Question: PLS help w all 4 Suppose you put $100 into a bank account that has a 7 percent interest rate. In this example, the $100

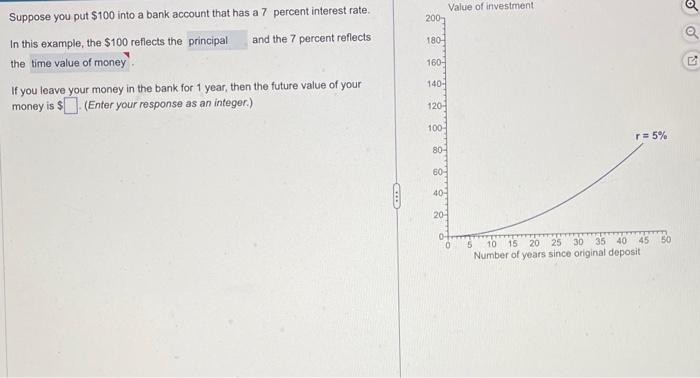

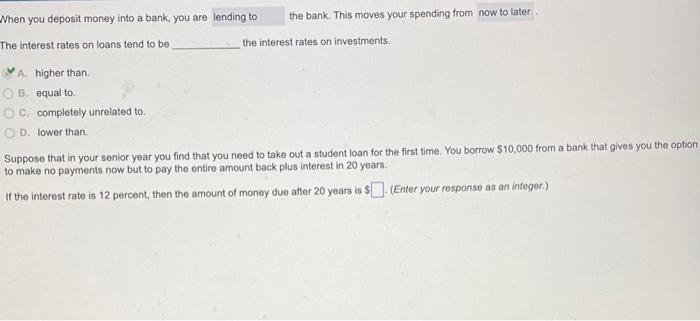

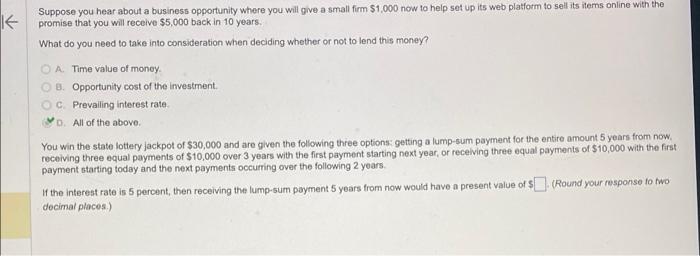

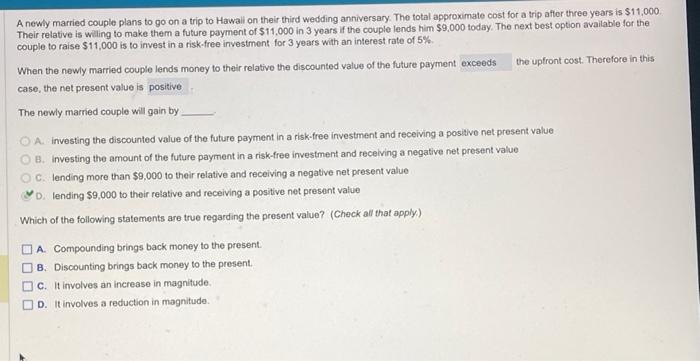

Suppose you put $100 into a bank account that has a 7 percent interest rate. In this example, the $100 reflects the and the 7 percent reflects the If you leave your money in the bank for 1 year, then the future value of your money is $ (Enter your response as an integer.) A. higher than. B. equal to. c. completely unrelated to. D. lower than. Suppose that in your senior year you find that you need to take out a student loan for the first time. You borrow $10,000 from a bank that gives you the option to make no payments now but to pay the entire amount back plus interest in 20 years. If the interest rate is 12 percent, then the amount of money due after 20 years is $ (Entor your response as an integer.) Suppose you hear about a business opportunity where you will give a small firm $1,000 now to help set up its web platform to sell its items online with the promise that you will receive $5,000 back in 10 years. What do you need to take into consideration when deciding whether or not to lend this money? A. Time value of money. B. Opportunity cost of the investment. c. Prevaling interest rate. D. All of the above. You win the state lottery jackpot of $30,000 and are given the following three options: getting a lump-sum payment for the entire amount 5 years from now. receiving three equal payments of $10,000 over 3 years with the first payment starting next year, or recelving three equal payments of $10,000 with the first payment starting today and the next payments occuring over the following 2 years. If the interest rate is 5 percent, then receiving the lump-sum payment 5 years from now would have a present value of $ (Round your response to two) docimal places.) A newly married couple plans to go on a trip to Hawali on their third wedding anniversary. The total approximate cost for a trip after three years is $11,000. Their relative is wiling to make them a future payment of $11,000 in 3 years if the couple lends him $9,000 today. The next bost option available for the couple to raise $11,000 is to invest in a risk-free investment for 3 years with an interest rate of 5%. When the newly married couple lends money to their relative the discounted value of the future payment the upfront cost. Therefore in this case, the net present value is The newly marned couple will gain by A. investing the discounted value of the future payment in a risk-free investment and receiving a positive net present value B. Investing the amount of the future payment in a risk-free investment and recelving a negative net present value C. lending more than $9,000 to their relative and receiving a negative net present value D. lending $9,000 to their relative and receiving a positive net present value Which of the following statements are true regarding the present value? (Check all that apply.) A. Compounding brings back money to the present. B. Discounting brings back money to the present. C. It involves an increase in magnitude. D. It involves a reduction in magnitude

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts