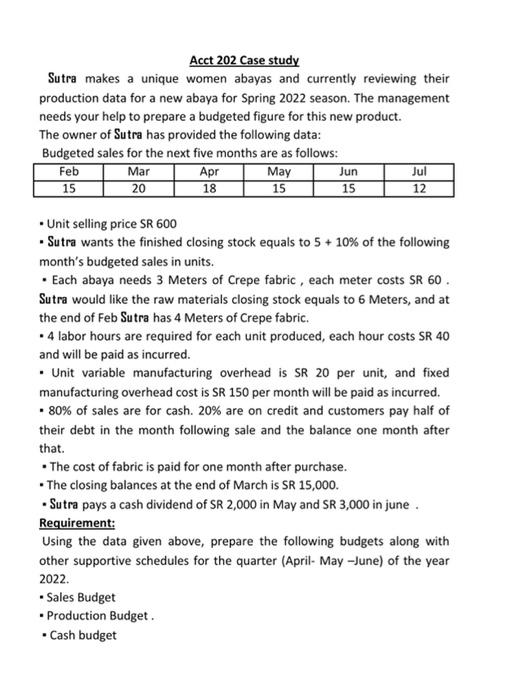

Acct 202 Case study Sutra makes a unique women abayas and currently reviewing their production data for a new abaya for Spring 2022 season. The management needs your help to prepare a budgeted figure for this new product. The owner of Sutra has provided the following data: Budgeted sales for the next five months are as follows: Feb Apr May Jul 15 20 18 15 15 12 Mar Jun Unit selling price SR 600 Sutra wants the finished closing stock equals to 5 + 10% of the following month's budgeted sales in units. Each abaya needs 3 Meters of Crepe fabric, each meter costs SR 60 Sutra would like the raw materials closing stock equals to 6 Meters, and at the end of Feb Sutra has 4 Meters of Crepe fabric. 4 labor hours are required for each unit produced, each hour costs SR 40 and will be paid as incurred. . Unit variable manufacturing overhead is SR 20 per unit, and fixed manufacturing overhead cost is SR 150 per month will be paid as incurred. . 80% of sales are for cash. 20% are on credit and customers pay half of their debt in the month following sale and the balance one month after that The cost of fabric is paid for one month after purchase. The closing balances at the end of March is SR 15,000. Sutra pays a cash dividend of SR 2,000 in May and SR 3,000 in june Requirement: Using the data given above, prepare the following budgets along with other supportive schedules for the quarter (April- May - June) of the year 2022. Sales Budget Production Budget Cash budget

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts