Question: Pls refer to the image for the question. Part 2: Profitability Analysis - Compute for what is asked. Show your solution in good form. The

Pls refer to the image for the question.

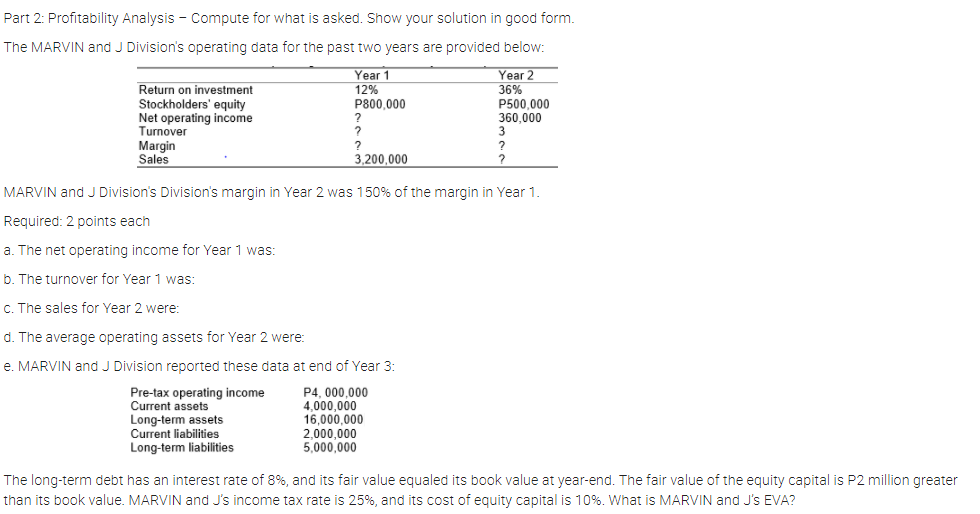

Part 2: Profitability Analysis - Compute for what is asked. Show your solution in good form. The MARVIN and J Division's operating data for the past two years are provided below: Year 1 Year 2 Return on investment 12% 36% Stockholders' equity P800,000 P500,000 Net operating income ? 360,000 Turnover Margin Sales 3,200,000 MARVIN and J Division's Division's margin in Year 2 was 150% of the margin in Year 1. Required: 2 points each a. The net operating income for Year 1 was: b. The turnover for Year 1 was: c. The sales for Year 2 were: d. The average operating assets for Year 2 were: e. MARVIN and J Division reported these data at end of Year 3: Pre-tax operating income P4, 000,000 Current assets 4,000,000 Long-term assets 16,000,000 Current liabilities 2,000,000 Long-term liabilities 5,000,000 The long-term debt has an interest rate of 8%, and its fair value equaled its book value at year-end. The fair value of the equity capital is P2 million greater than its book value. MARVIN and J's income tax rate is 25%, and its cost of equity capital is 10%. What is MARVIN and J's EVA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts