Question: pls help with these three questions( short answer and calculation), thank you very much! Question B2 (10 marks) a) In January 2018, an Australian fund

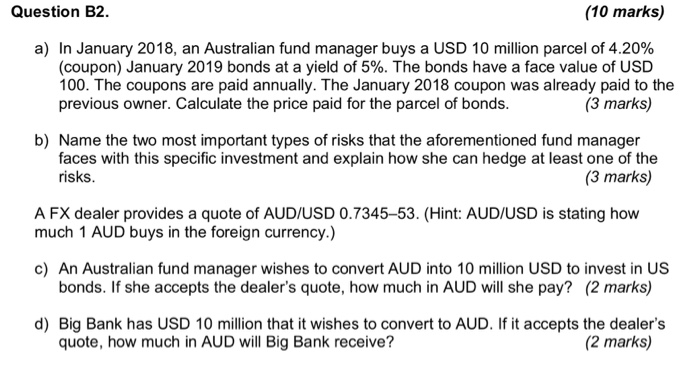

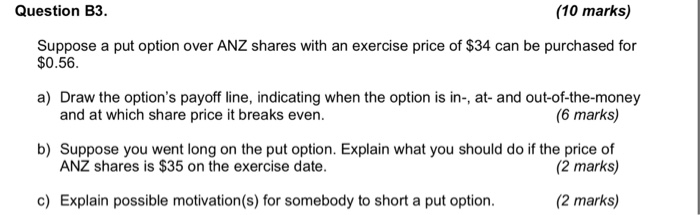

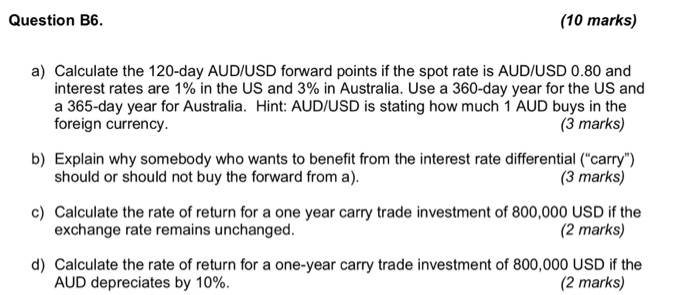

Question B2 (10 marks) a) In January 2018, an Australian fund manager buys a USD 10 million parcel of 4.20% (coupon) January 2019 bonds at a yield of 5%. The bonds have a face value of USD 100. The coupons are paid annually. The January 2018 coupon was already paid to the previous owner. Calculate the price paid for the parcel of bonds. (3 marks) b) Name the two most important types of risks that the aforementioned fund manager faces with this specific investment and explain how she can hedge at least one of the risks (3 marks) A FX dealer provides a quote of AUD/USD 0.7345-53. (Hint: AUD/USD is stating how much 1 AUD buys in the foreign currency.) c) An Australian fund manager wishes to convert AUD into 10 million USD to invest in US bonds. If she accepts the dealer's quote, how much in AUD will she pay? (2 marks) d) Big Bank has USD 10 million that it wishes to convert to AUD. If it accepts the dealer's quote, how much in AUD will Big Bank receive? (2 marks) Question B3. (10 marks) Suppose a put option over ANZ shares with an exercise price of $34 can be purchased for $0.56 a) Draw the option's payoff line, indicating when the option is in-, at- and out-of-the-money and at which share price it breaks even. (6 marks) b) Suppose you went long on the put option. Explain what you should do if the price of ANZ shares is $35 on the exercise date. (2 marks) c) Explain possible motivation(s) for somebody to short a put option (2 marks) Question B6 (10 marks) a) Calculate the 120-day AUD/USD forward points if the spot rate is AUD/USD 0.80 and interest rates are 1% in the US and 3% in Australia. Use a 360-day year for the US and a 365-day year for Australia. Hint: AUD/USD is stating how much 1 AUD buys in the foreign currency (3 marks) b) Explain why somebody who wants to benefit from the interest rate differential ("carry") should or should not buy the forward from a) (3 marks) c) Calculate the rate of return for a one year carry trade investment of 800,000 USD if the exchange rate remains unchanged. (2 marks) d) Calculate the rate of return for a one-year carry trade investment of 800,000 USD if the AUD depreciates by 10% (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts