Question: pls only answer if u know what your doing. 1: Devin Moody earned gross pay of $1,450 during a recent pay period. He conttibutes 11%

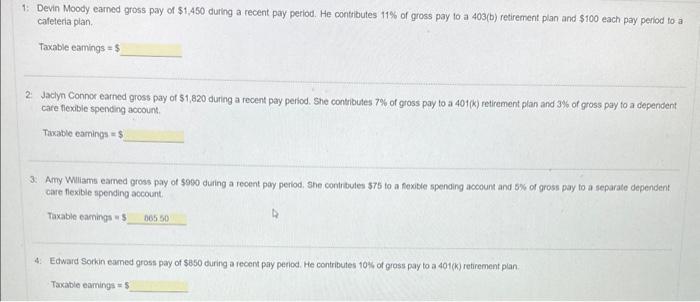

1: Devin Moody earned gross pay of $1,450 during a recent pay period. He conttibutes 11% of gross pay lo a 403(b) retirement plan and $100 each pay period to a caleleria plan. Taxable eamings =5 2. Jaclyn Connor earned gross pay of $1,820 during a recent pay period. She contributes 7% of gross pay to a 401(k) retirement plan and 3% of gross pay to a dependent. care fiexibie spending account. Tixable eamings =$ 3. Arry Wiliams eamed gross pay of $990 duting a recent pay period. she contibules $75 to a foxible spending account and 5% of gross pay to a separate dependent. care fiexibie spending account. Taxable camings =1 4. Edward Sockin eamed gross pay of $850 during a recent pay penod. He contributes 10% of gross pay to a 401(k) retirement plan. Taxable eamings =5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts