Question: pls help not the same as the ones uploaded, pls help Question 3 Tosca Inc. is currently trading at $100 per share. After examining the

pls help

not the same as the ones uploaded, pls help

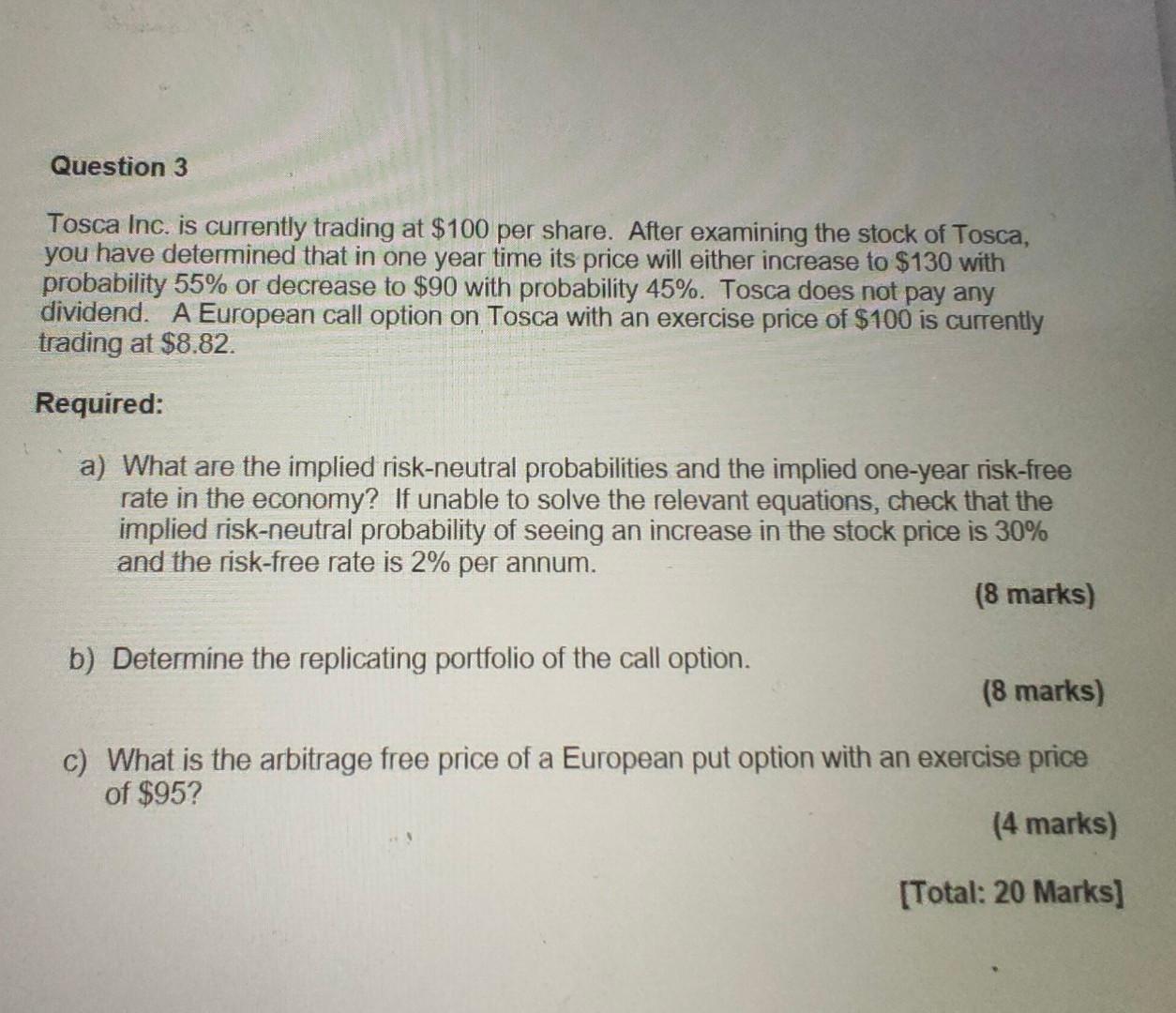

Question 3 Tosca Inc. is currently trading at $100 per share. After examining the stock of Tosca, you have determined that in one year time its price will either increase to $130 with probability 55% or decrease to $90 with probability 45%. Tosca does not pay any dividend. A European call option on Tosca with an exercise price of $100 is currently trading at $8.82. Required: a) What are the implied risk-neutral probabilities and the implied one-year risk-free rate in the economy? If unable to solve the relevant equations, check that the implied risk-neutral probability of seeing an increase in the stock price is 30% and the risk-free rate is 2% per annum. (8 marks) b) Determine the replicating portfolio of the call option. (8 marks) c) What is the arbitrage free price of a European put option with an exercise price of $95? (4 marks) [Total: 20 Marks] Question 3 Tosca Inc. is currently trading at $100 per share. After examining the stock of Tosca, you have determined that in one year time its price will either increase to $130 with probability 55% or decrease to $90 with probability 45%. Tosca does not pay any dividend. A European call option on Tosca with an exercise price of $100 is currently trading at $8.82. Required: a) What are the implied risk-neutral probabilities and the implied one-year risk-free rate in the economy? If unable to solve the relevant equations, check that the implied risk-neutral probability of seeing an increase in the stock price is 30% and the risk-free rate is 2% per annum. (8 marks) b) Determine the replicating portfolio of the call option. (8 marks) c) What is the arbitrage free price of a European put option with an exercise price of $95? (4 marks) [Total: 20 Marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts