Question: Pls i need this asap!!!! 4. a. Bond X has a face value of 10,000 USD and matures in 10 years. The bond makes no

Pls i need this asap!!!!

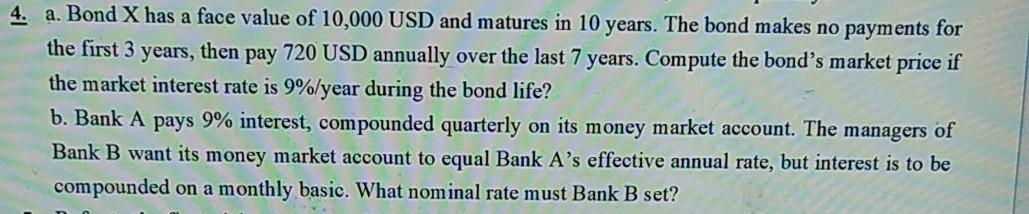

4. a. Bond X has a face value of 10,000 USD and matures in 10 years. The bond makes no payments for the first 3 years, then pay 720 USD annually over the last 7 years. Compute the bond's market price if the market interest rate is 9%/year during the bond life? b. Bank A pays 9% interest, compounded quarterly on its money market account. The managers of Bank B want its money market account to equal Bank A's effective annual rate, but interest is to be compounded on a monthly basic. What nominal rate must Bank B set

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock