Question: pls put answers in format where its clearly stated Consider the following information for Presidio Inc's most recent year of operations. Additional information for Presidio's

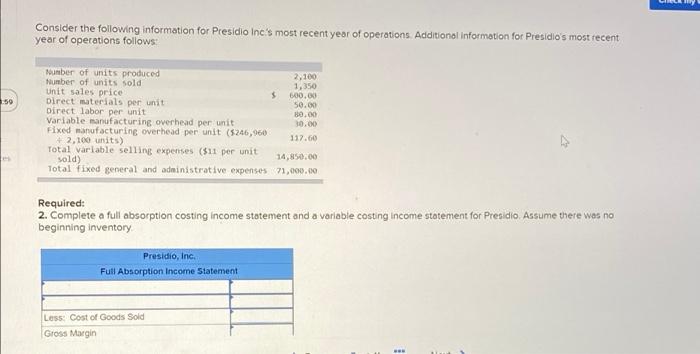

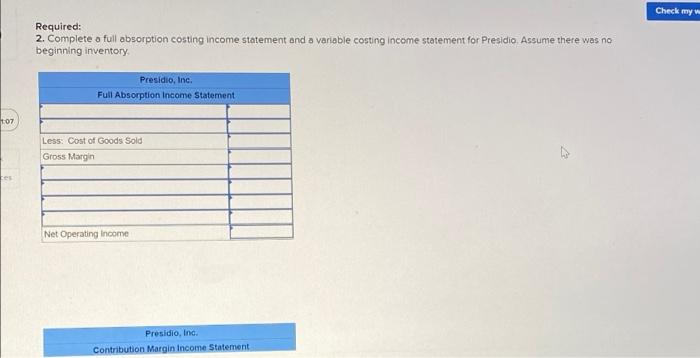

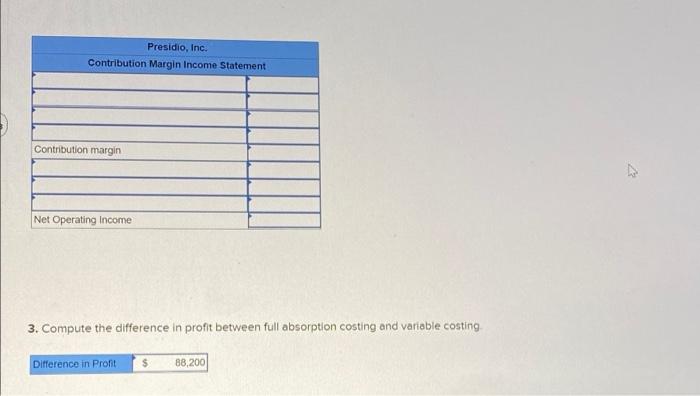

Consider the following information for Presidio Inc's most recent year of operations. Additional information for Presidio's most recent year of operations follows: 50 Sumber of units produced 2.100 Number of units sold 1,350 Unit sales price $ 600.00 Direct materials per unit 50.00 Direct labor per unit 80.00 Variable manufacturing overhead per unit 30.00 Fixed manufacturing overhead per unit (5246,960 + 2,100 units) 117.60 Total variable selling expenses ($11 per unit sold) 14,850.00 Total fixed general and administrative expenses 71,000.00 Required: 2. Complete a full absorption costing income statement and a variable costing Income statement for Presidio Assume there was no beginning inventory Presidio, Inc. Full Absorption Income Statement Less: Cost of Goods Sold Gross Margin ... Check my Required: 2. Complete a full absorption costing income statement and a variable costing income statement for Presidio Assume there was no beginning inventory Presidio, Inc. Full Absorption Income Statement 107 Less: Cost of Goods Sold Gross Margin Net Operating Income Presidio, Inc. Contribution Margin Income Statement Presidio, Inc. Contribution Margin Income Statement Contribution margin Net Operating Income 3. Compute the difference in profit between full absorption costing and variable costing Difference in Profit $ 88,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts