Question: PLS HELP ME WITH THIS DONT DO IT IN EXCEL IN PLS TIA. Given the following information of a call option: Stock Price (S) 21

PLS HELP ME WITH THIS DONT DO IT IN EXCEL IN PLS TIA.

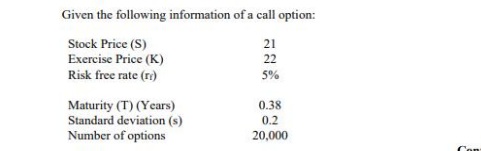

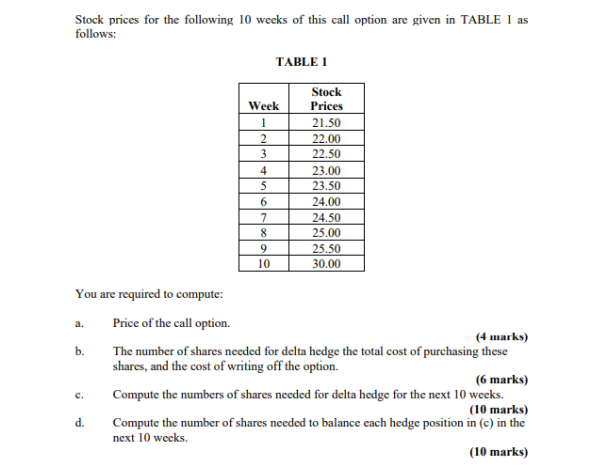

Given the following information of a call option: Stock Price (S) 21 Exercise Price (K) 22 Risk free rate (11) 5% Maturity (T) (Years) Standard deviation(s) Number of options 0.38 0.2 20,000 Stock prices for the following 10 weeks of this call option are given in TABLE 1 as follows: TABLE 1 Week 1 2 3 4 5 6 7 8 9 10 Stock Prices 21.50 22.00 22.50 23.00 23.50 24.00 24.50 25.00 25.50 30.00 a. You are required to compute: Price of the call option. (4 marks) b. The number of shares needed for delta hedge the total cost of purchasing these shares, and the cost of writing off the option. (6 marks) Compute the numbers of shares needed for delta hedge for the next 10 weeks. (10 marks) Compute the number of shares needed to balance each hedge position in (c) in the next 10 weeks. (10 marks) c. d. Given the following information of a call option: Stock Price (S) 21 Exercise Price (K) 22 Risk free rate (11) 5% Maturity (T) (Years) Standard deviation(s) Number of options 0.38 0.2 20,000 Stock prices for the following 10 weeks of this call option are given in TABLE 1 as follows: TABLE 1 Week 1 2 3 4 5 6 7 8 9 10 Stock Prices 21.50 22.00 22.50 23.00 23.50 24.00 24.50 25.00 25.50 30.00 a. You are required to compute: Price of the call option. (4 marks) b. The number of shares needed for delta hedge the total cost of purchasing these shares, and the cost of writing off the option. (6 marks) Compute the numbers of shares needed for delta hedge for the next 10 weeks. (10 marks) Compute the number of shares needed to balance each hedge position in (c) in the next 10 weeks. (10 marks) c. d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts