Question: pls help with this problem O Search Instruction: You have been retained by the Brooklyn-SHB investment group to provide a fundamental analysis report to the

pls help with this problem

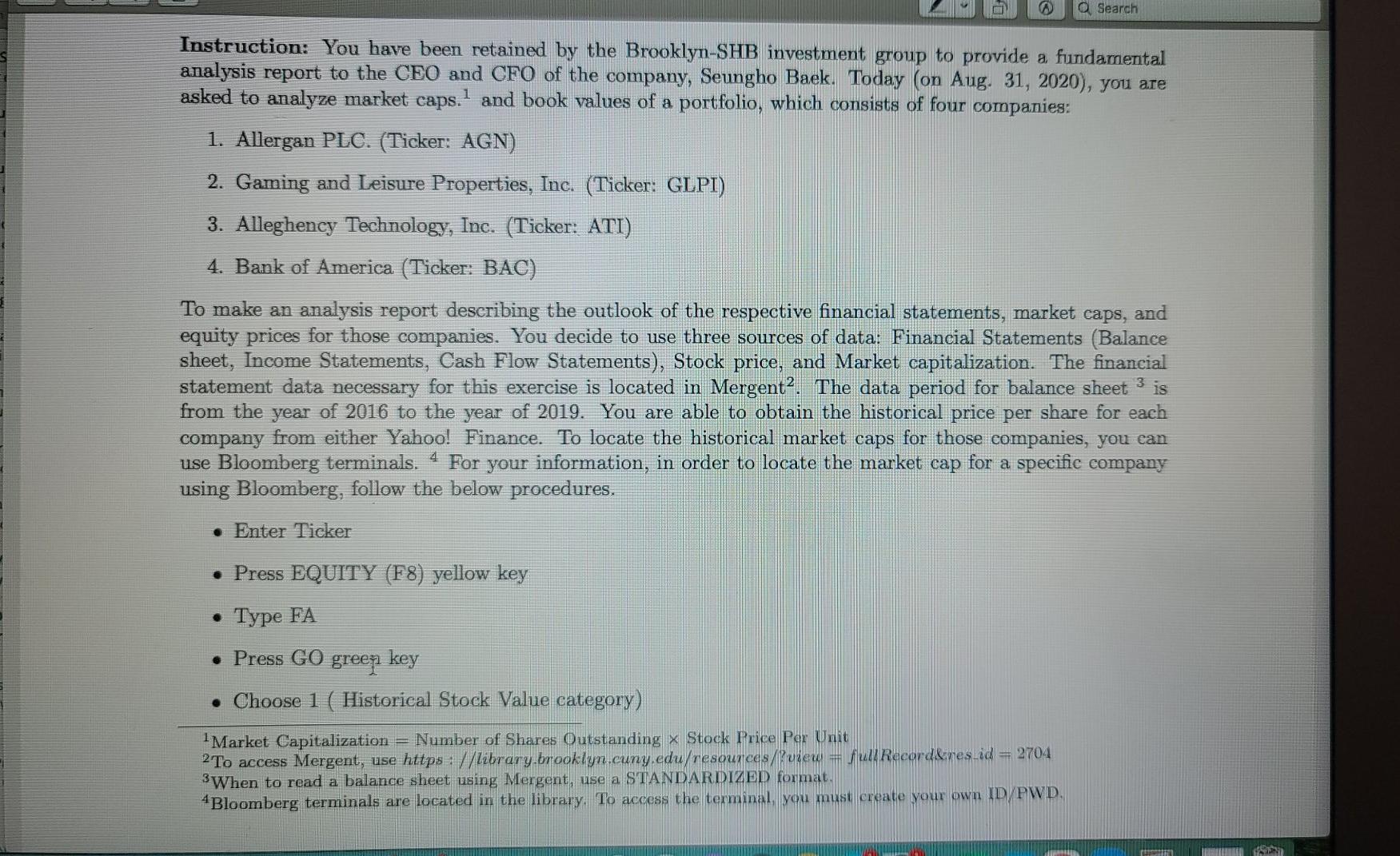

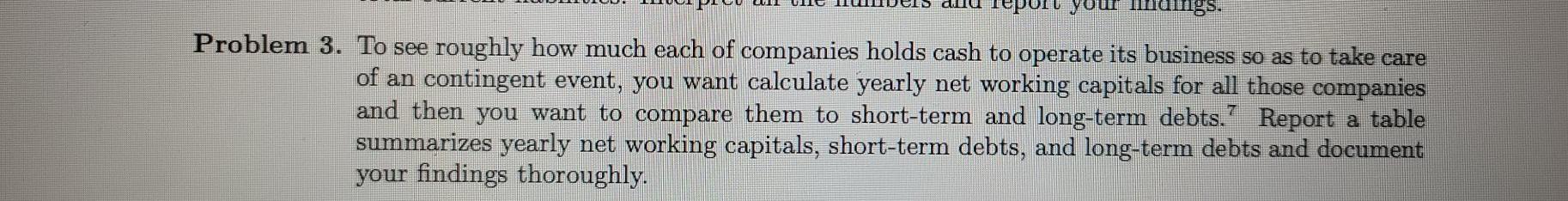

O Search Instruction: You have been retained by the Brooklyn-SHB investment group to provide a fundamental analysis report to the CEO and CFO of the company, Seungho Baek. Today (on Aug. 31, 2020), you are asked to analyze market caps, and book values of a portfolio, which consists of four companies: 1. Allergan PLC. (Ticker: AGN) 2. Gaming and Leisure Properties, Inc. (Ticker: GLPI) 3. Alleghency Technology, Inc. (Ticker: ATI) 4. Bank of America (Ticker: BAC) To make an analysis report describing the outlook of the respective financial statements, market caps, and equity prices for those companies. You decide to use three sources of data: Financial Statements (Balance sheet, Income Statements, Cash Flow Statements), Stock price, and Market capitalization. The financial statement data necessary for this exercise is located in Mergent?. The data period for balance sheet 3 is from the year of 2016 to the year of 2019. You are able to obtain the historical price per share for each company from either Yahoo! Finance. To locate the historical market caps for those companies, you can use Bloomberg terminals. 4 For your information, in order to locate the market cap for a specific company using Bloomberg, follow the below procedures. Enter Ticker Press EQUITY (F8) yellow key Type FA Press GO green key . Choose 1 ( Historical Stock Value category) Market Capitalization = Number of Shares Outstanding Stock Price Per Unit 2 To access Mergent, use https://library.brooklyn.cuny.edu/resources/Puiew = full Record&res_id = 2704 3 When to read a balance sheet using Mergent, use a STANDARDIZED format. 4 Bloomberg terminals are located in the library. To access the terminal , you must create your own ID/PWD. BS. Problem 3. To see roughly how much each of companies holds cash to operate its business so as to take care of an contingent event, you want calculate yearly net working capitals for all those companies and then you want to compare them to short-term and long-term debts. Report a table summarizes yearly net working capitals, short-term debts, and long-term debts and document your findings thoroughly. O Search Instruction: You have been retained by the Brooklyn-SHB investment group to provide a fundamental analysis report to the CEO and CFO of the company, Seungho Baek. Today (on Aug. 31, 2020), you are asked to analyze market caps, and book values of a portfolio, which consists of four companies: 1. Allergan PLC. (Ticker: AGN) 2. Gaming and Leisure Properties, Inc. (Ticker: GLPI) 3. Alleghency Technology, Inc. (Ticker: ATI) 4. Bank of America (Ticker: BAC) To make an analysis report describing the outlook of the respective financial statements, market caps, and equity prices for those companies. You decide to use three sources of data: Financial Statements (Balance sheet, Income Statements, Cash Flow Statements), Stock price, and Market capitalization. The financial statement data necessary for this exercise is located in Mergent?. The data period for balance sheet 3 is from the year of 2016 to the year of 2019. You are able to obtain the historical price per share for each company from either Yahoo! Finance. To locate the historical market caps for those companies, you can use Bloomberg terminals. 4 For your information, in order to locate the market cap for a specific company using Bloomberg, follow the below procedures. Enter Ticker Press EQUITY (F8) yellow key Type FA Press GO green key . Choose 1 ( Historical Stock Value category) Market Capitalization = Number of Shares Outstanding Stock Price Per Unit 2 To access Mergent, use https://library.brooklyn.cuny.edu/resources/Puiew = full Record&res_id = 2704 3 When to read a balance sheet using Mergent, use a STANDARDIZED format. 4 Bloomberg terminals are located in the library. To access the terminal , you must create your own ID/PWD. BS. Problem 3. To see roughly how much each of companies holds cash to operate its business so as to take care of an contingent event, you want calculate yearly net working capitals for all those companies and then you want to compare them to short-term and long-term debts. Report a table summarizes yearly net working capitals, short-term debts, and long-term debts and document your findings thoroughly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts