Question: pls only answer no explanation needed q2 1. What is the highest acceptable transfer price for the divisions? 2. Assuming the transfer price is negotiated

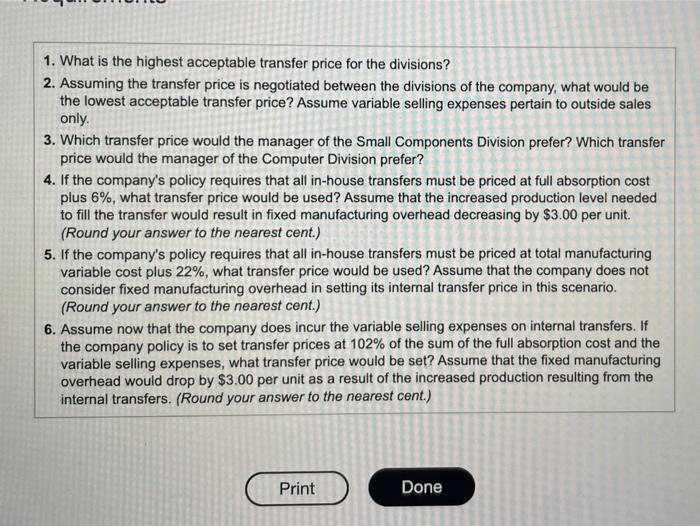

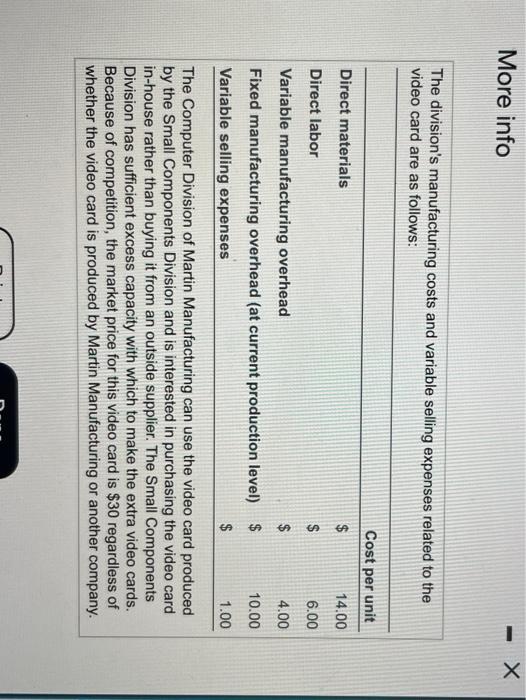

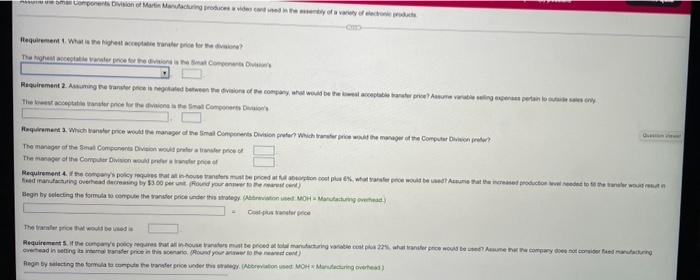

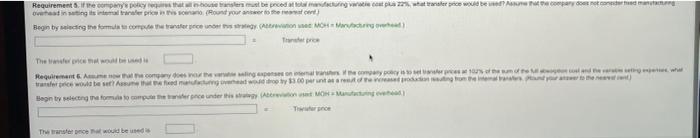

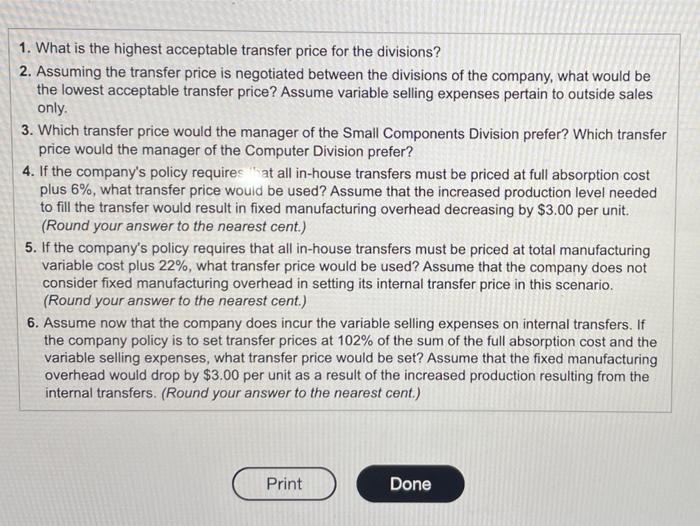

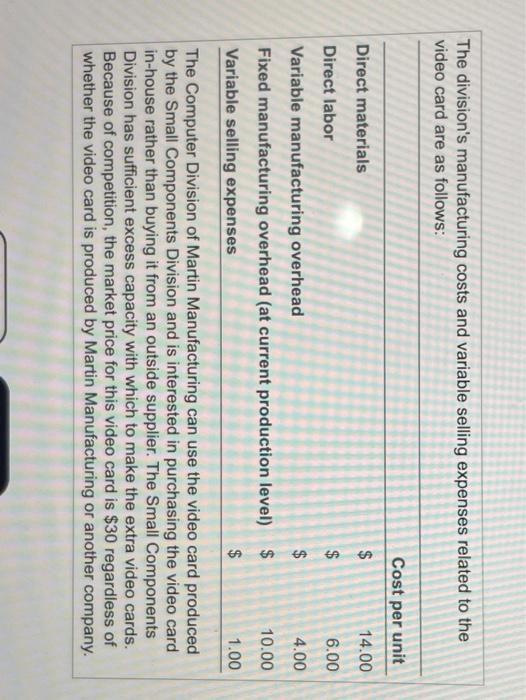

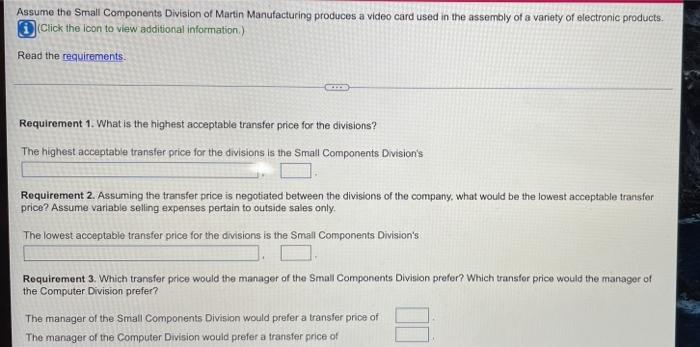

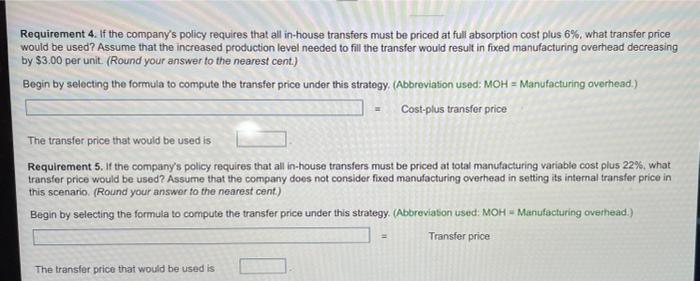

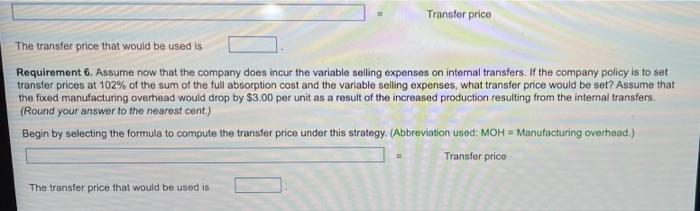

1. What is the highest acceptable transfer price for the divisions? 2. Assuming the transfer price is negotiated between the divisions of the company, what would be the lowest acceptable transfer price? Assume variable selling expenses pertain to outside sales only. 3. Which transfer price would the manager of the Small Components Division prefer? Which transfer price would the manager of the Computer Division prefer? 4. If the company's policy requires that all in-house transfers must be priced at full absorption cost plus 6%, what transfer price would be used? Assume that the increased production level needed to fill the transfer would result in fixed manufacturing overhead decreasing by $3.00 per unit. (Round your answer to the nearest cent.) 5. If the company's policy requires that all in-house transfers must be priced at total manufacturing variable cost plus 22%, what transfer price would be used? Assume that the company does not consider fixed manufacturing overhead in setting its internal transfer price in this scenario. (Round your answer to the nearest cent.) 6. Assume now that the company does incur the variable selling expenses on internal transfers. If the company policy is to set transfer prices at 102% of the sum of the full absorption cost and the variable selling expenses, what transfer price would be set? Assume that the fixed manufacturing overhead would drop by $3.00 per unit as a result of the increased production resulting from the internal transfers. (Round your answer to the nearest cent.) Print Done More info - The division's manufacturing costs and variable selling expenses related to the video card are as follows: Cost per unit Direct materials $ 14.00 Direct labor $ 6.00 $ 4.00 Variable manufacturing overhead Fixed manufacturing overhead (at current production level) $ Variable selling expenses $ 10.00 1.00 The Computer Division of Martin Manufacturing can use the video card produced by the Small Components Division and is interested in purchasing the video card in-house rather than buying it from an outside supplier. The Small Components Division has sufficient excess capacity with which to make the extra video cards. Because of competition, the market price for this video card is $30 regardless of whether the video card is produced by Martin Manufacturing or another company. Components in Martin Marding protector Iequirement What is right one price for the The Componente Requirement 2. Ang weige bevision of the company w would be acceptable pouvor gesperanto The cleanser for the ones al Corpor' Porqueremans 3. schwerer price manager of the Smal Contraris Division pratar chambers went the manager of the computer Deinen groter The manager of the Senat Cocon Division would pro The manager of the Com Divine Requirement comployees at the brand new produto cope what water per molt bened! Anuntut he needed reduction wond to the wordt Bemanning overhead stressing by $300 personed your heart Begin by lecting the formulas compute the panier price under this strategy (tredoton EOH Martinove Requirements. The complication total sung von andere would be company of our heading ter price is this son Round your cont Regnby lecting the formato comparecer. A MOH Margo Requirements in the company that smete preceding with andere we be compared Begin by wing the forma como transfer CAMHR There was Requirement congres varen en compromet trance we feed godina) Ben by cong to competence under the MOM There would be di 1. What is the highest acceptable transfer price for the divisions? 2. Assuming the transfer price is negotiated between the divisions of the company, what would be the lowest acceptable transfer price? Assume variable selling expenses pertain to outside sales only. 3. Which transfer price would the manager of the Small Components Division prefer? Which transfer price would the manager of the Computer Division prefer? 4. If the company's policy requires at all in-house transfers must be priced at full absorption cost plus 6%, what transfer price would be used? Assume that the increased production level needed to fill the transfer would result in fixed manufacturing overhead decreasing by $3.00 per unit. (Round your answer to the nearest cent.) 5. If the company's policy requires that all in-house transfers must be priced at total manufacturing variable cost plus 22%, what transfer price would be used? Assume that the company does not consider fixed manufacturing overhead in setting its internal transfer price in this scenario. (Round your answer to the nearest cent.) 6. Assume now that the company does incur the variable selling expenses on internal transfers. If the company policy is to set transfer prices at 102% of the sum of the full absorption cost and the variable selling expenses, what transfer price would be set? Assume that the fixed manufacturing overhead would drop by $3.00 per unit as a result of the increased production resulting from the internal transfers. (Round your answer to the nearest cent.) Print Done The division's manufacturing costs and variable selling expenses related to the video card are as follows: Cost per unit $ 14.00 Direct materials Direct labor $ 6.00 $ $ $ Variable manufacturing overhead Fixed manufacturing overhead (at current production level) Variable selling expenses 4.00 10.00 $ 1.00 The Computer Division of Martin Manufacturing can use the video card produced by the Small Components Division and is interested in purchasing the video card in-house rather than buying it from an outside supplier. The Small Components Division has sufficient excess capacity with which to make the extra video cards. Because of competition, the market price for this video card is $30 regardless of whether the video card is produced by Martin Manufacturing or another company. Assume the Small Components Division of Martin Manufacturing produces a video card used in the assembly of a variety of electronic products. Click the icon to view additional information) Read the requirements Requirement 1. What is the highest acceptable transfer price for the divisions? The highest acceptable transfer price for the divisions is the Small Components Division's Requirement 2. Assuming the transfer price is negotiated between the divisions of the company, what would be the lowest acceptable transfer price? Assume variable selling expenses pertain to outside sales only The lowest acceptable transfer price for the divisions is the Small Components Division's Requirement 3. Which transfer price would the manager of the Small Components Division prefer? Which transfer price would the manager of the Computer Division prefer? The manager of the Small Components Division would prefer a transfer price of The manager of the Computer Division would prefer a transfer price of Requirement 4. If the company's policy requires that all in-house transfers must be priced at full absorption cost plus 6%, what transfer price would be used? Assume that the increased production level needed to fill the transfer would result in fixed manufacturing overhead decreasing by $3.00 per unit. (Round your answer to the nearest cent.) Begin by selecting the formula to compute the transfer price under this strategy. (Abbreviation used: MOH = Manufacturing overhead) Cost-plus transfer price The transfer price that would be used is Requirement 5. If the company's policy requires that all in-house transfers must be priced at total manufacturing variable cost plus 22%, what transfer price would be used? Assume that the company does not consider fixed manufacturing overhead in setting its internal transfer price in this scenario (Round your answer to the nearest cent) Begin by selecting the formula to compute the transfer price under this strategy. Abbreviation used: MOH - Manufacturing overhead.) Transfer price The transfer price that would be used is Transfer price The transfer price that would be used is Requiremont 6. Assume now that the company does incur the variable selling expenses on internal transfers. If the company policy is to set transfer prices at 102% of the sum of the full absorption cost and the variable selling expenses, what transfer price would be set? Assume that the fixed manufacturing overhead would drop by $3.00 per unit as a result of the increased production resulting from the internal transfers. (Round your answer to the nearest cent) Begin by selecting the formula to compute the transfer price under this strategy. (Abbreviation used: MOH = Manufacturing overhead.) Transfer price The transfer price that would be used is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts