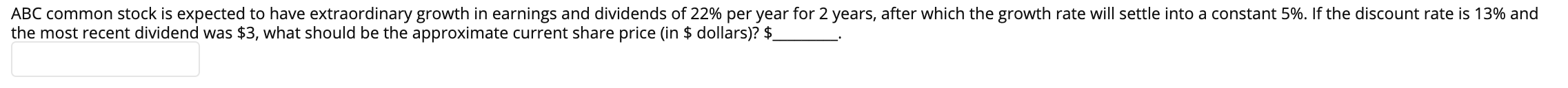

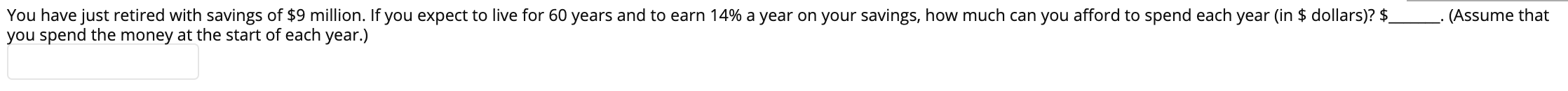

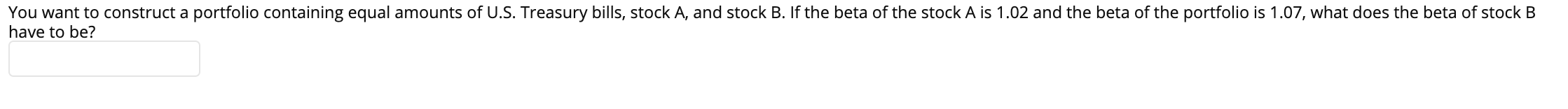

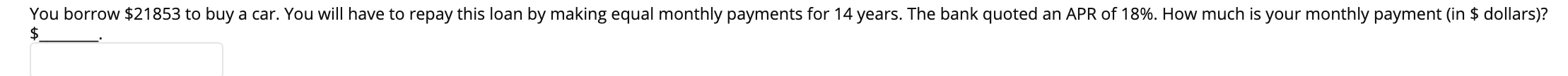

Question: pls help with all five questions ASAP please ABC common stock is expected to have extraordinary growth in earnings and dividends of 22% per year

pls help with all five questions ASAP please

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock