Question: Pls help with Question 9 Question 9 You have been given the task of calculating the Weighted Average Cost of Capital for Funck's Fantastic Frisbees

Pls help with Question 9

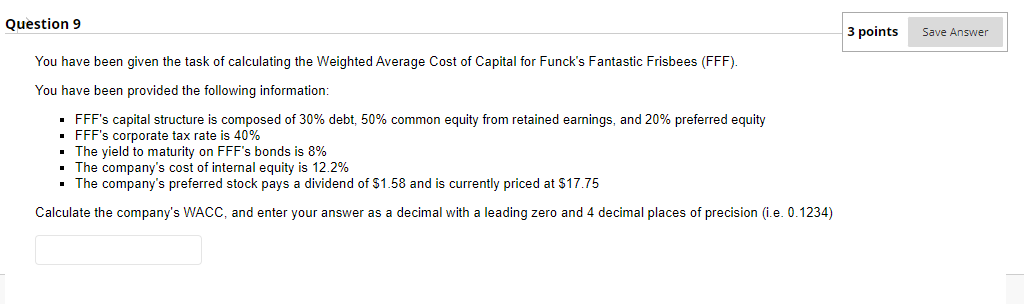

Question 9 You have been given the task of calculating the Weighted Average Cost of Capital for Funck's Fantastic Frisbees (FFF). You have been provided the following information: FFF's capital structure is composed of 30% debt, 50% common equity from retained earnings, and 20% preferred equity FFF's corporate tax rate is 40% The yield to maturity on FFF's bonds is 8% The company's cost of internal equity is 12.2% The company's preferred stock pays a dividend of $1.58 and is currently priced at $17.75 Calculate the company's WACC, and enter your answer as a decimal with a leading zero and 4 decimal places of precision (i.e. 0.1234) 3 points Save

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts