Question: PLS HELP USE ONLY MACRS DEPRECIATION METHOD: NO EXCEL!!!! a. A company with a MARR policy of 12% is trying to estimate the initial cost

PLS HELP USE ONLY MACRS DEPRECIATION METHOD: NO EXCEL!!!!

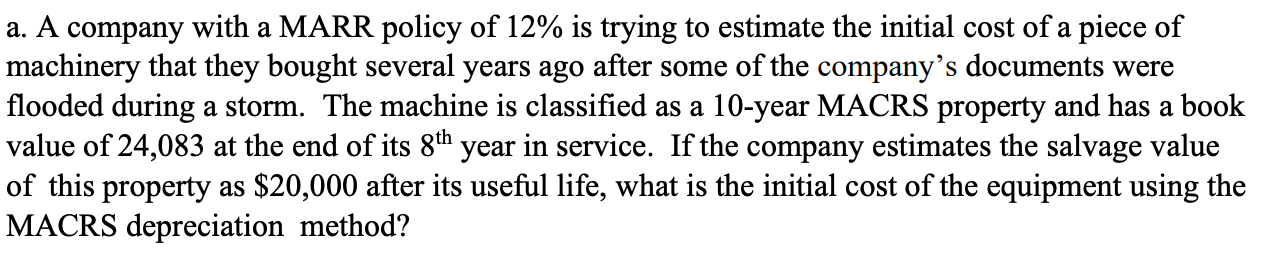

a. A company with a MARR policy of 12% is trying to estimate the initial cost of a piece of machinery that they bought several years ago after some of the company's documents were flooded during a storm. The machine is classified as a 10-year MACRS property and has a book value of 24,083 at the end of its 8th year in service. If the company estimates the salvage value of this property as $20,000 after its useful life, what is the initial cost of the equipment using the MACRS depreciation method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts