Question: pls qith step?formual and the answer format same as the picture Dynamic, Inc. had credit sales of $625,000 for March. Accounts receivable of $11,000 were

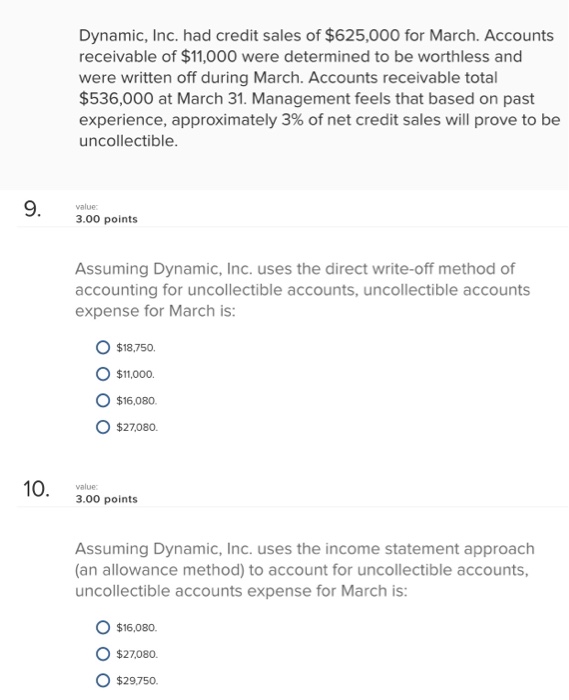

Dynamic, Inc. had credit sales of $625,000 for March. Accounts receivable of $11,000 were determined to be worthless and were written off during March. Accounts receivable total $536,000 at March 31. Management feels that based on past experience, approximately 3% of net credit sales will prove to be uncollectible value 3.00 points Assuming Dynamic, Inc. uses the direct write-off method of accounting for uncollectible accounts, uncollectible accounts expense for March is O$18,750 $11,000. o $16,080 O $27080. value 3.00 points Assuming Dynamic, Inc. uses the income statement approach (an allowance method) to account for uncollectible accounts, uncollectible accounts expense for March is: o $16,080. O $27080. O $29,750

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts