Question: pls help select an option for these trading comps Qs This question uses the same data as the previous question. You are comparing Gap to

pls help select an option for these trading comps Qs

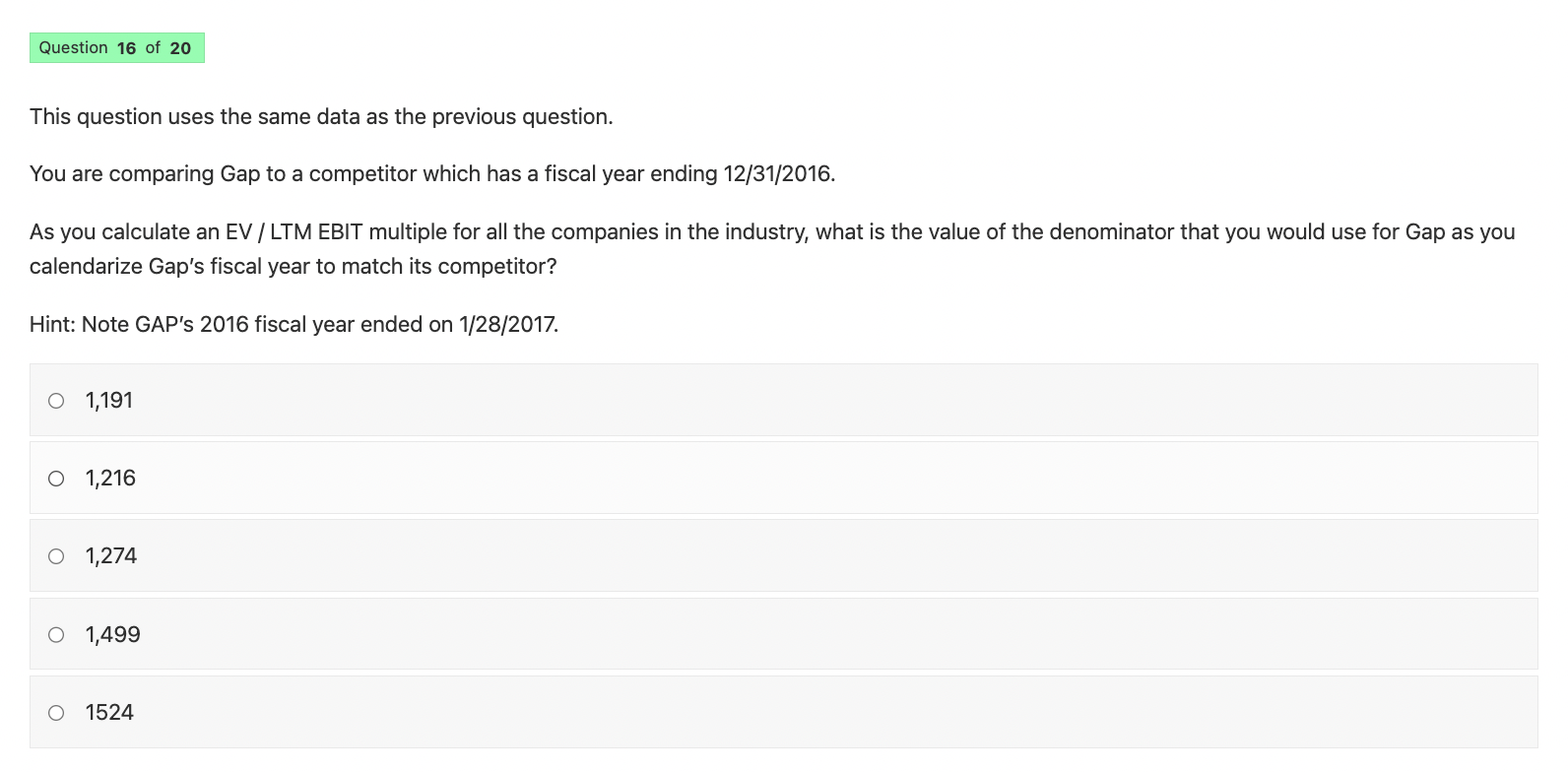

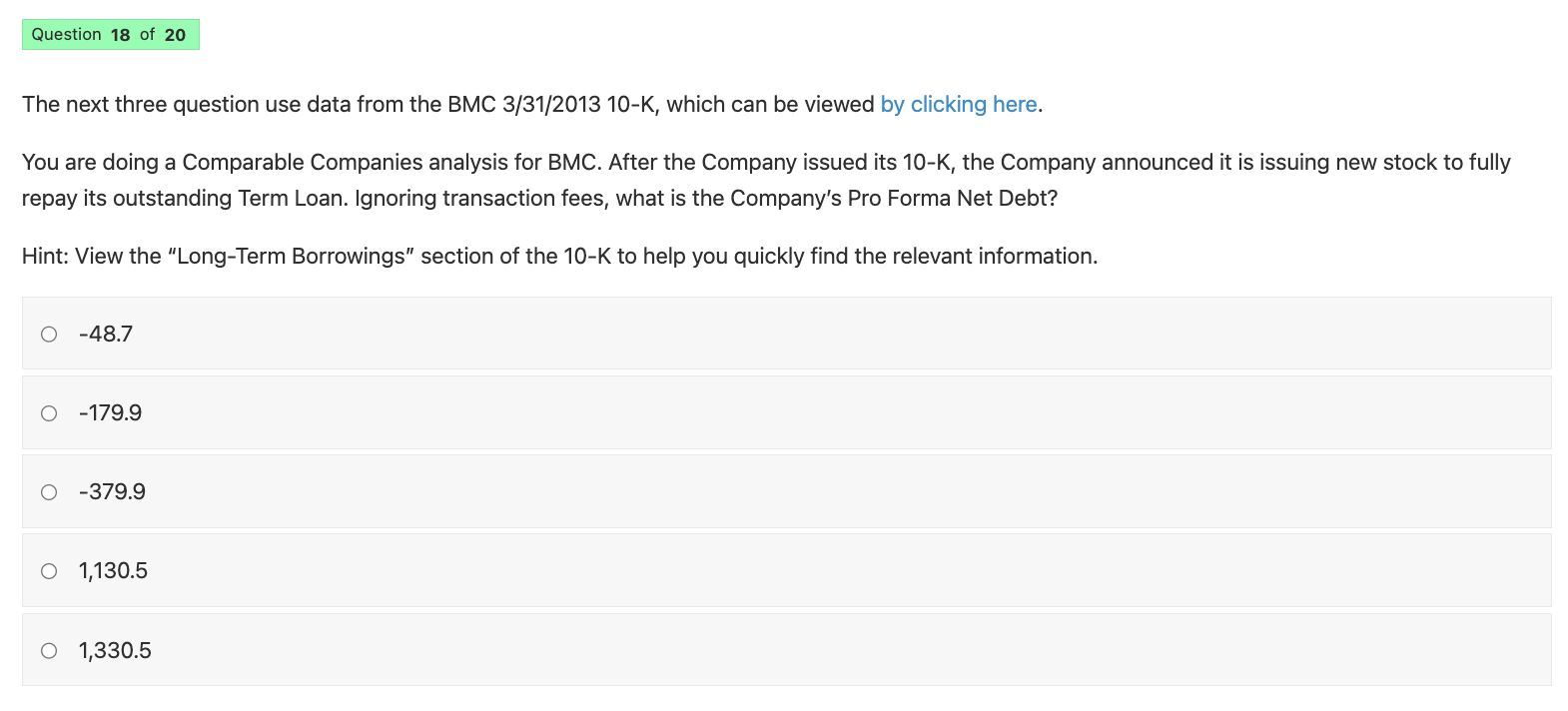

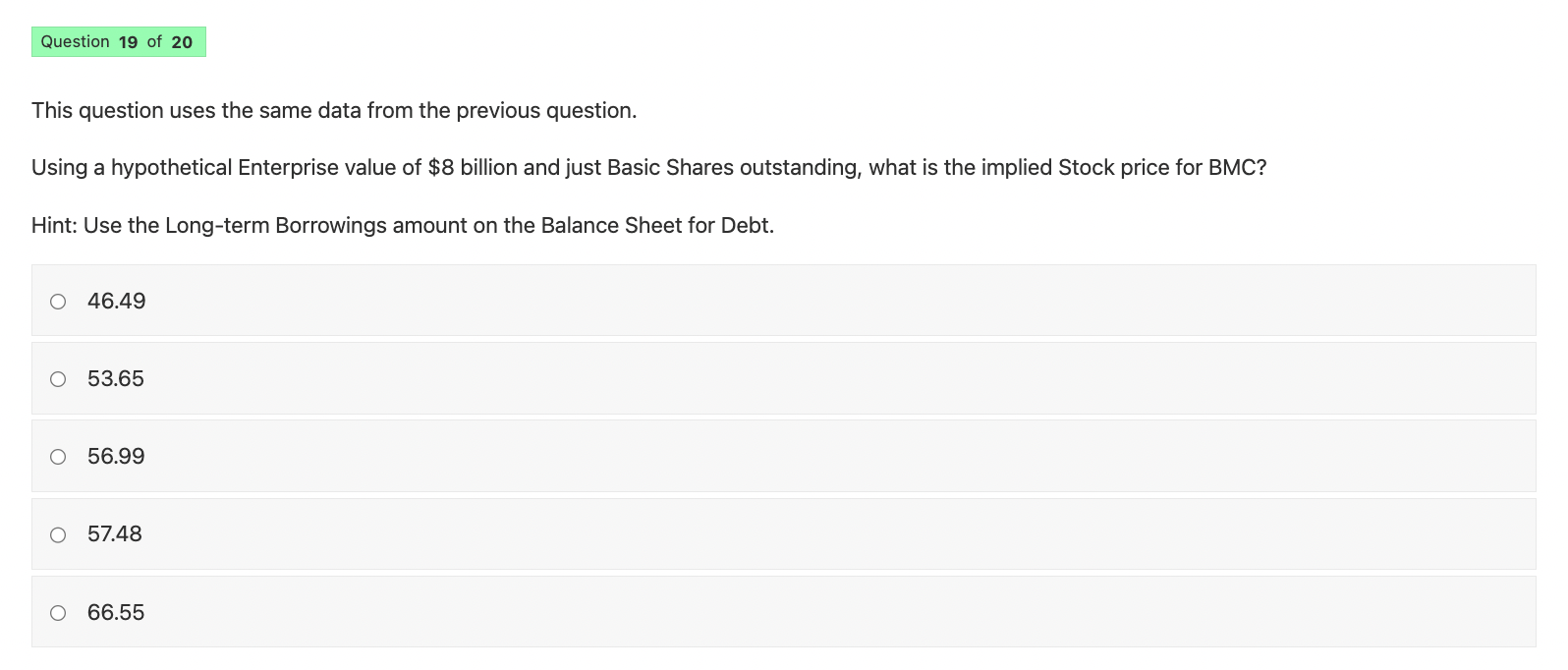

This question uses the same data as the previous question. You are comparing Gap to a competitor which has a fiscal year ending 12/31/2016. As you calculate an EV / LTM EBIT multiple for all the companies in the industry, what is the value of the denominator that you would use for Gap as you calendarize Gap's fiscal year to match its competitor? Hint: Note GAP's 2016 fiscal year ended on 1/28/2017. 1,191 1,216 1,274 1,499 1524 The next three question use data from the BMC 3/31/2013 10-K, which can be viewed by clicking here. You are doing a Comparable Companies analysis for BMC. After the Company issued its 10-K, the Company announced it is issuing new stock to fully repay its outstanding Term Loan. Ignoring transaction fees, what is the Company's Pro Forma Net Debt? Hint: View the "Long-Term Borrowings" section of the 10-K to help you quickly find the relevant information. 48.7 179.9 379.9 1,130.5 1,330.5 This question uses the same data from the previous question. Using a hypothetical Enterprise value of $8 billion and just Basic Shares outstanding, what is the implied Stock price for BMC? Hint: Use the Long-term Borrowings amount on the Balance Sheet for Debt. 46.49 53.65 56.99 57.48 66.55 This question uses the same data as the previous question. You are comparing Gap to a competitor which has a fiscal year ending 12/31/2016. As you calculate an EV / LTM EBIT multiple for all the companies in the industry, what is the value of the denominator that you would use for Gap as you calendarize Gap's fiscal year to match its competitor? Hint: Note GAP's 2016 fiscal year ended on 1/28/2017. 1,191 1,216 1,274 1,499 1524 The next three question use data from the BMC 3/31/2013 10-K, which can be viewed by clicking here. You are doing a Comparable Companies analysis for BMC. After the Company issued its 10-K, the Company announced it is issuing new stock to fully repay its outstanding Term Loan. Ignoring transaction fees, what is the Company's Pro Forma Net Debt? Hint: View the "Long-Term Borrowings" section of the 10-K to help you quickly find the relevant information. 48.7 179.9 379.9 1,130.5 1,330.5 This question uses the same data from the previous question. Using a hypothetical Enterprise value of $8 billion and just Basic Shares outstanding, what is the implied Stock price for BMC? Hint: Use the Long-term Borrowings amount on the Balance Sheet for Debt. 46.49 53.65 56.99 57.48 66.55

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts