Question: pls input the solution step by step required: 1. prepare the necessary entries of sole proprietorship and individual partnerships 2. what shall be the amount

pls input the solution step by step

required: 1. prepare the necessary entries of sole proprietorship and individual partnerships 2. what shall be the amount of cash to be contributed by ceazar? 3. prepare the open journal entries in the book of the partnership A. book of sole proprietorship retrained as a book of partnership B. new set of book will be open for the partnership 4. prepare the statement of financial position after the formation of Julius, Caesar international partnership.

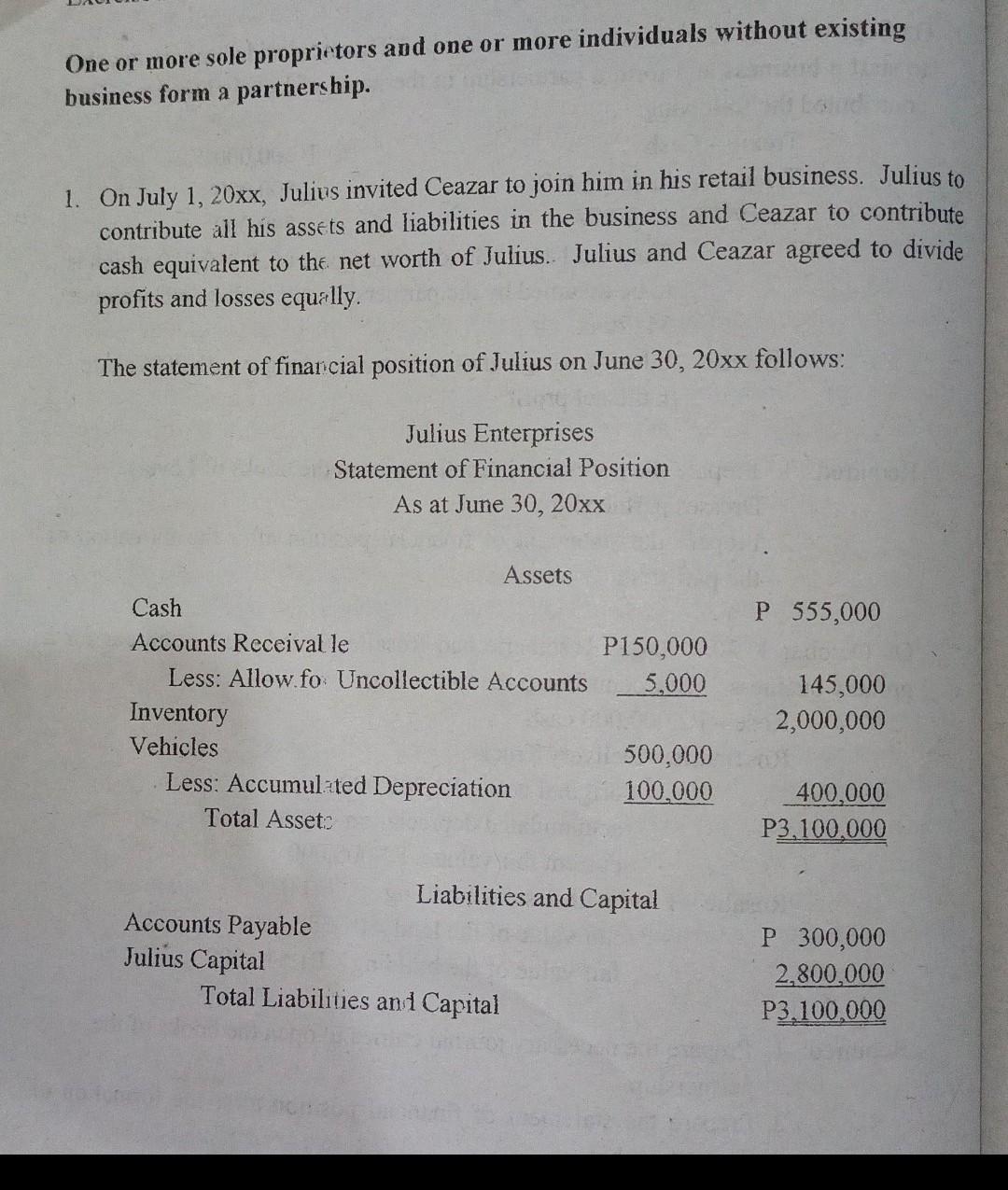

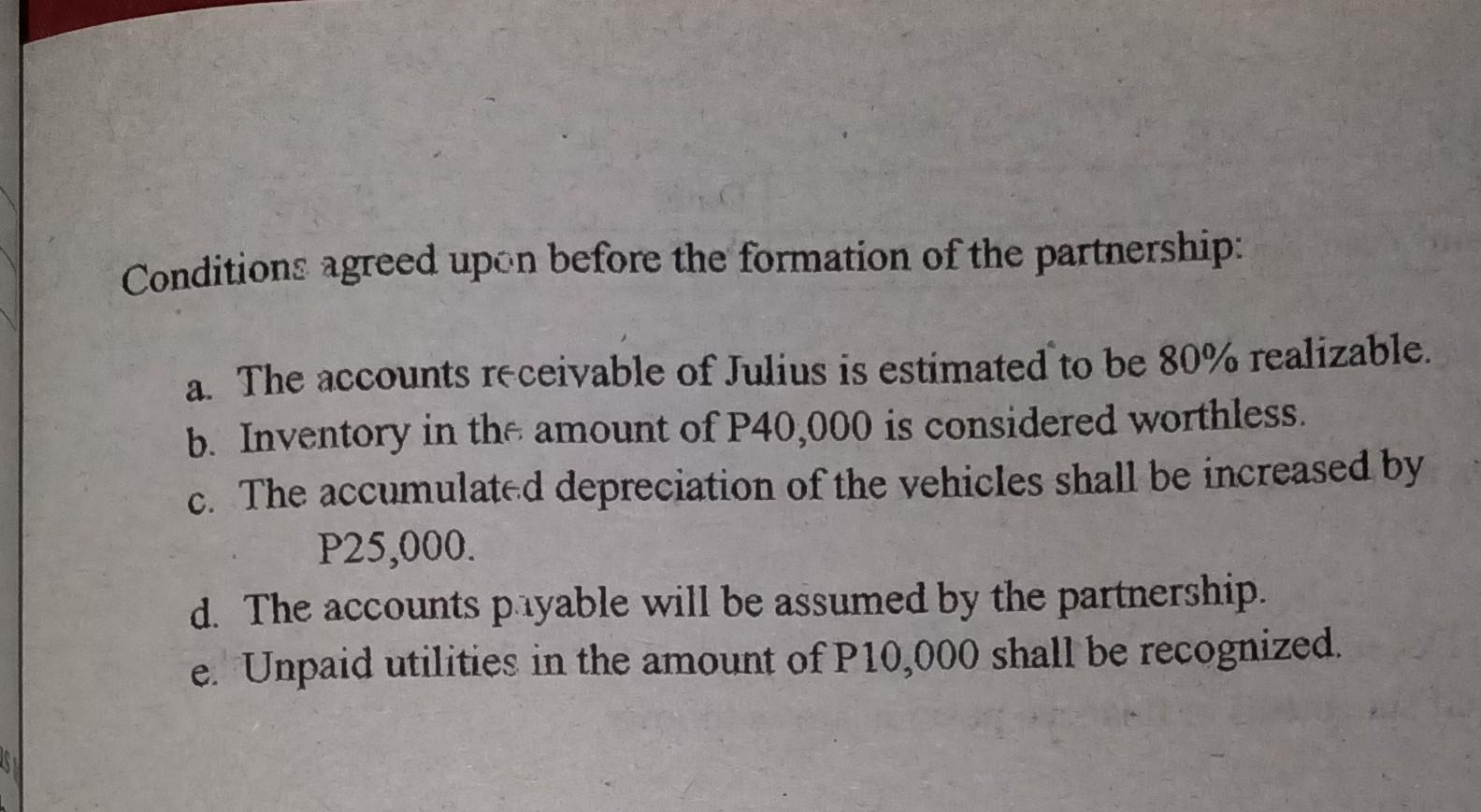

One or more sole proprietors and one or more individuals without existing business form a partnership. 1. On July 1, 20xx, Julius invited Ceazar to join him in his retail business. Julius to contribute all his assets and liabilities in the business and Ceazar to contribute cash equivalent to the net worth of Julius. Julius and Ceazar agreed to divide profits and losses equally. The statement of financial position of Julius on June 30, 20xx follows: Julius Enterprises Statement of Financial Position As at June 30, 20xx Assets P 555,000 P150,000 5,000 Cash Accounts Receival le Less: Allow.fo Uncollectible Accounts Inventory Vehicles Less: Accumulated Depreciation Total Assets 145,000 2,000,000 500,000 100,000 400,000 P3.100.000 Liabilities and Capital Accounts Payable Julius Capital Total Liabilities and Capital P 300,000 2,800,000 P3.100.000 Conditions agreed upon before the formation of the partnership: a. The accounts receivable of Julius is estimated to be 80% realizable. b. Inventory in the amount of P40,000 is considered worthless. c. The accumulated depreciation of the vehicles shall be increased by P25,000 d. The accounts payable will be assumed by the partnership. e. Unpaid utilities in the amount of P10,000 shall be recognized

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts