Question: Pls help thanks!! You are evaluating a project for your firm. The project will require an investment today of $650,000 and is expected to generate

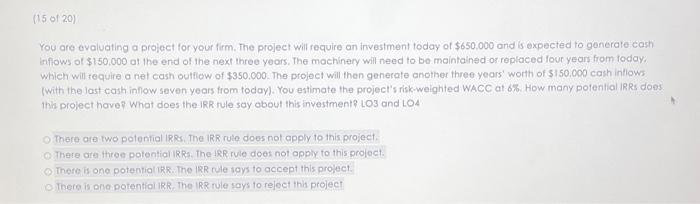

You are evaluating a project for your firm. The project will require an investment today of $650,000 and is expected to generate cash inflows of $150,000 at the end of the next three years, The machinery will need to be maintalned or replaced four years from foday: which will tequire a nel cash outliow of $350,000. The project will then generate another three years' worth of 3150,000 cash intlows (With the last cash inflow seven years from today). You estimate the project's risk-weighted WACC at 6%. How many potential IRRs does thh prolect have? What does the IRR rule say obout this investment? LO3 and LOA There are two potential IRRs. The IRR rule does not apply to this project. There are three polential IRRe. The IRR rule does not opply to this project. There is one potentiol iRR. The IRR rule toys to accept this prolect. There is ona potentiol IRR. The IRR rule says to reject thit project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts